Question: Subject Taxation please help me answer this #1) (2 Marks) Kaya Whitmore is an employee who recently was injured and was hospitalized for a period

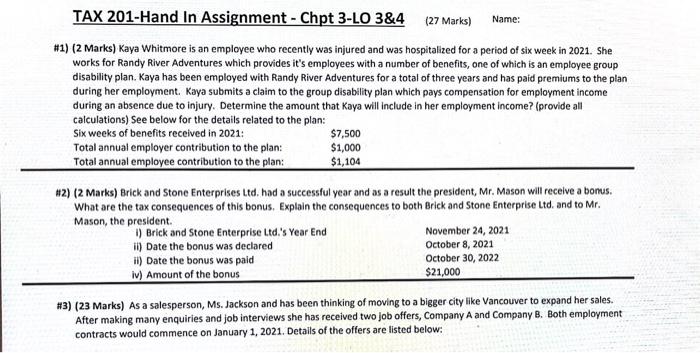

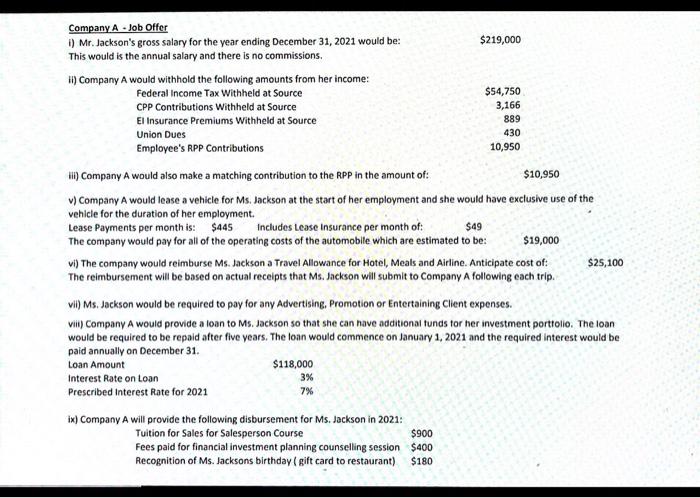

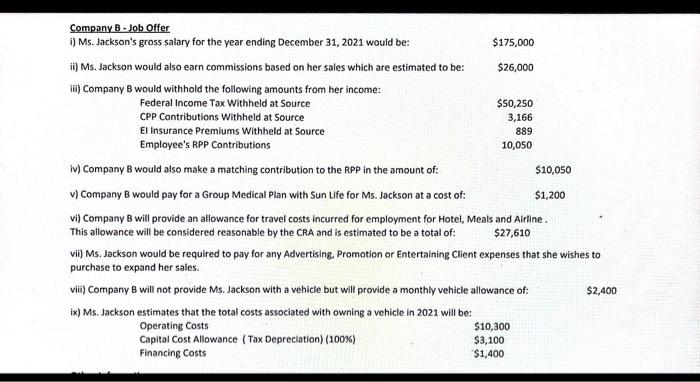

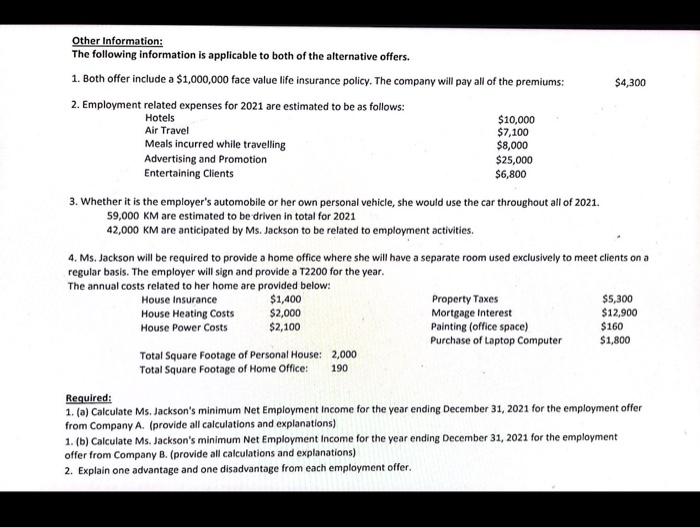

#1) (2 Marks) Kaya Whitmore is an employee who recently was injured and was hospitalized for a period of six week in 2021. She works for Randy River Adventures which provides it's employees with a number of benefits, one of which is an employee group disability plan. Kaya has been employed with Randy River Adventures for a total of three years and has paid premiums to the plan during her employment. Kaya submits a claim to the group disability plan which pays compensation for employment income during an absence due to injury. Determine the amount that Kaya will include in her employment income? (provide all calculations) See below for the details related to the olan: #12) (2 Marks) Brick and Stone Enterprises Ltd. had a successful year and as a result the president, Mr. Mason will receive a bonus. What are the tax consequences of this bonus. Explain the consequences to both Brick and Stone Enterprise Ltd. and to Mr. Ma #3) (23 Marks) As a salesperson, Ms. Jackson and has been thinking of moving to a bigger city like Vancouver to expand her sales. After making many enquiries and job interviews she has received two job offers, Company A and Company B. Both employment contracts would commence on January 1, 2021. Details of the offers are listed below: iii) Company A would also make a matching contribution to the RPP in the amount of: $10,950 v) Company A would lease a vehicle for Ms. Jackson at the start of her employment and she would have exclusive use of the vehicle for the duration of her employment. vi) The company would reimburse Ms. Jackson a Travel Allowance for Hotel, Meals and Airline. Anticipate cost of: $25,100 The reimbursement will be based on actual receipts that Ms. Jackson will submit to Company A following each trip. vii) Ms. Jackson would be required to pay for any Advertising. Promotion or Entertaining Client expenses. vii) Company A would provide a loan to Ms. Jackson so that she can have additional funds tor her investment porttolio. The loan would be required to be repaid after flve years. The loan would commence on January 1,2021 and the required interest would be nairl annuallu an Decomhar 31 . ix) Company A will provide the following disbursement for Ms. Jackson in 2021: Tuition for Sales for Salesperson Course $900 Fees paid for financial investment planning counselling session $400 Recognition of Ms. Jacksons birthday ( gift card to restaurant) $180 i) Ms. Jackson's gross salary for the year ending December 31,2021 would be: $175,000 iv) Company B would also make a matching contribution to the RPP in the amount of: v) Company B would pay for a Group Medical Plan with Sun Life for Ms. Jackson at a cost of: $1,200 vi) Company B will provide an allowance for travel costs incurred for employment for Hotel, Meals and Airline. This allowance will be considered reasonable by the CRA and is estimated to be a total of: $27,610 vii) Ms. Jackson would be required to pay for any Advertising. Promotion or Entertaining Client expenses that she wishes to purchase to expand her sales. viii) Company B will not provide Ms. Jackson with a vehicle but will provide a monthly vehicle allowance of: $2,400 ix) Ms. Ji Other Information: The following information is applicable to both of the alternative offers. 1. Both offer include a $1,000,000 face value life insurance policy. The company will pay all of the premiums: $4,300 3. Whether it is the employer's automobile or her own personal vehicle, she would use the car throughout all of 2021. 59,000KM are estimated to be driven in total for 2021 42,000KM are anticipated by Ms. Jackson to be related to employment activities. 4. Ms. Jackson will be required to provide a home office where she will have a separate room used exclusively to meet clients on a regular basis. The employer will sign and provide a T2200 for the year. The ant Required: 1. (a) Calculate Ms. Jackson's minimum Net Employment income for the year ending December 31, 2021 for the employment offer from Company A. (provide all calculations and explanations) 1. (b) Calculate Ms. Jackson's minimum Net Employment income for the year ending December 31, 2021 for the employment offer from Company B. (provide all calculations and explanations) 2. Explain one advantage and one disadvantage from each employment offer. #1) (2 Marks) Kaya Whitmore is an employee who recently was injured and was hospitalized for a period of six week in 2021. She works for Randy River Adventures which provides it's employees with a number of benefits, one of which is an employee group disability plan. Kaya has been employed with Randy River Adventures for a total of three years and has paid premiums to the plan during her employment. Kaya submits a claim to the group disability plan which pays compensation for employment income during an absence due to injury. Determine the amount that Kaya will include in her employment income? (provide all calculations) See below for the details related to the olan: #12) (2 Marks) Brick and Stone Enterprises Ltd. had a successful year and as a result the president, Mr. Mason will receive a bonus. What are the tax consequences of this bonus. Explain the consequences to both Brick and Stone Enterprise Ltd. and to Mr. Ma #3) (23 Marks) As a salesperson, Ms. Jackson and has been thinking of moving to a bigger city like Vancouver to expand her sales. After making many enquiries and job interviews she has received two job offers, Company A and Company B. Both employment contracts would commence on January 1, 2021. Details of the offers are listed below: iii) Company A would also make a matching contribution to the RPP in the amount of: $10,950 v) Company A would lease a vehicle for Ms. Jackson at the start of her employment and she would have exclusive use of the vehicle for the duration of her employment. vi) The company would reimburse Ms. Jackson a Travel Allowance for Hotel, Meals and Airline. Anticipate cost of: $25,100 The reimbursement will be based on actual receipts that Ms. Jackson will submit to Company A following each trip. vii) Ms. Jackson would be required to pay for any Advertising. Promotion or Entertaining Client expenses. vii) Company A would provide a loan to Ms. Jackson so that she can have additional funds tor her investment porttolio. The loan would be required to be repaid after flve years. The loan would commence on January 1,2021 and the required interest would be nairl annuallu an Decomhar 31 . ix) Company A will provide the following disbursement for Ms. Jackson in 2021: Tuition for Sales for Salesperson Course $900 Fees paid for financial investment planning counselling session $400 Recognition of Ms. Jacksons birthday ( gift card to restaurant) $180 i) Ms. Jackson's gross salary for the year ending December 31,2021 would be: $175,000 iv) Company B would also make a matching contribution to the RPP in the amount of: v) Company B would pay for a Group Medical Plan with Sun Life for Ms. Jackson at a cost of: $1,200 vi) Company B will provide an allowance for travel costs incurred for employment for Hotel, Meals and Airline. This allowance will be considered reasonable by the CRA and is estimated to be a total of: $27,610 vii) Ms. Jackson would be required to pay for any Advertising. Promotion or Entertaining Client expenses that she wishes to purchase to expand her sales. viii) Company B will not provide Ms. Jackson with a vehicle but will provide a monthly vehicle allowance of: $2,400 ix) Ms. Ji Other Information: The following information is applicable to both of the alternative offers. 1. Both offer include a $1,000,000 face value life insurance policy. The company will pay all of the premiums: $4,300 3. Whether it is the employer's automobile or her own personal vehicle, she would use the car throughout all of 2021. 59,000KM are estimated to be driven in total for 2021 42,000KM are anticipated by Ms. Jackson to be related to employment activities. 4. Ms. Jackson will be required to provide a home office where she will have a separate room used exclusively to meet clients on a regular basis. The employer will sign and provide a T2200 for the year. The ant Required: 1. (a) Calculate Ms. Jackson's minimum Net Employment income for the year ending December 31, 2021 for the employment offer from Company A. (provide all calculations and explanations) 1. (b) Calculate Ms. Jackson's minimum Net Employment income for the year ending December 31, 2021 for the employment offer from Company B. (provide all calculations and explanations) 2. Explain one advantage and one disadvantage from each employment offer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts