Question: Subject: Engineering Economics Need Step by step solution within 40 minutes. Question #5: a. You have 2 investment choices. The Warlight machine costs $10,000 and

Subject: Engineering Economics

Need Step by step solution within 40 minutes.

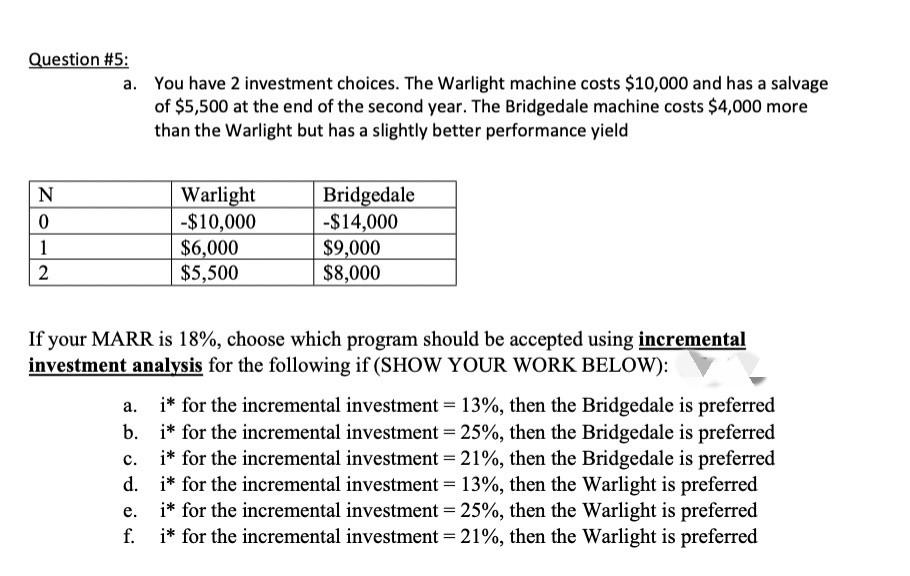

Question #5: a. You have 2 investment choices. The Warlight machine costs $10,000 and has a salvage of $5,500 at the end of the second year. The Bridgedale machine costs $4,000 more than the Warlight but has a slightly better performance yield N Warlight Bridgedale 0 -$10,000 -$14,000 1 $6,000 $9,000 2 $5,500 $8,000 If your MARR is 18%, choose which program should be accepted using incremental investment analysis for the following if (SHOW YOUR WORK BELOW): C. i* for the incremental investment = 13%, then the Bridgedale is preferred b. i* for the incremental investment = 25%, then the Bridgedale is preferred i* for the incremental investment = 21%, then the Bridgedale is preferred i* for the incremental investment = 13%, then the Warlight is preferred i* for the incremental investment = 25%, then the Warlight is preferred i* for the incremental investment = 21%, then the Warlight is preferred e. f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts