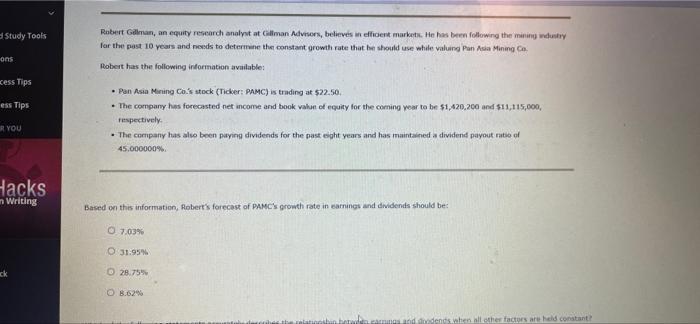

Question: Study Tools Robert Gilman, an equity research analyst at Gillman Advisors, believes inefficient markets. He has been following the mining wdustry for the past 10

Study Tools Robert Gilman, an equity research analyst at Gillman Advisors, believes inefficient markets. He has been following the mining wdustry for the past 10 years and needs to determine the constant growth rate that he should use while valuing Pan Asia Mining , ons Robert has the following information available: cess Tips ess Tips Pan Asia Mining Co.'s stock Ticker: PAMC) is trading at $22.50 - The company has forecasted net income and book value of equity for the coming year to be $1,420,200 and 511,115,000, respectively . The company has also been paying dividends for the past eight years and has maintained a dividend payout ratio of 45.000000% IR YOU Hacks n Writing Based on this information, Robert's forecast of PAMC's growth rate in earnings and dividends should be 07.03% O 31.95% 28.75 8.62% haddenschen her factors are held constant

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts