Question: Subject: Financial Information & Decision Making in Construction Word count; 2,500 words (Excluding appendices) Submission date: 20ch April 2022 ASSIGNMENT Maze Construction Ltd is a

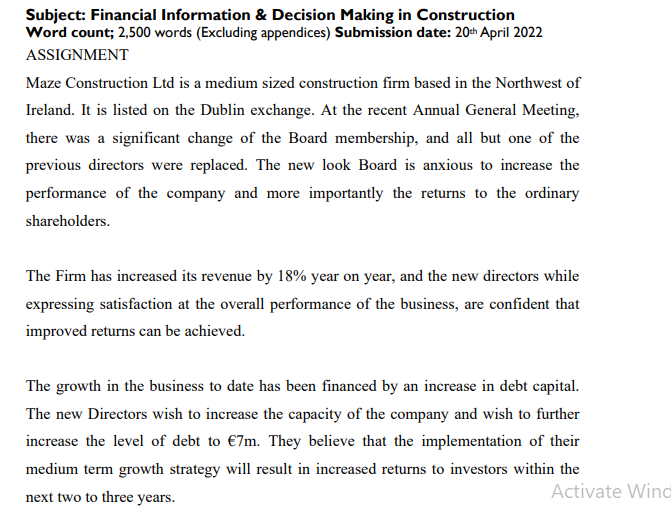

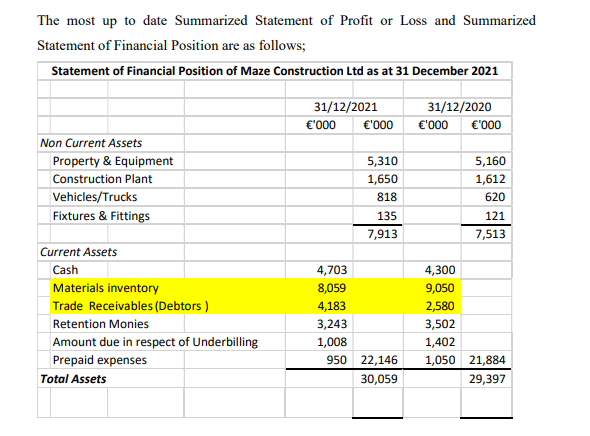

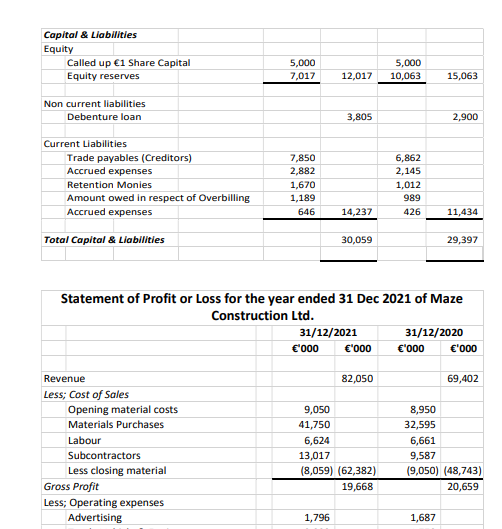

Subject: Financial Information & Decision Making in Construction Word count; 2,500 words (Excluding appendices) Submission date: 20ch April 2022 ASSIGNMENT Maze Construction Ltd is a medium sized construction firm based in the Northwest of Ireland. It is listed on the Dublin exchange. At the recent Annual General Meeting, there was a significant change of the Board membership, and all but one of the previous directors were replaced. The new look Board is anxious to increase the performance of the company and more importantly the returns to the ordinary shareholders. The Firm has increased its revenue by 18% year on year, and the new directors while expressing satisfaction at the overall performance of the business, are confident that improved returns can be achieved. The growth in the business to date has been financed by an increase in debt capital. The new Directors wish to increase the capacity of the company and wish to further increase the level of debt to 7m. They believe that the implementation of their medium term growth strategy will result in increased returns to investors within the next two to three years. Activate Wind The most up to date Summarized Statement of Profit or Loss and Summarized Statement of Financial Position are as follows; Statement of Financial Position of Maze Construction Ltd as at 31 December 2021 31/12/2021 '000 '000 31/12/2020 '000 '000 Non Current Assets Property & Equipment Construction Plant Vehicles/Trucks Fixtures & Fittings 5,310 1,650 818 135 7,913 5,160 1,612 620 121 7,513 Current Assets Cash Materials inventory Trade Receivables (Debtors) Retention Monies Amount due in respect of Underbilling Prepaid expenses Total Assets 4,703 8,059 4,183 3,243 1,008 950 22,146 30,059 4,300 9,050 2,580 3,502 1,402 1,050 21,884 29,397 Capital & Liabilities Equity Called up 1 Share Capital Equity reserves 5,000 7,017 5,000 10,063 12,017 15,063 Non current liabilities Debenture loan 3,805 2,900 Current Liabilities Trade payables (Creditors) Accrued expenses Retention Monies Amount owed in respect of Overbilling Accrued expenses 7,850 2,882 1,670 1,189 646 6,862 2,145 1,012 989 426 14,237 11,434 Total Capital & Liabilities 30,059 29,397 Statement of Profit or Loss for the year ended 31 Dec 2021 of Maze Construction Ltd. 31/12/2021 31/12/2020 '000 '000 '000 '000 82,050 69,402 Revenue Less; Cost of Sales Opening material costs Materials Purchases Labour Subcontractors Less closing material Gross Profit Less; Operating expenses Advertising 9,050 41,750 6,624 13,017 (8,059) (62,382) 19,668 8,950 32,595 6,661 9,587 (9,050) (48,743) 20,659 1,796 1,687 20,659 Gross Profit 19,668 Less; Operating expenses Advertising 1,796 Truck, Vehicle & Equipment expense 2,328 Insurance 860 Bad debts 320 Rent 456 Depreciation 1,020 Salaries 7,520 Legal & audit 202 Maintenance & repairs 352 Office supplies 316 Utilities 420 Sundry 119 (15,709) Net Operating Profit before taxation and interest expense 3,959 Interest Expense (1,105) Net Operating Profit Before taxation 2,854 1,687 1,770 640 370 280 1,005 7,250 165 193 264 271 99 (13,994) 6,665 (905) 5,760 Taxation Net Operating Profit After taxation (814) 2,040 (1,315) 4,445 The following additional information in relation to the Summarized Financial Statements has also been provided; Long Term Borrowing The long-term debt is repayable in 2028. Contingency Liabilities The notes to the Financial Statements include details of a contingent liability of 30million. A major customer, Blackhall Regional Council, is suing Maze Construction Ltd, claiming that it used poor quality materials in construction work they completed. The customer has had to rectify some of the building work completed by Maze Construction Ltd. Subsequent investigation by the Blackhall Regional Council has indicated that the material used by Maze Construction Ltd is hazardous. The initial assessment from the lawyers of Maze Construction Ltd is that the case is likely to be successful although the amount of damages could not be measured with sufficient reliability at the year-end date. The Directors have approached their local bank, ABC Bank Ltd, concerning securing funding for the expansion of existing capacity. As requested by the bank, the directors have forwarded the above Summarized Financial Statements to the bank. Required: Your Role: You are employed by ABC Bank Ltd as a Qualified Financial Advisor with specific expert knowledge of the Construction Industry. Your Conclusion and recommendations are necessary in advance of any decision by the Finance Committee to sanction any loans to Customers engaged in the construction industry.] You with are required to produce a formal business report on the above proposal as set out in the requirements below. The report should be addressed to the Finance Committee within ABC Bank Ltd and it should address the following: A. Outline in detail the company specific criteria that the Bank should consider in advance of granting funding to any construction related firm. Explain in detail the rationale for each criteria item, carefully considering the exposure of the bank and the requirement to meet customer demands. (30 marks) B. Outline in detail the macro economic factors that the Bank should consider in advance of granting funding to any construction related firm. (20 marks) C. Analyse the financial performance of Maze Construction Ltd using the Financial Information attached. The Analysis should provide a comprehensive overview of the current performance. (Your report should provide a complete comparative analysis). (40 marks) D. Based on your detailed reviews in Parts A, B and C, advise the Finance Committee on whether they should advance the funding as required by the new Board of Directors. (Your recommendations should reflect a realistic assessment of the current commercial environment within the construction industry and the current position of Maze Construction Ltd). (10 marks) Subject: Financial Information & Decision Making in Construction Word count; 2,500 words (Excluding appendices) Submission date: 20ch April 2022 ASSIGNMENT Maze Construction Ltd is a medium sized construction firm based in the Northwest of Ireland. It is listed on the Dublin exchange. At the recent Annual General Meeting, there was a significant change of the Board membership, and all but one of the previous directors were replaced. The new look Board is anxious to increase the performance of the company and more importantly the returns to the ordinary shareholders. The Firm has increased its revenue by 18% year on year, and the new directors while expressing satisfaction at the overall performance of the business, are confident that improved returns can be achieved. The growth in the business to date has been financed by an increase in debt capital. The new Directors wish to increase the capacity of the company and wish to further increase the level of debt to 7m. They believe that the implementation of their medium term growth strategy will result in increased returns to investors within the next two to three years. Activate Wind The most up to date Summarized Statement of Profit or Loss and Summarized Statement of Financial Position are as follows; Statement of Financial Position of Maze Construction Ltd as at 31 December 2021 31/12/2021 '000 '000 31/12/2020 '000 '000 Non Current Assets Property & Equipment Construction Plant Vehicles/Trucks Fixtures & Fittings 5,310 1,650 818 135 7,913 5,160 1,612 620 121 7,513 Current Assets Cash Materials inventory Trade Receivables (Debtors) Retention Monies Amount due in respect of Underbilling Prepaid expenses Total Assets 4,703 8,059 4,183 3,243 1,008 950 22,146 30,059 4,300 9,050 2,580 3,502 1,402 1,050 21,884 29,397 Capital & Liabilities Equity Called up 1 Share Capital Equity reserves 5,000 7,017 5,000 10,063 12,017 15,063 Non current liabilities Debenture loan 3,805 2,900 Current Liabilities Trade payables (Creditors) Accrued expenses Retention Monies Amount owed in respect of Overbilling Accrued expenses 7,850 2,882 1,670 1,189 646 6,862 2,145 1,012 989 426 14,237 11,434 Total Capital & Liabilities 30,059 29,397 Statement of Profit or Loss for the year ended 31 Dec 2021 of Maze Construction Ltd. 31/12/2021 31/12/2020 '000 '000 '000 '000 82,050 69,402 Revenue Less; Cost of Sales Opening material costs Materials Purchases Labour Subcontractors Less closing material Gross Profit Less; Operating expenses Advertising 9,050 41,750 6,624 13,017 (8,059) (62,382) 19,668 8,950 32,595 6,661 9,587 (9,050) (48,743) 20,659 1,796 1,687 20,659 Gross Profit 19,668 Less; Operating expenses Advertising 1,796 Truck, Vehicle & Equipment expense 2,328 Insurance 860 Bad debts 320 Rent 456 Depreciation 1,020 Salaries 7,520 Legal & audit 202 Maintenance & repairs 352 Office supplies 316 Utilities 420 Sundry 119 (15,709) Net Operating Profit before taxation and interest expense 3,959 Interest Expense (1,105) Net Operating Profit Before taxation 2,854 1,687 1,770 640 370 280 1,005 7,250 165 193 264 271 99 (13,994) 6,665 (905) 5,760 Taxation Net Operating Profit After taxation (814) 2,040 (1,315) 4,445 The following additional information in relation to the Summarized Financial Statements has also been provided; Long Term Borrowing The long-term debt is repayable in 2028. Contingency Liabilities The notes to the Financial Statements include details of a contingent liability of 30million. A major customer, Blackhall Regional Council, is suing Maze Construction Ltd, claiming that it used poor quality materials in construction work they completed. The customer has had to rectify some of the building work completed by Maze Construction Ltd. Subsequent investigation by the Blackhall Regional Council has indicated that the material used by Maze Construction Ltd is hazardous. The initial assessment from the lawyers of Maze Construction Ltd is that the case is likely to be successful although the amount of damages could not be measured with sufficient reliability at the year-end date. The Directors have approached their local bank, ABC Bank Ltd, concerning securing funding for the expansion of existing capacity. As requested by the bank, the directors have forwarded the above Summarized Financial Statements to the bank. Required: Your Role: You are employed by ABC Bank Ltd as a Qualified Financial Advisor with specific expert knowledge of the Construction Industry. Your Conclusion and recommendations are necessary in advance of any decision by the Finance Committee to sanction any loans to Customers engaged in the construction industry.] You with are required to produce a formal business report on the above proposal as set out in the requirements below. The report should be addressed to the Finance Committee within ABC Bank Ltd and it should address the following: A. Outline in detail the company specific criteria that the Bank should consider in advance of granting funding to any construction related firm. Explain in detail the rationale for each criteria item, carefully considering the exposure of the bank and the requirement to meet customer demands. (30 marks) B. Outline in detail the macro economic factors that the Bank should consider in advance of granting funding to any construction related firm. (20 marks) C. Analyse the financial performance of Maze Construction Ltd using the Financial Information attached. The Analysis should provide a comprehensive overview of the current performance. (Your report should provide a complete comparative analysis). (40 marks) D. Based on your detailed reviews in Parts A, B and C, advise the Finance Committee on whether they should advance the funding as required by the new Board of Directors. (Your recommendations should reflect a realistic assessment of the current commercial environment within the construction industry and the current position of Maze Construction Ltd). (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts