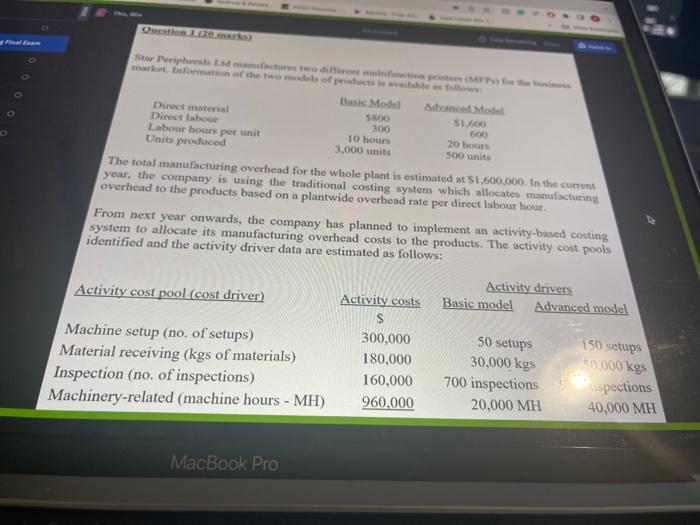

Question: sub - managerial accounting Final Exam Question L(20.marka) Star Peripherals Ltd manufactures two different multifimction printers (MFP) for the business market. Information of the two

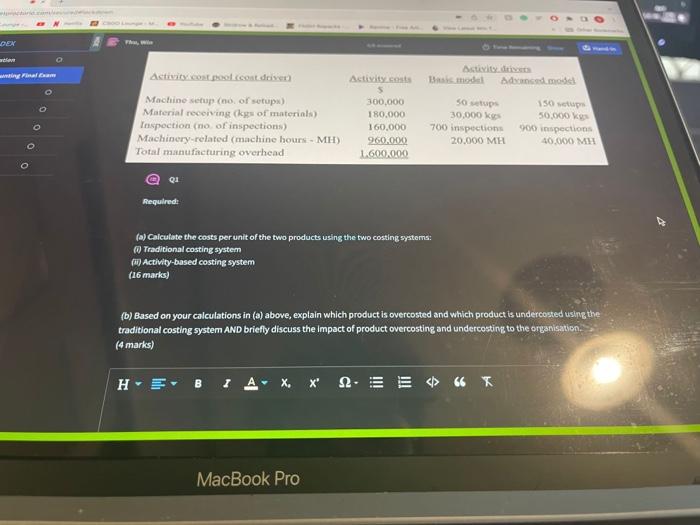

Final Exam Question L(20.marka) Star Peripherals Ltd manufactures two different multifimction printers (MFP) for the business market. Information of the two models of products is available as follows Advanced Model Direct material Direct labour Basic Model 5800 300 $1,600 600 Labour hours per unit 10 hours Units produced 20 hours 500 units 3,000 units The total manufacturing overhead for the whole plant is estimated at $1,600,000. In the current year, the company is using the traditional costing system which allocates manufacturing overhead to the products based on a plantwide overhead rate per direct labour hour. From next year onwards, the company has planned to implement an activity-based costing system to allocate its manufacturing overhead costs to the products. The activity cost pools identified and the activity driver data are estimated as follows: Activity drivers Advanced model Activity cost pool (cost driver) Basic model Activity costs S Machine setup (no. of setups) 300,000 50 setups Material receiving (kgs of materials) 180,000 30,000 kgs 160,000 700 inspections Inspection (no. of inspections) 960,000 20,000 MH Machinery-related (machine hours - MH) MacBook Pro 150 setups 50,000 kgs spections 40,000 MH wardam DEX ting Final Exam OOO00 Activity drivers Activity cost pool ccost driver) Activity costs Basis model Advanced model 300,000 Machine setup (no. of setups) Material receiving (kgs of materials) Inspection (no. of inspections) 50 setups 30,000 kgs 150 setups 50,000 kgs 180,000 700 inspections 160,000 960.000 900 inspections 40,000 MH 20,000 MH Machinery-related (machine hours - MH) Total manufacturing overhead 1.600.000 Required: (a) Calculate the costs per unit of the two products using the two costing systems: (1) Traditional costing system (ii) Activity-based costing system (16 marks) (b) Based on your calculations in (a) above, explain which product is overcosted and which product is undercosted using the traditional costing system AND briefly discuss the impact of product overcosting and undercosting to the organisation. (4 marks) HE B IA MacBook Pro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts