Question: Study Problem: Corporate Reporting and Analysis Scenario: The Source Corporation is a publicly traded company that recently issued financial statements for the fiscal year. The

Study Problem: Corporate Reporting and Analysis Scenario: The Source Corporation is a publicly traded company that recently issued financial statements for the fiscal year. The following partial stockholders equity section is provided from its balance sheet: Stockholders' Equity Section Partial The Source Corporation Common Stock par value $ shares authorized, shares issued and outstanding: $ Preferred Stock $ par value, shares authorized, shares issued and outstanding: $ Additional Paidin Capital Common Stock: $ Retained Earnings: $ Total Stockholders' Equity: $ During the fiscal year, The Source Corporation declared and paid a total cash dividend of $ Requirements: Dividend Allocation: o Calculate how much of the $ dividend is allocated to preferred stockholders and how much is allocated to common stockholders. Earnings Per Share EPS Calculation: o Assume The Source Corporation reported a net income of $ for the year. o Compute the earnings per share EPS assuming no additional common stock was issued during the year. Stockholder Return Analysis: o If The Source Corporations stock is currently trading at $ per share, calculate the PricetoEarnings PE Ratio based on your EPS calculation. o Interpret whether The Sources PE ratio suggests the stock is undervalued or overvalued relative to an industry average of DecisionMaking Question: o Based on the financial information provided, would you invest in The Source Corporations common stock? Justify your answer using financial ratios, dividend payout, and any risk considerations. Study Problem: Corporate Reporting and Analysis

Scenario:

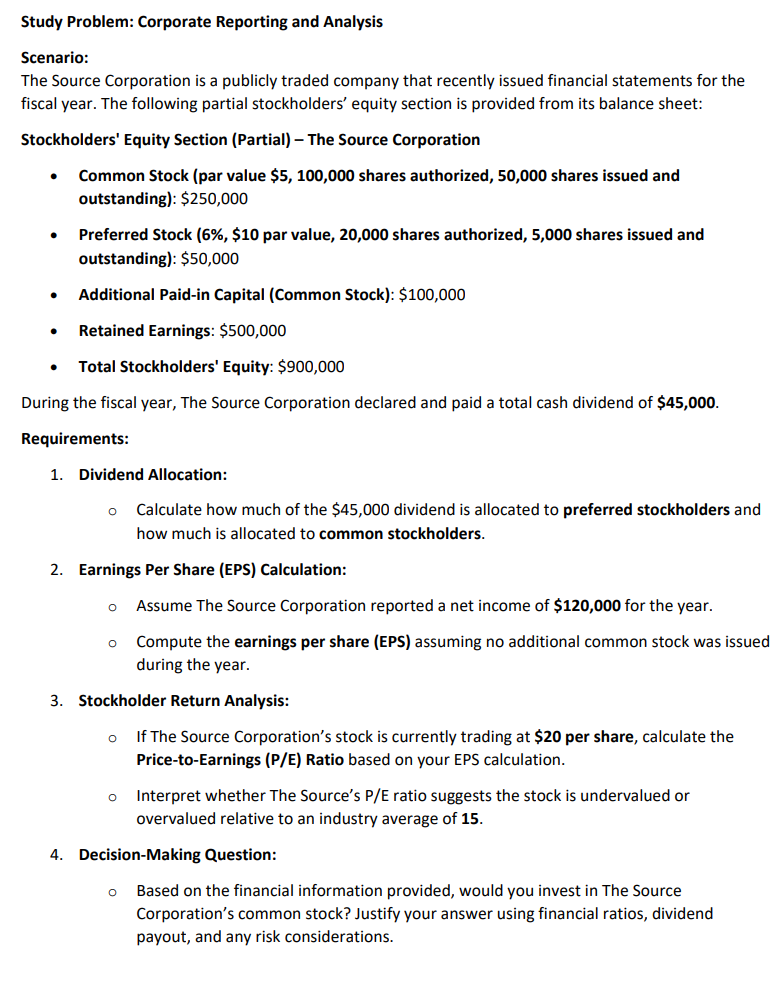

The Source Corporation is a publicly traded company that recently issued financial statements for the fiscal year. The following partial stockholders' equity section is provided from its balance sheet:

Stockholders' Equity Section Partial The Source Corporation

Common Stock par value mathbf$ shares authorized, mathbf shares issued and outstanding: $

Preferred Stock mathbf$ par value, shares authorized, shares issued and outstanding: $

Additional Paidin Capital Common Stock: $

Retained Earnings: $

Total Stockholders' Equity: $

During the fiscal year, The Source Corporation declared and paid a total cash dividend of mathbf$

Requirements:

Dividend Allocation:

Calculate how much of the $ dividend is allocated to preferred stockholders and how much is allocated to common stockholders.

Earnings Per Share EPS Calculation:

Assume The Source Corporation reported a net income of mathbf$ for the year.

Compute the earnings per share EPS assuming no additional common stock was issued during the year.

Stockholder Return Analysis:

If The Source Corporation's stock is currently trading at mathbf$ per share, calculate the PricetoEarnings PE Ratio based on your EPS calculation.

Interpret whether The Source's PE ratio suggests the stock is undervalued or overvalued relative to an industry average of

DecisionMaking Question:

Based on the financial information provided, would you invest in The Source Corporation's common stock? Justify your answer using financial ratios, dividend payout, and any risk considerations.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock