Question: Styles Editing 1 QUESTION 4 Green Grocer Ltd is a manufacturing entity in the city of Clutchmore. The company manufactures and sells a single product

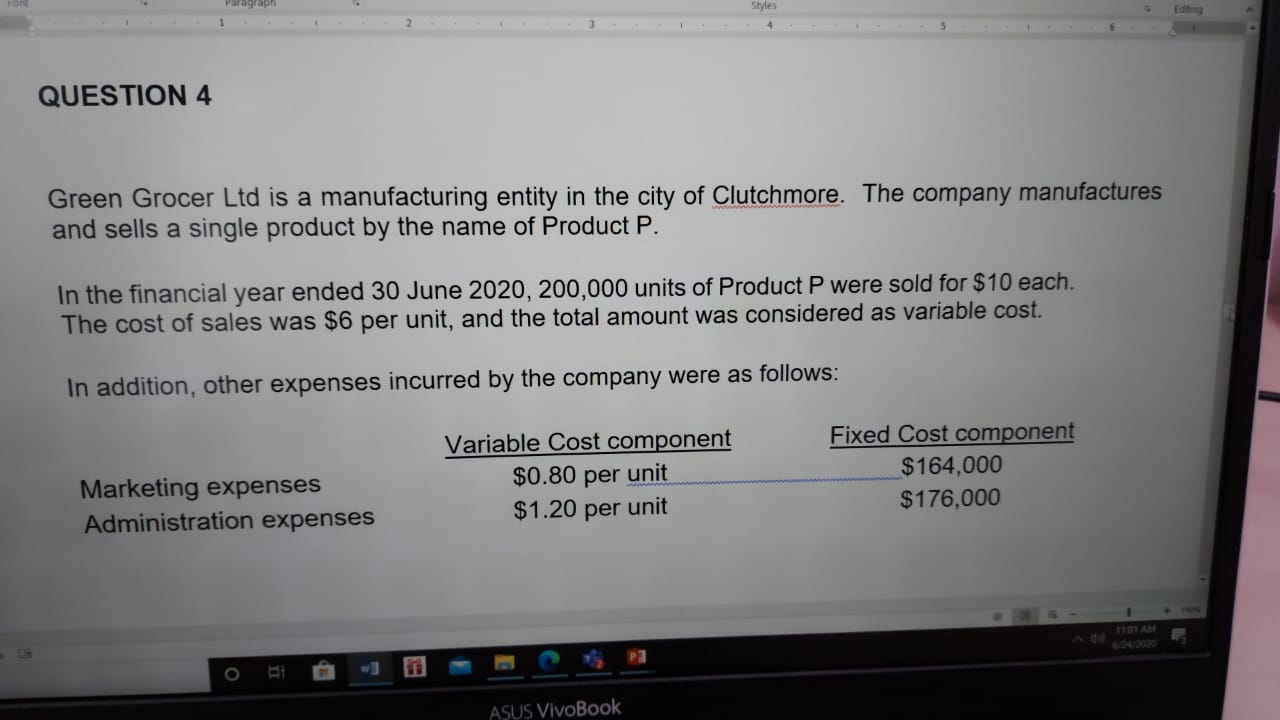

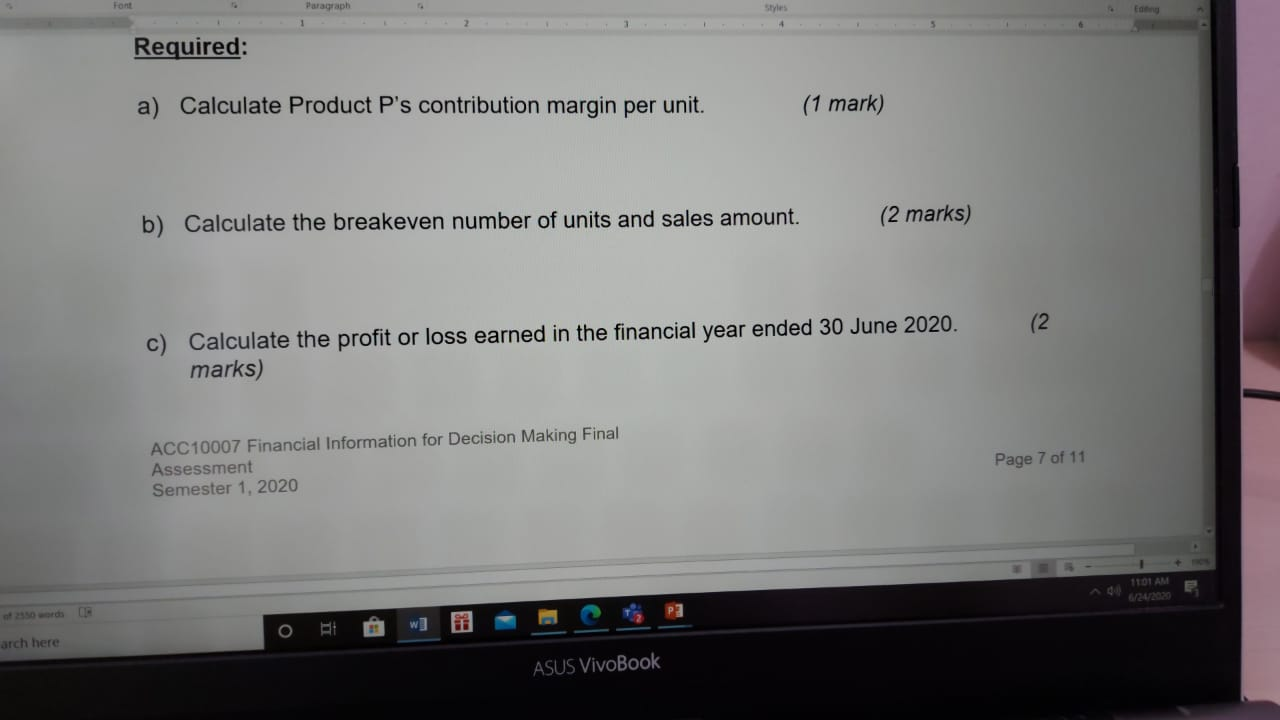

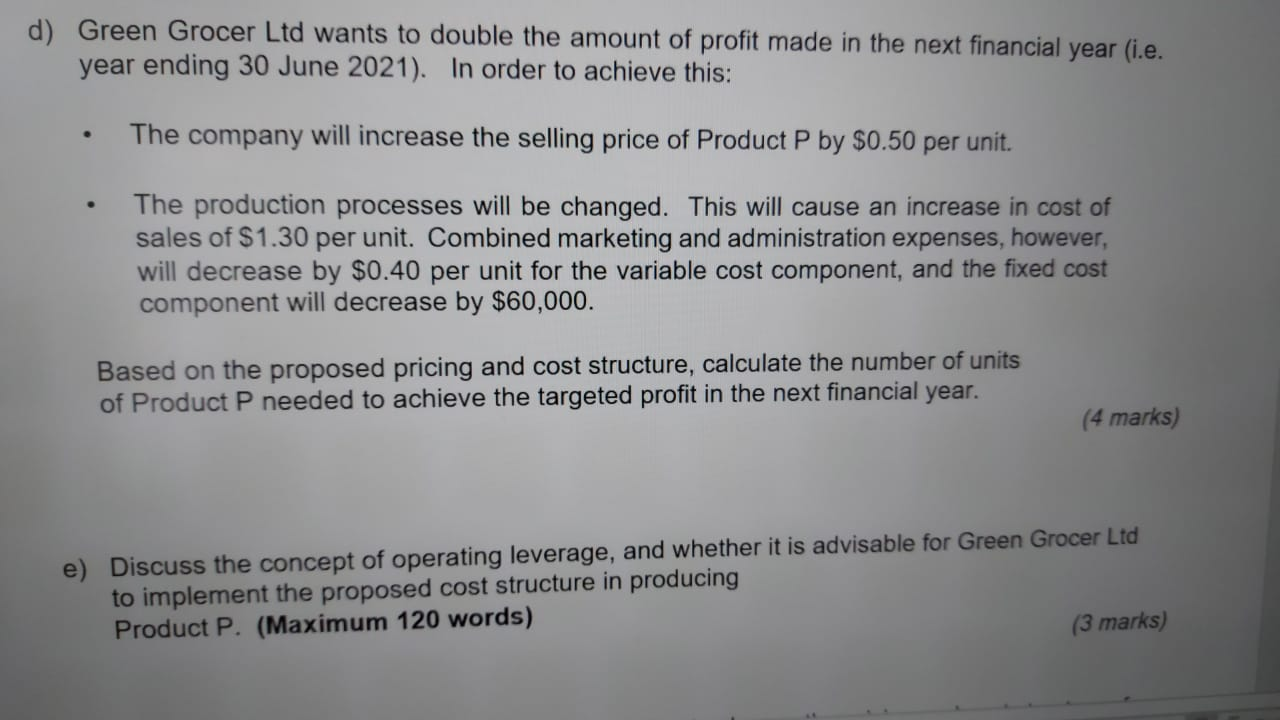

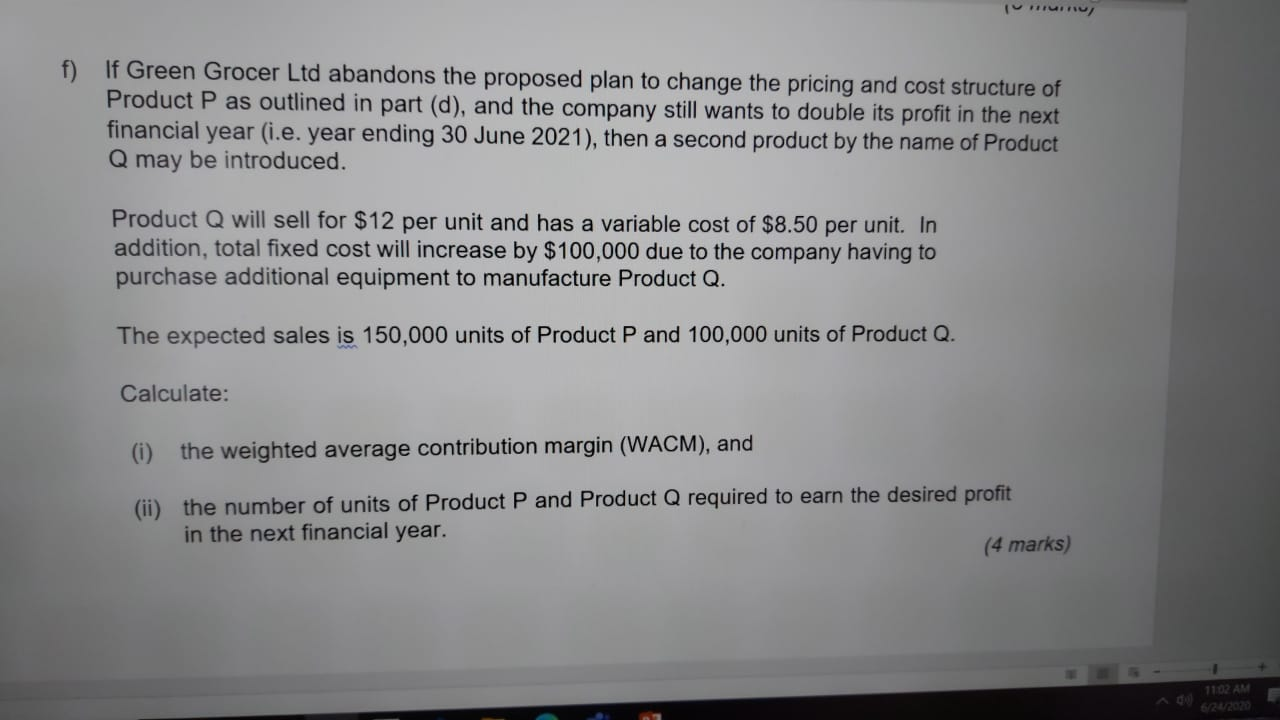

Styles Editing 1 QUESTION 4 Green Grocer Ltd is a manufacturing entity in the city of Clutchmore. The company manufactures and sells a single product by the name of Product P. In the financial year ended 30 June 2020, 200,000 units of Product P were sold for $10 each. The cost of sales was $6 per unit, and the total amount was considered as variable cost. In addition, other expenses incurred by the company were as follows: Variable Cost component $0.80 per unit $1.20 per unit Fixed Cost component $164,000 $176,000 Marketing expenses Administration expenses ASUS VivoBook Font Paragraph Required: a) Calculate Product P's contribution margin per unit. (1 mark) b) Calculate the breakeven number of units and sales amount. (2 marks) (2 c) Calculate the profit or loss earned in the financial year ended 30 June 2020. marks) ACC10007 Financial Information for Decision Making Final Assessment Semester 1, 2020 Page 7 of 11 1101 AM P] o wl arch here ASUS VivoBook d) Green Grocer Ltd wants to double the amount of profit made in the next financial year (i.e. year ending 30 June 2021). In order to achieve this: The company will increase the selling price of Product P by $0.50 per unit. The production processes will be changed. This will cause an increase in cost of sales of $1.30 per unit. Combined marketing and administration expenses, however, will decrease by $0.40 per unit for the variable cost component, and the fixed cost component will decrease by $60,000. Based on the proposed pricing and cost structure, calculate the number of units of Product P needed to achieve the targeted profit in the next financial year. (4 marks) e) Discuss the concept of operating leverage, and whether it is advisable for Green Grocer Ltd to implement the proposed cost structure in producing Product P. (Maximum 120 words) (3 marks) Hiru f) If Green Grocer Ltd abandons the proposed plan to change the pricing and cost structure of Product P as outlined in part (d), and the company still wants to double its profit in the next financial year (i.e. year ending 30 June 2021), then a second product by the name of Product Q may be introduced. Product Q will sell for $12 per unit and has a variable cost of $8.50 per unit. In addition, total fixed cost will increase by $100,000 due to the company having to purchase additional equipment to manufacture Product Q. The expected sales is 150,000 units of Product P and 100,000 units of Product Q. Calculate: (i) the weighted average contribution margin (WACM), and (ii) the number of units of Product P and Product Q required to earn the desired profit in the next financial year. (4 marks) Styles Editing 1 QUESTION 4 Green Grocer Ltd is a manufacturing entity in the city of Clutchmore. The company manufactures and sells a single product by the name of Product P. In the financial year ended 30 June 2020, 200,000 units of Product P were sold for $10 each. The cost of sales was $6 per unit, and the total amount was considered as variable cost. In addition, other expenses incurred by the company were as follows: Variable Cost component $0.80 per unit $1.20 per unit Fixed Cost component $164,000 $176,000 Marketing expenses Administration expenses ASUS VivoBook Font Paragraph Required: a) Calculate Product P's contribution margin per unit. (1 mark) b) Calculate the breakeven number of units and sales amount. (2 marks) (2 c) Calculate the profit or loss earned in the financial year ended 30 June 2020. marks) ACC10007 Financial Information for Decision Making Final Assessment Semester 1, 2020 Page 7 of 11 1101 AM P] o wl arch here ASUS VivoBook d) Green Grocer Ltd wants to double the amount of profit made in the next financial year (i.e. year ending 30 June 2021). In order to achieve this: The company will increase the selling price of Product P by $0.50 per unit. The production processes will be changed. This will cause an increase in cost of sales of $1.30 per unit. Combined marketing and administration expenses, however, will decrease by $0.40 per unit for the variable cost component, and the fixed cost component will decrease by $60,000. Based on the proposed pricing and cost structure, calculate the number of units of Product P needed to achieve the targeted profit in the next financial year. (4 marks) e) Discuss the concept of operating leverage, and whether it is advisable for Green Grocer Ltd to implement the proposed cost structure in producing Product P. (Maximum 120 words) (3 marks) Hiru f) If Green Grocer Ltd abandons the proposed plan to change the pricing and cost structure of Product P as outlined in part (d), and the company still wants to double its profit in the next financial year (i.e. year ending 30 June 2021), then a second product by the name of Product Q may be introduced. Product Q will sell for $12 per unit and has a variable cost of $8.50 per unit. In addition, total fixed cost will increase by $100,000 due to the company having to purchase additional equipment to manufacture Product Q. The expected sales is 150,000 units of Product P and 100,000 units of Product Q. Calculate: (i) the weighted average contribution margin (WACM), and (ii) the number of units of Product P and Product Q required to earn the desired profit in the next financial year. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts