Question: Students will create a n Excel worksheet t o forecast the cash flows o f a proposed project leading t o calculating its N P

Students will create Excel worksheet forecast the cash flows a proposed project leading

calculating its result, following the method introduced Chapter The proposed

project Example Baldwin Company Chapter Cash Flow The goal

have a systematic approach forecast cash flows and also provide users the flexibility modify

key inputs quickly get the results under different scenarios. A good reference the

Excel Template provided the Canvas course. grading purposes, these key inputs include:

Units sold for each year the project

Price per unit for Year

Price increase percentage per year the same for all years

Unit production cost for Year

Unit production cost increase percentage per year the same for all years

start project

for subsequent years a percentage Sales the same for all years

Cost warehouse

Cost machine

Depreciation rate for each year the project

Salvage value machine tax

Tax rate the same for all years

Discount rate the same for all years

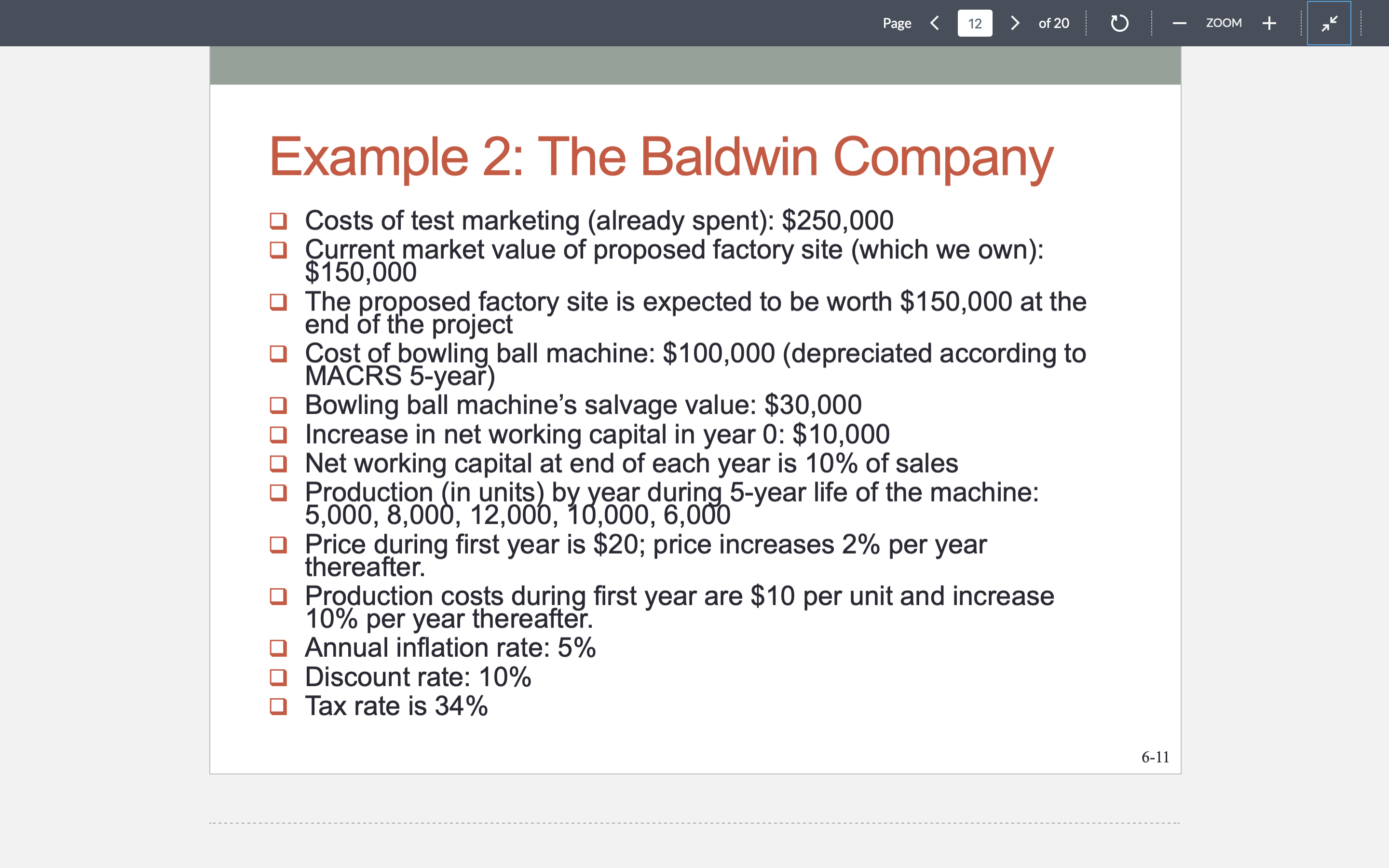

Example : The Baldwin Company

Costs test marketing spent: $

Current market value proposed factory site own:

$

The proposed factory site expected worth $ the

end the project

Cost bowling ball machine: $ according

MACRS year

Bowling ball machine's salvage value: $

Increase net working capital year : $

Net working capital end each year sales

Production units year during year life the machine:

Price during first year $; price increases per year

thereafter.

Production costs during first year are $ per unit and increase

per year thereafter.

Annual inflation rate:

Discount rate:

Tax rate Example : The Baldwin Company

Costs test marketing spent: $

Current market value proposed factory site own:

$

The proposed factory site expected worth $ the

end the project

Cost bowling ball machine: $ according

MACRS year

Bowling ball machine's salvage value: $

Increase net working capital year : $

Net working capital end each year sales

Production units year during year life the machine:

Price during first year $; price increases per year

thereafter.

Production costs during first year are $ per unit and increase

per year thereafter.

Annual inflation rate:

Discount rate:

Tax rate Purpose

The purpose this project provide students incentive practice their Excel modelling

skills learned class cash flow forecasting for the capital budgeting purpose.

Instruction

Students will create Excel worksheet forecast the cash flows a proposed project leading

calculating its result, following the method introduced Chapter The proposed

project Example Baldwin Company Chapter Cash Flow The goal

have a systematic approach forecast cash flows and also provide users the flexibility modify

key inputs quickly get the results under different scenarios. A good reference the

Excel Template provided the Canvas course.

grading purposes, these key inputs include:

Units sold for each year the project

Price per unit for Year

Price increase percentage per year the same for all years

Unit production cost for Year

Unit production cost increase percentage per year the same for all years

start project

for subsequent years a percentage Sales the same for all years

Cost warehouse

Cost machine

Depreciation rate for each year the project

Salvage value machine tax

Tax rate the same for all years

Discount rate the same for all years

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock