Question: Study Tools ions ccess Tips xcess Tips back Ch 07: Assignment-Bonds and Their Valuation 8. Risks of investing in bonds The higher the risk of

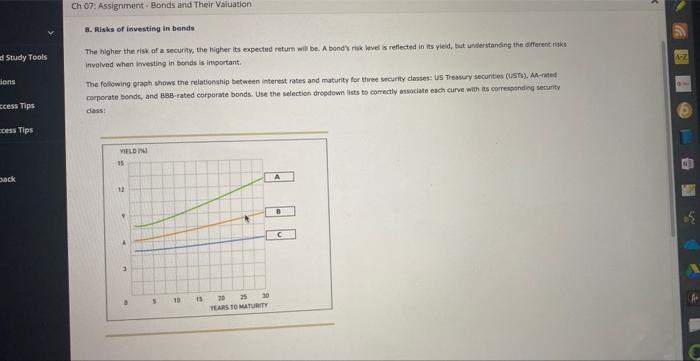

Study Tools ions ccess Tips xcess Tips back Ch 07: Assignment-Bonds and Their Valuation 8. Risks of investing in bonds The higher the risk of a security, the higher its expected return will be. A bond's risk level is reflected in its yield, but understanding the different risks involved when investing in bonds is important. The following graph shows the relationship between interest rates and maturity for three security classes: US Treasury securities (USTS), AA-rated corporate bonds, and BBB-rated corporate bonds. Use the selection dropdown lists to correctly associate each curve with its corresponding security class VIELD IN 15 12 4 3 S 10 15 20 25 30 YEARS TO MATURITY A B C A-Z DO 9 W P A C and Study Tools Options Success Tips Success Tips edback ABU 3 D kkk 00 5 10 Which type of bonds offer a higher yield? Noncallable bonds Callable bonds False 15 Answer the following question based on your understanding of interest rate risk and reinvestment risk. True or False: Assuming all else is equal, the shorter a bond's maturity, the more its price will change in response to a given change in interest rates True 20 25 30 YEARS TO MATURITY

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts