Question: subject financial statement analysis Act 450 QUESTION 2) (35 pts) Income statements for 2018 and 2019 of ABC Inc. are given below: a) Express the

subject financial statement analysis Act 450

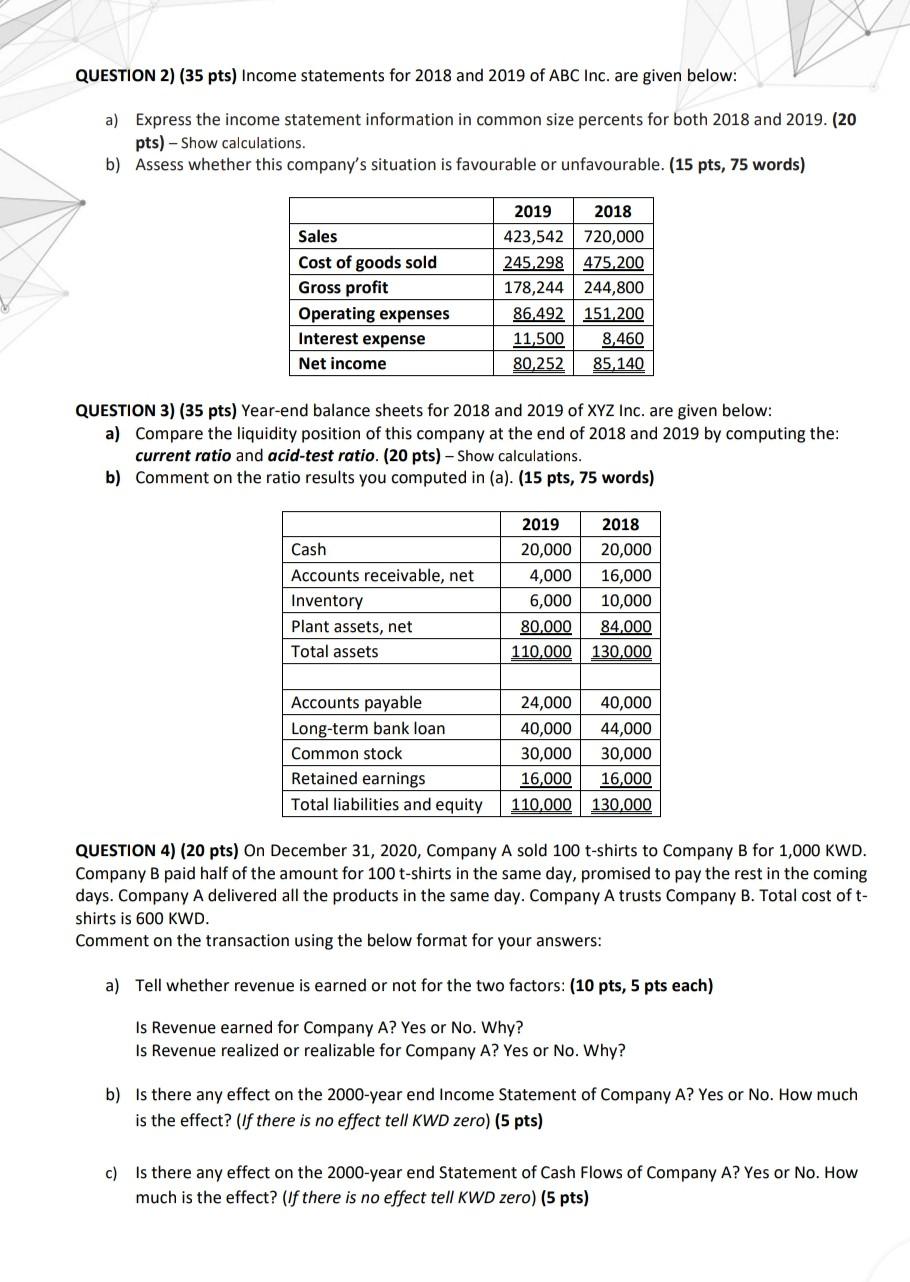

QUESTION 2) (35 pts) Income statements for 2018 and 2019 of ABC Inc. are given below: a) Express the income statement information in common size percents for both 2018 and 2019. (20 pts) - Show calculations. b) Assess whether this company's situation is favourable or unfavourable. (15 pts, 75 words) Sales Cost of goods sold Gross profit Operating expenses Interest expense Net income 2019 2018 423,542 720,000 245,298 475,200 178,244 244,800 86,492 151,200 11,500 8,460 80,252 85,140 QUESTION 3) (35 pts) Year-end balance sheets for 2018 and 2019 of XYZ Inc. are given below: a) Compare the liquidity position of this company at the end of 2018 and 2019 by computing the: current ratio and acid-test ratio. (20 pts) - Show calculations. b) Comment on the ratio results you computed in (a). (15 pts, 75 words) Cash Accounts receivable, net Inventory Plant assets, net Total assets 2019 20,000 4,000 6,000 80,000 110,000 2018 20,000 16,000 10,000 84,000 130.000 Accounts payable Long-term bank loan Common stock Retained earnings Total liabilities and equity 24,000 40,000 40,000 44,000 30,000 30,000 16,000 16,000 110,000 130.000 QUESTION 4) (20 pts) On December 31, 2020, Company A sold 100 t-shirts to Company B for 1,000 KWD. Company B paid half of the amount for 100 t-shirts in the same day, promised to pay the rest in the coming days. Company A delivered all the products in the same day. Company A trusts Company B. Total cost oft- shirts is 600 KWD. Comment on the transaction using the below format for your answers: a) Tell whether revenue is earned or not for the two factors: (10 pts, 5 pts each) Is Revenue earned for Company A? Yes or No. Why? Is Revenue realized or realizable for Company A? Yes or No. Why? b) Is there any effect on the 2000-year end Income Statement of Company A? Yes or No. How much is the effect? (if there is no effect tell KWD zero) (5 pts) c) Is there any effect on the 2000-year end Statement of Cash Flows of Company A? Yes or No. How much is the effect? (If there is no effect tell KWD zero) (5 pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts