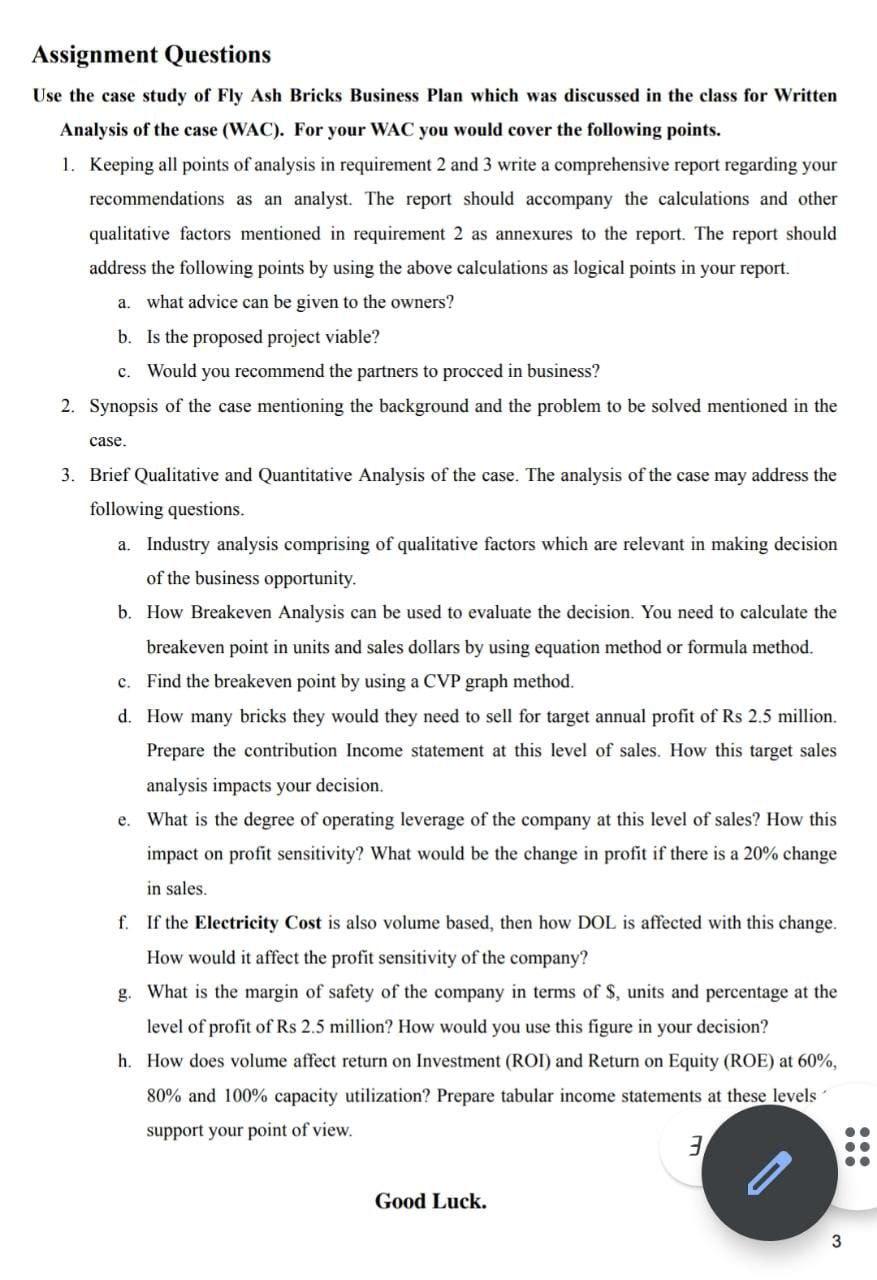

Question: Subject: Management Accounting-Decision Making FLY ASH BRICK PROJECT: FEASIBILITY STUDY USING CVP ANALYSIS Assignment Questions Use the case study of Fly Ash Bricks Business Plan

Subject: Management Accounting-Decision Making FLY ASH BRICK PROJECT: FEASIBILITY STUDY USING CVP ANALYSIS

Subject: Management Accounting-Decision Making FLY ASH BRICK PROJECT: FEASIBILITY STUDY USING CVP ANALYSIS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts