Question: Subject: Performance management BLQ - Variance Analysis (PYQ) Question 1 Blast Ltd has a manufacturing plant in Nilai Industrial Park and it makes a product

Subject: Performance management

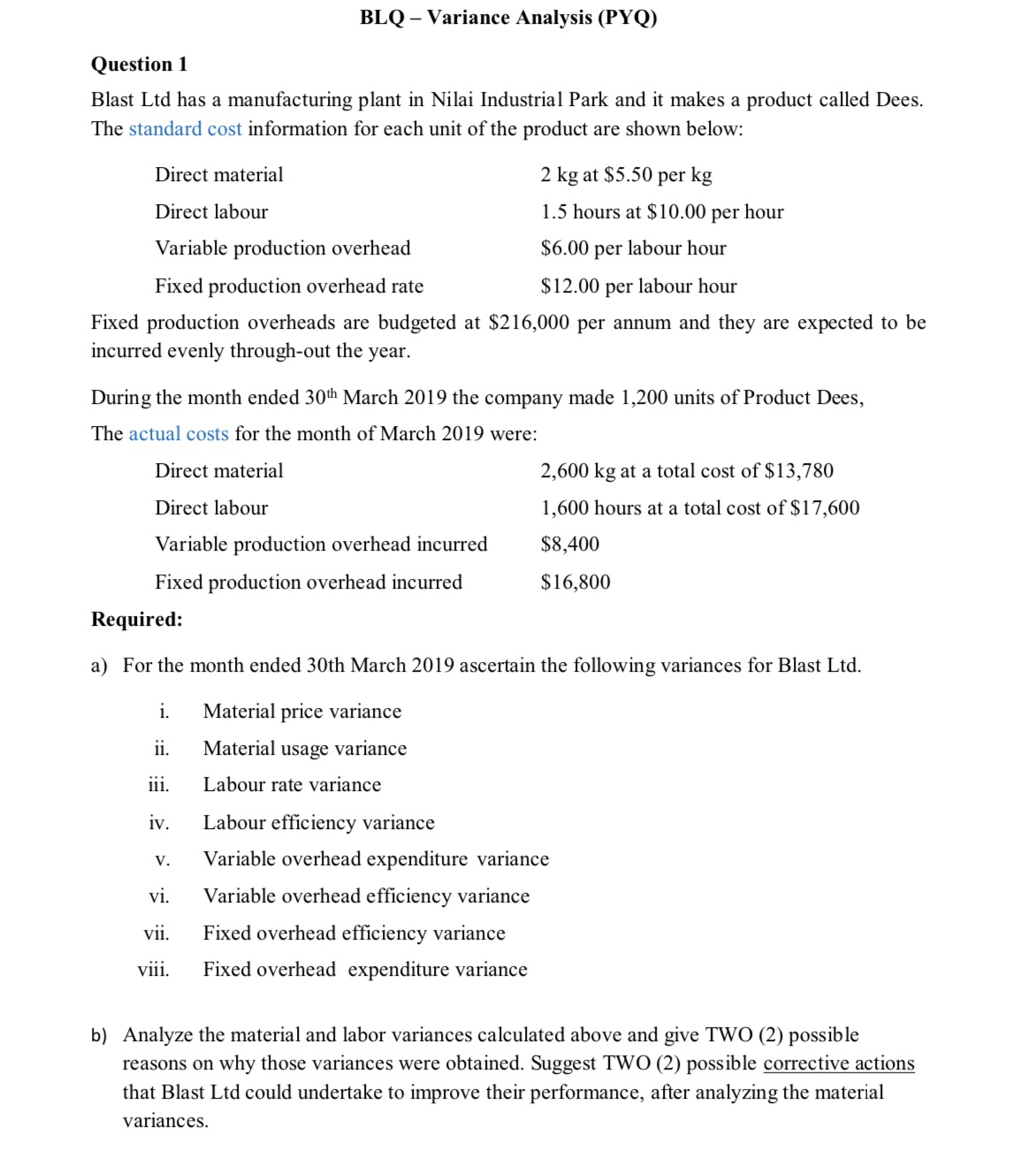

BLQ - Variance Analysis (PYQ) Question 1 Blast Ltd has a manufacturing plant in Nilai Industrial Park and it makes a product called Bees. The standard cost information for each unit of the product are shown below: Direct material 2 kg at $5.50 per kg Direct labour 1.5 hours at $10.00 per hour Variable production overhead $6.00 per labour hour Fixed production overhead rate $12.00 per labour hour Fixed production overheads are budgeted at $216,000 per annum and they are expected to be incurred evenly through-out the year. During the month ended 30'h March 2019 the company made 1,200 units of Product Does, The actual costs for the month of March 2019 were: Direct material 2,600 kg at a total cost of $13,780 Direct labour 1,600 hours at a total cost of $17,600 Variable production overhead incurred $8,400 Fixed production overhead incurred $16,800 Required: a) For the month ended 30th March 2019 ascertain the following variances for Blast Ltd. i. Material price variance ii. Material usage variance iii. Labour rate variance iv. Labour efciency variance v. Variable overhead expenditure variance vi. Variable overhead efciency variance vii. Fixed overhead efciency variance viii. Fixed overhead expenditure variance b} Analyze the material and labor variances calculated above and give TWO (2) possible reasons on why those variances were obtained. Suggest TWO (2) possible corrective actions that Blast Ltd could undertake to improve their performance, after analyzing the material variances

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts