Question: Subject: Global Financial Statement Analysis Altman's Z score analysis is a popular tool used by analysts. Required: Write about Altman's Z score analysis (in proper

Subject: Global Financial Statement Analysis

Altman's Z score analysis is a popular tool used by analysts.

Required:

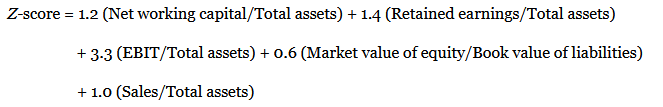

- Write about Altman's Z score analysis (in proper APA style) explaining what it is; how it is computed and how to interpret the results

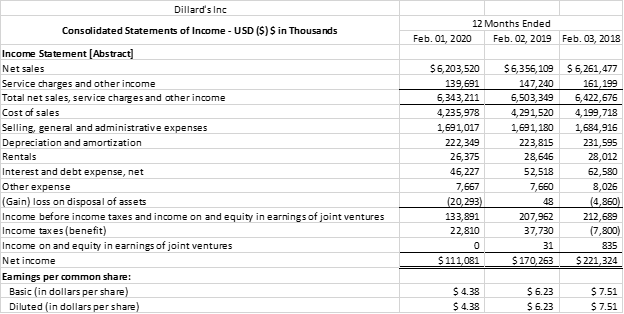

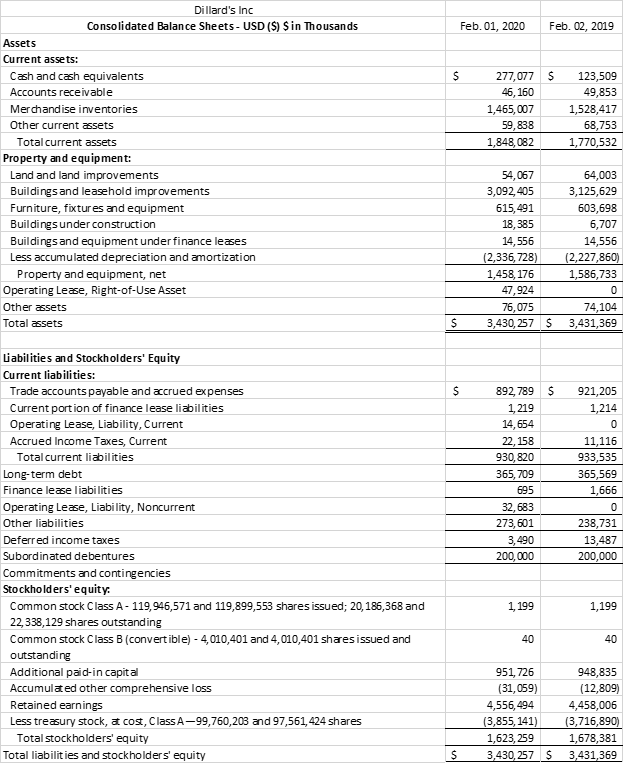

- Calculate and interpret the Z Score for Dillard's 2019 financial statements:

Dillard's Inc 12 Months Ended Consolidated Statements of Income - USD ($) $ in Thousands Feb. 01, 2020 Feb. 02, 2019 Feb. 03, 2018 Income Statement [Abstract] Net sales 5 6,203,520 5 6,356,109 S 6,261,477 Service charges and other income 139,691 147,240 161,199 Total net sales, service charges and other income 6,343,211 6,503,349 6,422,676 Cost of sales 4,235,978 4,291,520 4,199,718 Selling, general and administrative expenses 1, 691,017 1, 691,180 1,684,916 Depreciation and amortization 222,349 223,815 231,595 Rentals 26,375 28,646 28,012 Interest and debt expense, net 46,227 52,518 62,580 Other expense 7,667 7,660 8,026 (Gain) loss on disposal of assets (20,293) 48 (4,860) Income before income taxes and income on and equity in earnings of joint ventures 133,891 207,962 212,689 Income taxes (benefit) 22,810 37,730 (7,800) Income on and equity in earnings of joint ventures 31 835 Net income $ 11 1,081 $ 170,263 $ 221,324 Eamings per common share: Basic (in dollars per share) 5 4.38 5 6.23 $ 7.51 Diluted (in dollars per share) 5 4.38 5 6.23 $ 7.51Dillard's Inc Consolidated Balance Sheets - USD ($) $ in Thousands Feb. 01, 2020 Feb. 02, 2019 Assets Current assets: Cash and cash equivalents 277,077 S 123,509 Accounts receivable 46, 160 49,853 Merchandise inventories 1,465, 007 1,528,417 Other current assets 59, 838 68,753 Total current assets 1,848, 082 1,770,532 Property and equipment: Land and land improvements 54, 067 64,003 Buildings and leasehold improvements 3,092, 405 3,125,629 Furniture, fixtures and equipment 615, 491 603,698 Buildings under construction 18, 385 6,707 Buildings and equipment under finance leases 14,556 14,556 Less accumulated depreciation and amortization (2,336, 728) (2,227,860 Property and equipment, net 1,458, 176 1,586,733 Operating Lease, Right-of-Use Asset 47,924 0 Other assets 76, 075 74,104 Total assets 3,430, 257 5 3,431,369 Liabilities and Stockholders' Equity Current liabilities: Trade accounts payable and accrued expenses S 892, 789 921,205 Current portion of finance lease liabilities 1, 219 1,214 Operating Lease, Liability, Current 14, 654 0 Accrued Income Taxes, Current 22, 158 11,116 Total current liabilities 930, 820 933,535 Long-term debt 365, 709 365,569 Finance lease liabilities 595 1,666 Operating Lease, Liability, Noncurrent 32, 683 0 Other liabilities 273, 601 238,731 Deferred income taxes 3,490 13,487 Subordinated debentures 200,000 200,000 Commitments and contingencies Stockholders' equity. Common stock Class A- 119,946,571 and 119,899,553 shares issued; 20, 186,368 and 1,199 1,199 22, 338,129 shares outstanding Common stock Class B (convertible) - 4,010,401 and 4, 010,401 shares issued and 40 40 outstanding Additional paid-in capital 951, 726 948,835 Accumulated other comprehensive loss (31, 059) (12,809 Retained earnings 4,556, 494 4,458,006 Less treasury stock, at cost, Class A-99,760,208 and 97,561, 424 shares 3,855, 141) (3,716,890 Total stockholders' equity 1,623, 259 1,678,381 Total liabilities and stockholders' equity 3,430, 257 $ 3,431,369Z-score = 1.2 (Net working capital/Total assets) + 1.4 (Retained earnings/Total assets) + 3-3 (EBIT/Total assets) + 0.6 (Market value of equity/Book value of liabilities) + 1.0 (Sales/Total assets)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts