Question: Study Problem 12-1B on page 623. Calculate the total dollar value of partnership assets, liabilities, and capital as of April 1, 20Y1. Show your work.

Study Problem 12-1B on page 623. Calculate the total dollar value of partnership assets, liabilities, and capital as of April 1, 20Y1. Show your work.

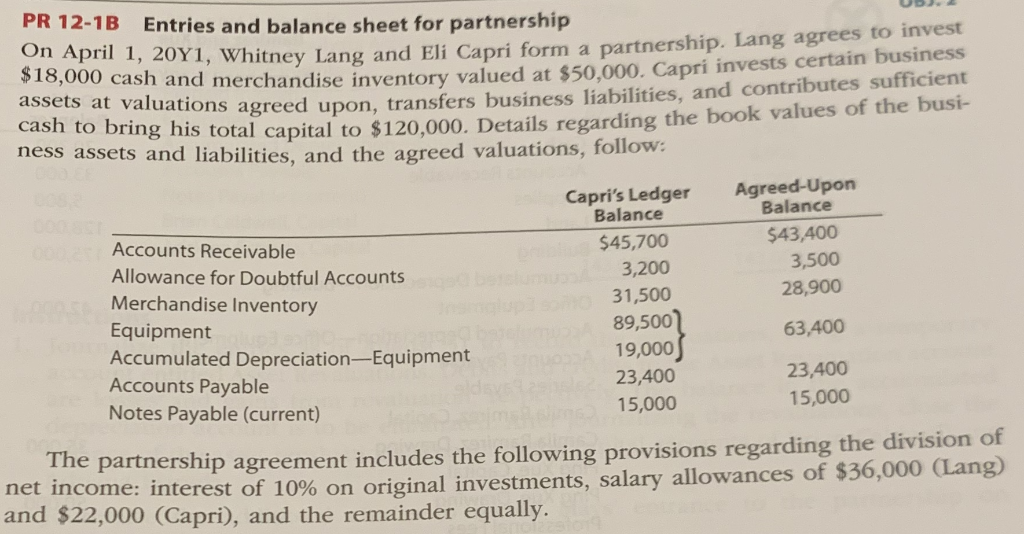

PR 12-1B Entries and balance sheet for partnership On April 1, $18,000 cash and merch assets at valuations cash to b 20Y1, Whitney Lang and Eli Capri form a partnership. Lang agrees to invest andise inventory valued at $50,000. Capri invests certain business tons agreed upon, transfers business liabilities, and contributes sufficient ting his total capital to $120,000. Details regarding the book values of the busi- ness assets and liabilities, and the agreed valuations, follow Capri's Ledger Agreed-Upon Balance Balance $43,400 3,500 28,900 $45,700 3,200 31,500 89,500 19,000 23,400 15,000 Accounts Receivable Allowance for Doubtful Accounts Merchandise Inventory Equipment Accumulated Depreciation-Equipment Accounts Payable Notes Payable (current) 63,400 23,400 15,000 partnership agreement includes the following provisions regarding the division of of $36,000 (Lang) The net income: interest of 10% on original investments, salary allowances and $22,000 (Capri), and the remainder equally

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts