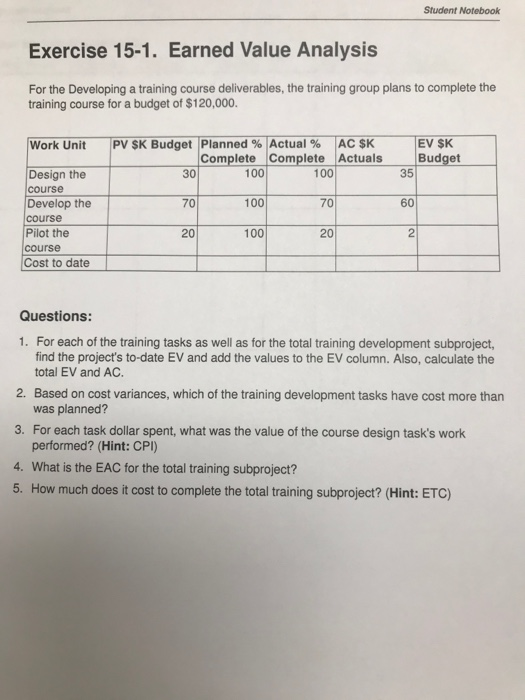

Question: Student Notebook Exercise 15-1. Earned Value Analysis For the Developing a training course deliverables, the training group plans to complete the training course for a

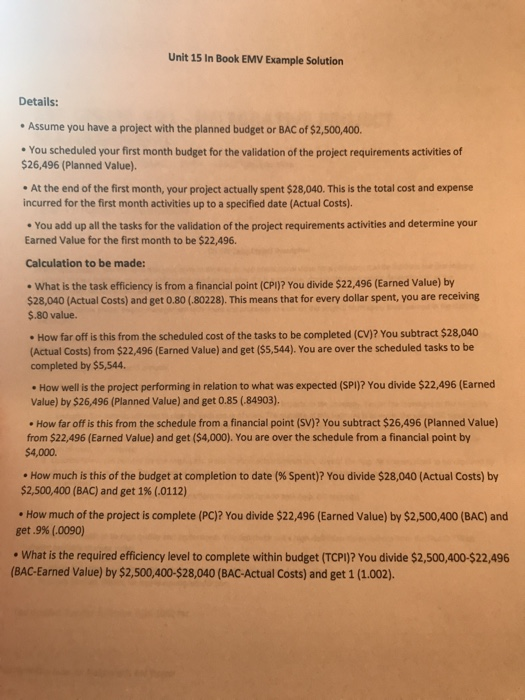

Student Notebook Exercise 15-1. Earned Value Analysis For the Developing a training course deliverables, the training group plans to complete the training course for a budget of $120,000. EV SK Budget Work Unit AC SK Complete Complete Actuals PV SK Budget Planned % Actual % Design the course Develop the course Pilot the course Cost to date 30 100 100 35 100 70 60 2 100 Questions: 1. For each of the training tasks as well as for the total training development subproject find the project's to-date EV and add the values to the EV column. Also, calculate the total EV and AC. 2. Based on cost variances, which of the training development tasks have cost more than was planned? 3. For each task dollar spent, what was the value of the course design task's work performed? (Hint: CPI) 4. What is the EAC for the total training subproject? 5. How much does it cost to complete the total training subproject? (Hint: ETC) 20 70 20 Unit 15 In Book EMV Example Solution Details: Assume you have a project with the planned budget or BAC of $2,500,400. You scheduled your first month budget for the validation of the project requirements activities of $26,496 (Planned Value). At the end of the first month, your project actually spent $28,040. This is the total cost and expense incurred for the first month activities up to a specified date (Actual Costs). You add up all the tasks for the validation of the project requirements activities and determine your Earned Value for the first month to be $22,496. Calculation to be made: What is the task efficiency is from a financial point (CPI)? You divide $22,496 (Earned Value) by $28,040 (Actual Costs) and get 0.80 (.80228). This means that for every dollar spent, you are receiving $.80 value. How far off is this from the scheduled cost of the tasks to be completed (CV)? You subtract $28,040 (Actual Costs) from $22,496 (Earned Value) and get ($5,544). You are over the scheduled tasks to be completed by $5,544. How well is the project performing in relation to what was expected (SPI)? You divide $22,496 (Earned Value) by $26,496 (Planned Value) and get 0.85 (.84903). How far off is this from the schedule from a financial point (SV)? You subtract $26,496 (Planned Value) from $22,496 (Earned Value) and get ($4,000). You are over the schedule from a financial point by $4,000. How much is this of the budget at completion to date (% Spent )? You divide $28,040 (Actual Costs) by $2,500,400 (BAC) and get 1% (.0112) How much of the project is complete (PC)? You divide $22,496 (Earned Value) by $2,500,400 (BAC) and get.9% (.0090) What is the required efficiency level to complete within budget (TCPI)? You divide $2,500,400-$22,496 (BAC-Earned Value) by $2,500,400-$28,040 (BAC-Actual Costs) and get 1 (1.002). Student Notebook Exercise 15-1. Earned Value Analysis For the Developing a training course deliverables, the training group plans to complete the training course for a budget of $120,000. EV SK Budget Work Unit AC SK Complete Complete Actuals PV SK Budget Planned % Actual % Design the course Develop the course Pilot the course Cost to date 30 100 100 35 100 70 60 2 100 Questions: 1. For each of the training tasks as well as for the total training development subproject find the project's to-date EV and add the values to the EV column. Also, calculate the total EV and AC. 2. Based on cost variances, which of the training development tasks have cost more than was planned? 3. For each task dollar spent, what was the value of the course design task's work performed? (Hint: CPI) 4. What is the EAC for the total training subproject? 5. How much does it cost to complete the total training subproject? (Hint: ETC) 20 70 20 Unit 15 In Book EMV Example Solution Details: Assume you have a project with the planned budget or BAC of $2,500,400. You scheduled your first month budget for the validation of the project requirements activities of $26,496 (Planned Value). At the end of the first month, your project actually spent $28,040. This is the total cost and expense incurred for the first month activities up to a specified date (Actual Costs). You add up all the tasks for the validation of the project requirements activities and determine your Earned Value for the first month to be $22,496. Calculation to be made: What is the task efficiency is from a financial point (CPI)? You divide $22,496 (Earned Value) by $28,040 (Actual Costs) and get 0.80 (.80228). This means that for every dollar spent, you are receiving $.80 value. How far off is this from the scheduled cost of the tasks to be completed (CV)? You subtract $28,040 (Actual Costs) from $22,496 (Earned Value) and get ($5,544). You are over the scheduled tasks to be completed by $5,544. How well is the project performing in relation to what was expected (SPI)? You divide $22,496 (Earned Value) by $26,496 (Planned Value) and get 0.85 (.84903). How far off is this from the schedule from a financial point (SV)? You subtract $26,496 (Planned Value) from $22,496 (Earned Value) and get ($4,000). You are over the schedule from a financial point by $4,000. How much is this of the budget at completion to date (% Spent )? You divide $28,040 (Actual Costs) by $2,500,400 (BAC) and get 1% (.0112) How much of the project is complete (PC)? You divide $22,496 (Earned Value) by $2,500,400 (BAC) and get.9% (.0090) What is the required efficiency level to complete within budget (TCPI)? You divide $2,500,400-$22,496 (BAC-Earned Value) by $2,500,400-$28,040 (BAC-Actual Costs) and get 1 (1.002)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts