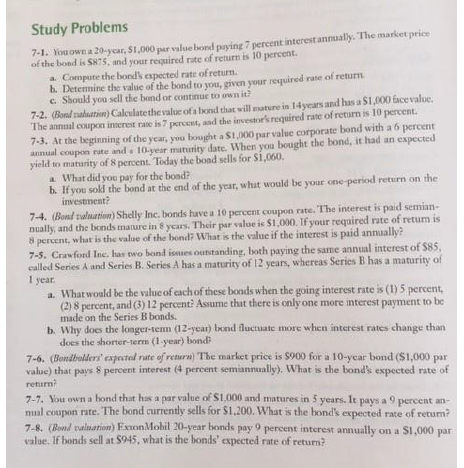

Question: Study Problems 7-1. Youowna 20-year, 51,000 par valuebond paying 7 percent interest annually. The market price of the bond is 5875 , and your repuired

Study Problems 7-1. Youowna 20-year, 51,000 par valuebond paying 7 percent interest annually. The market price of the bond is 5875 , and your repuired rote of return is 10 percent. a. Compute the bondls expected rate of return. b. Detemnine the value of the bond to you, given your required nate of return c. Sbould you sell the bend or continus to own it? 7-2. (Bond natuatin) Calculatethevalue of a bond that will matere in 14yeats and has a S1, 000 Groe value: The annual coupon ineret rase is 7 pereent, and the investor's required rate of return is 10 percent. 7.3. At the beginning of the year, you bought a $1,000 par value corporate bond with a 6 percent annual coupon rute and s 10year naturity date. When you bought the bond, it had an expected yield to maturity of 8 pereen.. Today the boad sells for 51,060 . a. What did you pay for the boad? b. If you sold the bond at the end of the yaar, what would be your one-period return on the investment? 7-4. (Boud taluation) Shelly lnc, bonds tave a 10 percent coupon rate. The interest is paid semiannually, and the bonds marure in 8 years. Their par valoe is $1,000. If your required rate of retum is 8 percent, what is the value of the bond? What is the vilue if the interest is paid annually? 7-5. Crawford tne. has two bont issues outstanding, both paying the same anneal interest of 585 , ealled Series A and Series B. Series A has a maturity of 12 years, whereas Series B has a maturity of 1 year: a. What would be the value of eachof these bonds when the going interest rate is (1) 5 percent, (2) 8 percent, and (3) 12 percent? Assume thit there is conly one more interest payment to be made on the Series B bonds. b. Why does the loager-temn (12-year) bond fluctuate more when interest rates change than does the shorter-term (1-year) bond 7-6. (Bondbolden' experel nate of reairu) 'The market price is $900 for a 10-year bond ( $1,000 par value) that pays 8 percent interest (4 pereent semiannually). What is the bonds expected rate of retiarn? 7-7. You own a hond that has a par value of S1,000 and matures in 5 years. It pays a 9 percent annual coappon rate. The bond currently sells for $1,200. What is the bond's expected rate of retum? 7.8. (Boand nuliation) FunnMobil 20-year bonds pay 9 percent interest annually on a \$1,000 par value. If bonds sell at $945, what is the bonds' expected rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts