Question: study guide for finance, Professor provided correct answers in bold. Need help on how to solve problems on TI-84 plus. Step by step 17. You

study guide for finance, Professor provided correct answers in bold. Need help on how to solve problems on TI-84 plus. Step by step

study guide for finance, Professor provided correct answers in bold. Need help on how to solve problems on TI-84 plus. Step by step

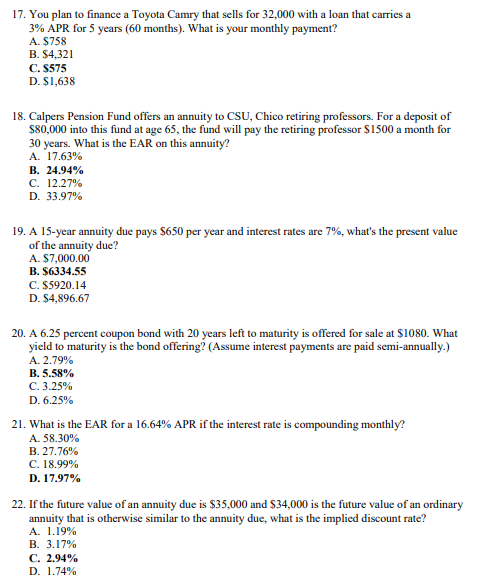

17. You plan to finance a Toyota Camry that sells for 32,000 with a loan that carries a 3% APR for 5 years (60 months). What is your monthly payment? A. S758 B. $4,321 C. 5575 D. S1,638 18. Calpers Pension Fund offers an annuity to CSU, Chico retiring professors. For a deposit of $80,000 into this fund at age 65, the fund will pay the retiring professor $1.500 a month for 30 years. What is the EAR on this annuity? A. 17.63% B. 24.94% C. 12.27% D. 33.97% 19. A 15-year annuity due pays $650 per year and interest rates are 7%, what's the present value of the annuity due? A. $7,000.00 B. $6334.55 C. S5920.14 D. S4,896.67 20. A 6.25 percent coupon bond with 20 years left to maturity is offered for sale at $1080. What yield to maturity is the bond offering? (Assume interest payments are paid semi-annually.) A. 2.79% B. 5.58% C. 3.25% D. 6.25% 21. What is the EAR for a 16.64% APR if the interest rate is compounding monthly? A. 58.30% B. 27.76% C. 18.99% D. 17.97% 22. If the future value of an annuity due is $35,000 and $34,000 is the future value of an ordinary annuity that is otherwise similar to the annuity due, what is the implied discount rate? A. 1.19% B. 3.17% C. 2.94% D. 1.74%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts