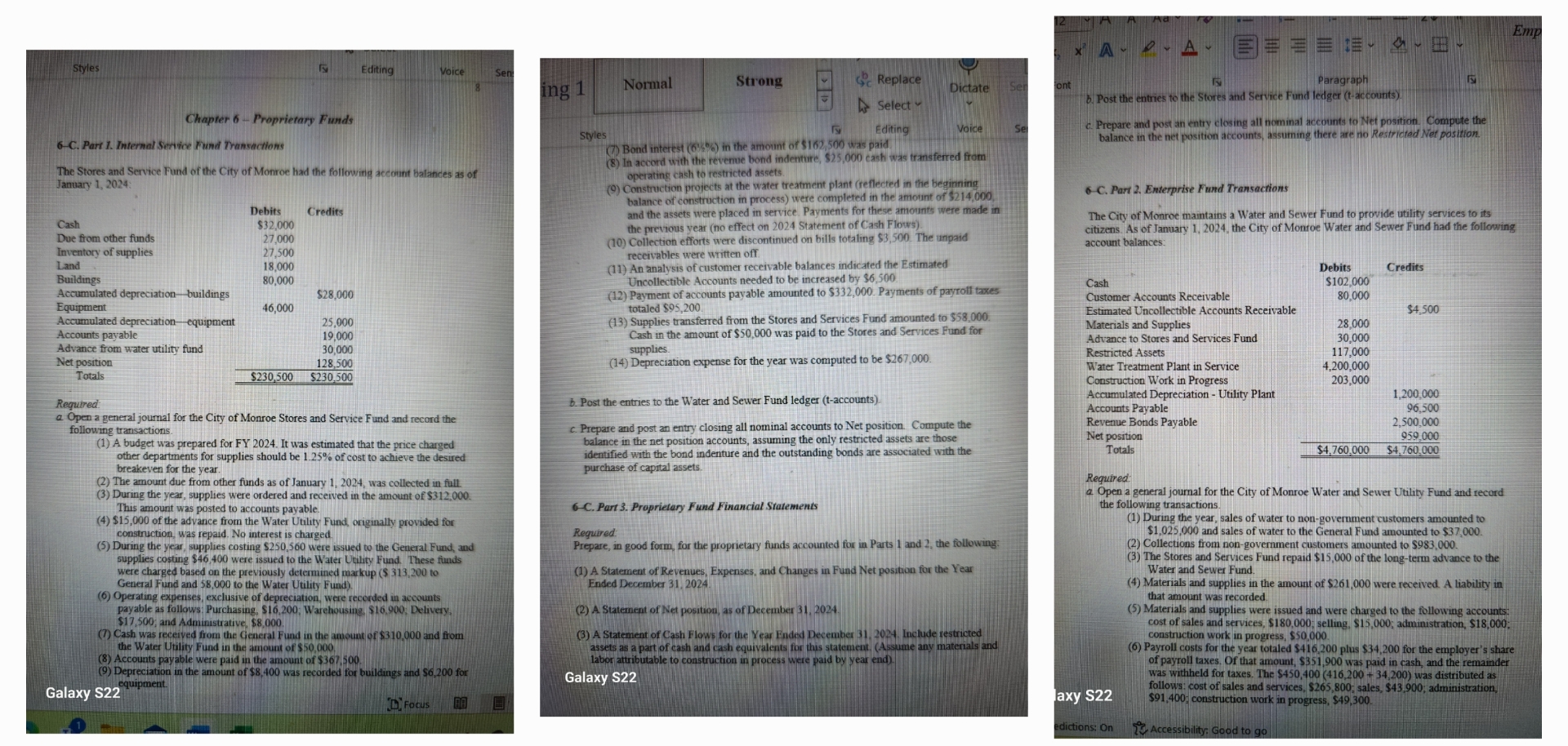

Question: Styles 6 - C . Part L . Internal Senie und TransactionsCashDue from other fundsInventory of suppliesLandThe Stores and Sevice Fund of the City of

StylesC Part L Internal Senie und TransactionsCashDue from other fundsInventory of suppliesLandThe Stores and Sevice Fund of the City of Monroe had the folfowind accotnt Balances as ofJanuary BuildingsAccumulated depreciationbuildngsEquipmentChapter Proprietary FundsAccunulated depreciationequipmentAccounts payableAdvance from water utility fundNet postionTotalsRequiredDebits$Credits$Galaxy S$ $Editinga Open a general journal for the City of Monroe Stores and Service Fund and record thefollowing transactionsVoice A budget was prepared for FY It was estimated that the price chargedother departments for supplies should be of cost to achiof cost to achieve the desiredbreakeven for the year. The amount due from other funds as of January was collected in ful During the year, supplies were ordered and received in the S of the advance from the Water Utality Fund, originally provided foxconstruction, was repaid. No interest is charged During the year, supples costing $ were issued to the General Fund, andsupplies costing $ were issued to the Water Uility Fund These ftundswere charged based on the previously determined makup $ toGeneral Fund and to the Water Uulity FundOperating expenses, exclusive of depreciation, wese recorded ia accountspayable as follows: Purchasing, SI Warehousing, S Delivery,$ and Adniinstrative, $the Water Uility Fund in the amount of $ Cash was received fhom the Gencral Fund in the amount or S and tom Accounts payable were paid in the amount of $ Depreciation in the amount of $s was recorded for buildings and S fouequipment.Seng StylesNormalStrong Bond interest in the amonnt of S ws paid In accord with the reveme bond indentre, $ cash was transfered fromoperatint cash to restricted assetsReplaceSelect vEdting Construction projects at the water treatment plant refleced in the beginningbalance of eonstroction in process were completed in the amiotnt of saband the assets were placed in service. Payments for these amounts werethe previous vear ho effect on Statement of Cash Flovs An nalysis of customer receivable balances indicated the Estimated Collection efforts were discontinued on bills totafing $ The unpaidreceivables were witten offUncollectible Accounts needed to be increased by $ Payment of accounts payable amounted to $ Payments of payroll taestotaled $ Depreciation expense for the year was computed to be Sb Post the entries to the Water and Sewer Fund ledger taccountsRequiredDictate Supplies transferred from the Stores and Services Fund amounted to $Cash in the amount of $ was paid to the Stores and Services Pund forsuppliesVoice SeC Part Proprietary Fund Financial Statementsc Prepare and post an entry closing all nominal accounts to Net position Compute thebalance in the net position accounts, assuming the only restricted assets are thoseidentified with the bond indenture and the outstanding bonds are associated with thepurchase of capital assets A Statenent of Net positiou, as of December Prepare, in good form, far the proprietary funds accounted fioxr in Pats I and the followngGalaxy S A Statement of Revenues, Expenses, and Changes in Fund Net position for the YoarEnded December A Statenment of Cash Flows for the Year Ended Deceaber Inchde restrictedassets as a part of cash and cash equivalents fos thas statemment. Assume any materials andlabor attributable to construction in process were paid by year endontAPost the entries to the Stores and Service Fund ledger taccountsc Prepare and post an entry closing all hommal aceounts to Net postiot Compute thebalance in the net postion accounts, assuming there are no Restricted Net positionC Par Enterprise Fund Transactionsaccount balances:CashAEEEThe City of Monroe mantains a Water and Sewer Fund to provide utility services to itscitizens. As of January the Cityof Monroe Water and Sewer Fund had the followingCustomer Accounts ReceivableEstimated Uncollectible Accounts ReceivableMaterials and SuppliesAdvance to Stores and Services FundRestricted AssetsWater Treatment Plant in SeryiceConstruction Work in ProgressAccumulated Depreciation Utility PlantAccounts PayableRevenue Bonds PayableNet positionTotalsRequiredParagraphaxy Sdictions: OnDebitsSCredits$Accessibility: Good to goa Open a general journal for the City of Monroe Water and Sewer Utility Fund and recordthe following transactions$ $ During the year, sales of water to nongovernment customers amounted to$ and sales of water to the General Fund amounted to $ Co

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock