Question: Subject : financial management Question : Case Dividend is a source of income for common shareholders and companies try to increase shareholder's wealth through different

Subject : financial management

Question :

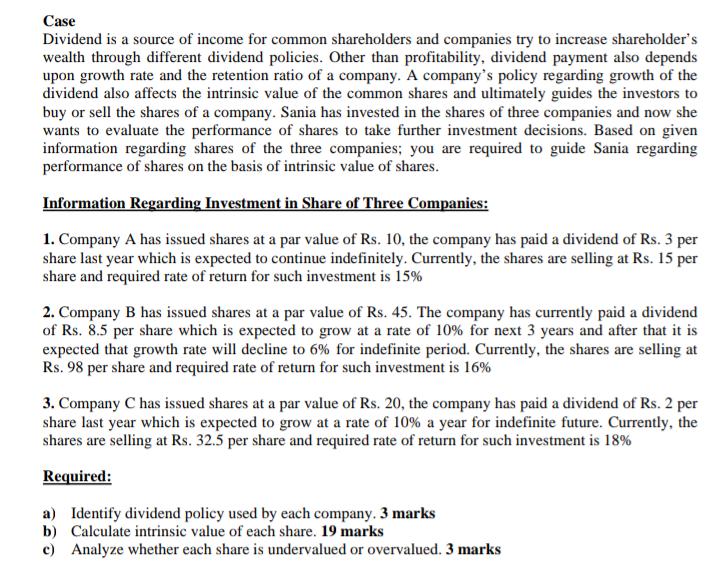

Case Dividend is a source of income for common shareholders and companies try to increase shareholder's wealth through different dividend policies. Other than profitability, dividend payment also depends upon growth rate and the retention ratio of a company. A company's policy regarding growth of the dividend also affects the intrinsic value of the common shares and ultimately guides the investors to buy or sell the shares of a company. Sania has invested in the shares of three companies and now she wants to evaluate the performance of shares to take further investment decisions. Based on given information regarding shares of the three companies; you are required to guide Sania regarding performance of shares on the basis of intrinsic value of shares. Information Regarding Investment in Share of Three Companies: 1. Company A has issued shares at a par value of Rs. 10, the company has paid a dividend of Rs. 3 per share last year which is expected to continue indefinitely. Currently, the shares are selling at Rs. 15 per share and required rate of return for such investment is 15% 2. Company B has issued shares at a par value of Rs. 45. The company has currently paid a dividend of Rs. 8.5 per share which is expected to grow at a rate of 10% for next 3 years and after that it is expected that growth rate will decline to 6% for indefinite period. Currently, the shares are selling at Rs. 98 per share and required rate of return for such investment is 16% 3. Company C has issued shares at a par value of Rs. 20, the company has paid a dividend of Rs. 2 per share last year which is expected to grow at a rate of 10% a year for indefinite future. Currently, the shares are selling at Rs. 32.5 per share and required rate of return for such investment is 18% Required: a) Identify dividend policy used by each company. 3 marks b) Calculate intrinsic value of each share. 19 marks c) Analyze whether each share is undervalued or overvalued. 3 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts