Question: Study Guide Lightfoot Inc., a software development firm, has stock outstanding as follows: 42,000 shares of cumulative preferred 1% stock, $135 par and 110,000 shares

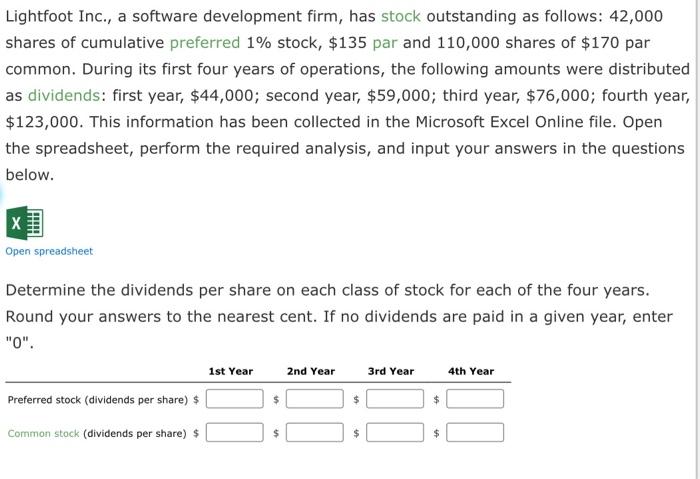

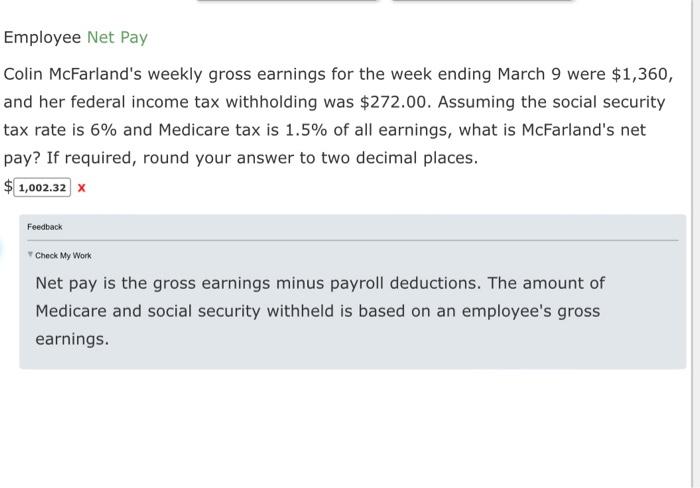

Lightfoot Inc., a software development firm, has stock outstanding as follows: 42,000 shares of cumulative preferred 1% stock, $135 par and 110,000 shares of $170 par common. During its first four years of operations, the following amounts were distributed as dividends: first year, $44,000; second year, $59,000; third year, $76,000; fourth year, $123,000. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. X Open spreadsheet Determine the dividends per share on each class of stock for each of the four years. Round your answers to the nearest cent. If no dividends are paid in a given year, enter "0". Employee Net Pay Colin McFarland's weekly gross earnings for the week ending March 9 were $1,360, and her federal income tax withholding was $272.00. Assuming the social security tax rate is 6% and Medicare tax is 1.5% of all earnings, what is McFarland's net pay? If required, round your answer to two decimal places. $x Feedback Tcheck My Work Net pay is the gross earnings minus payroll deductions. The amount of Medicare and social security withheld is based on an employee's gross earnings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts