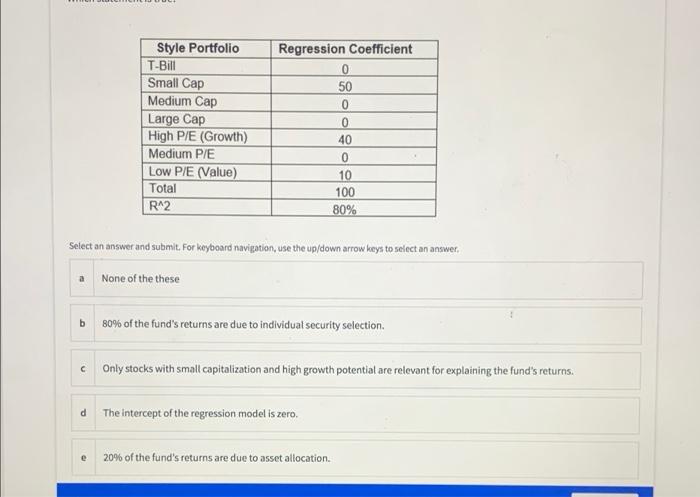

Question: Style Portfolio T-Bill Small Cap Medium Cap Large Cap High P/E (Growth) Medium P/E Low P/E (Value) Total R^2 Regression Coefficient 0 50 0 0

Style Portfolio T-Bill Small Cap Medium Cap Large Cap High P/E (Growth) Medium P/E Low P/E (Value) Total R^2 Regression Coefficient 0 50 0 0 40 0 10 100 80% Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer, None of the these b 80% of the fund's returns are due to individual security selection. Only stocks with small capitalization and high growth potential are relevant for explaining the fund's returns. d The intercept of the regression model is zero. e 20% of the fund's returns are due to asset allocation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts