Question: Study Tools ons cess Tips cess Tips back The following graph shows the contingency graph for sellers of euro call options, with a premium of

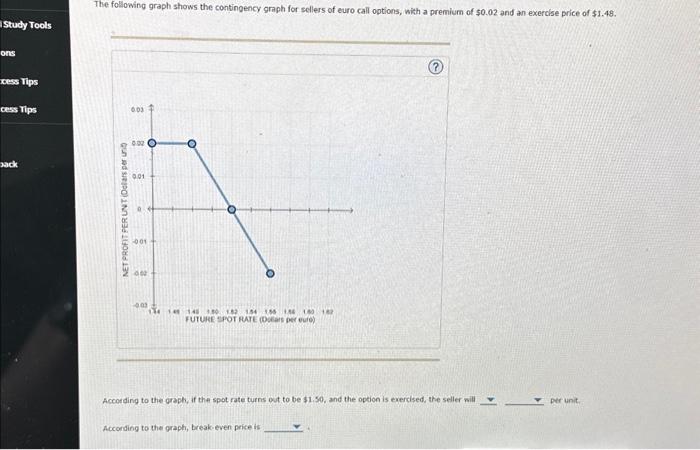

The following graph shows the contingency graph for sellers of euro call options, with a premium of $0.02 and an exercise price of $1.48. According to the graph, if the spot rate turns out to be $1.50, and the option is evercised, the seller will per unit: According to the graph, breake even price is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts