Question: Styles Open file 1. What do we call a bond that is issued by a state or local government? What special feature does such

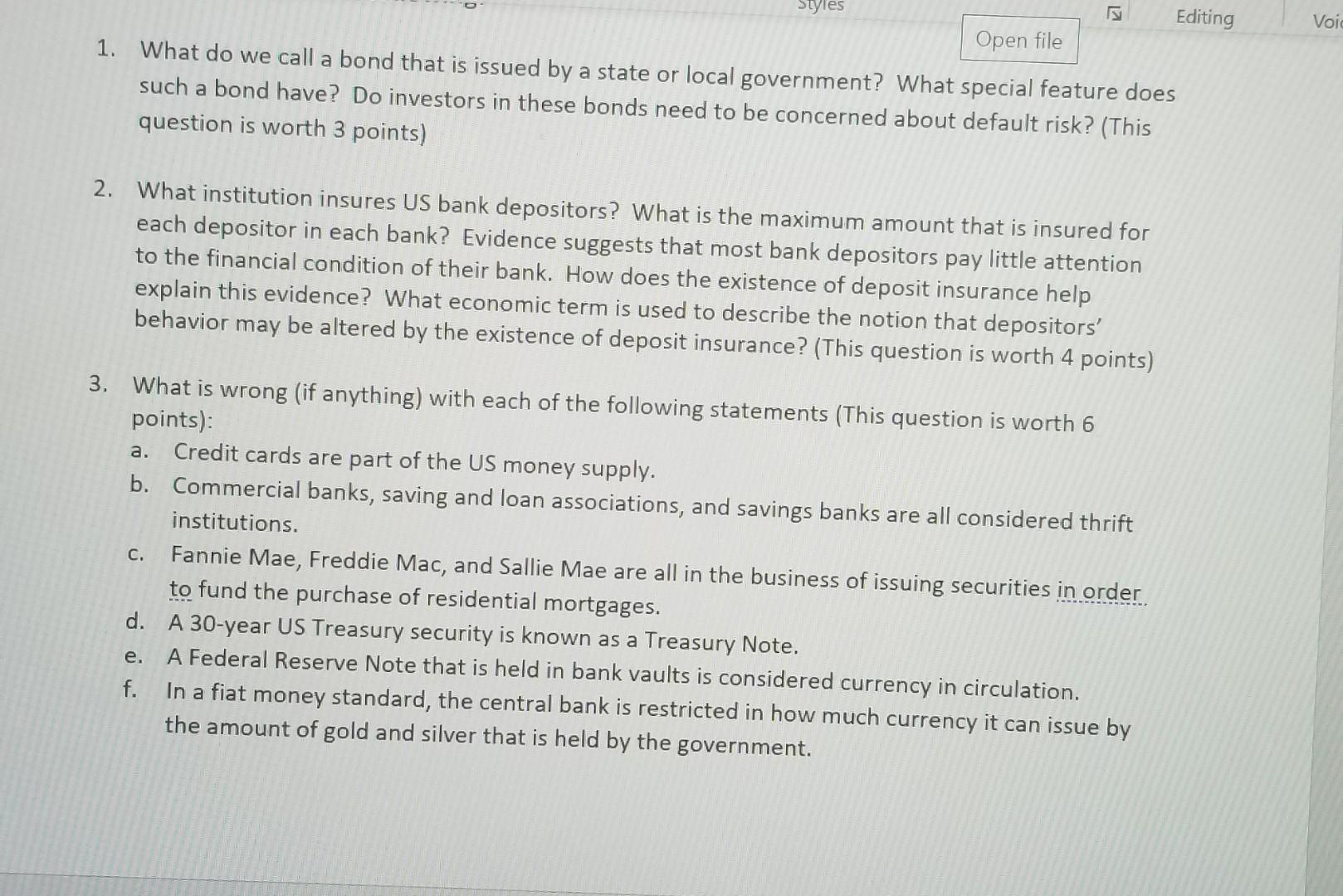

Styles Open file 1. What do we call a bond that is issued by a state or local government? What special feature does such a bond have? Do investors in these bonds need to be concerned about default risk? (This question is worth 3 points) 2. What institution insures US bank depositors? What is the maximum amount that is insured for each depositor in each bank? Evidence suggests that most bank depositors pay little attention to the financial condition of their bank. How does the existence of deposit insurance help explain this evidence? What economic term is used to describe the notion that depositors' behavior may be altered by the existence of deposit insurance? (This question is worth 4 points) 3. What is wrong (if anything) with each of the following statements (This question is worth 6 points): S a. Credit cards are part of the US money supply. b. Commercial banks, saving and loan associations, and savings banks are all considered thrift institutions. C. Fannie Mae, Freddie Mac, and Sallie Mae are all in the business of issuing securities in order to fund the purchase of residential mortgages. d. A 30-year US Treasury security is known as a Treasury Note. e. A Federal Reserve Note that is held in bank vaults is considered currency in circulation. f. In a fiat money standard, the central bank is restricted in how much currency it can issue by the amount of gold and silver that is held by the government. Editing Voic

Step by Step Solution

3.54 Rating (161 Votes )

There are 3 Steps involved in it

1 a A bond issued by a state or local government is called a municipal bond b A municipal bond has the special feature of being exempt from federal in... View full answer

Get step-by-step solutions from verified subject matter experts