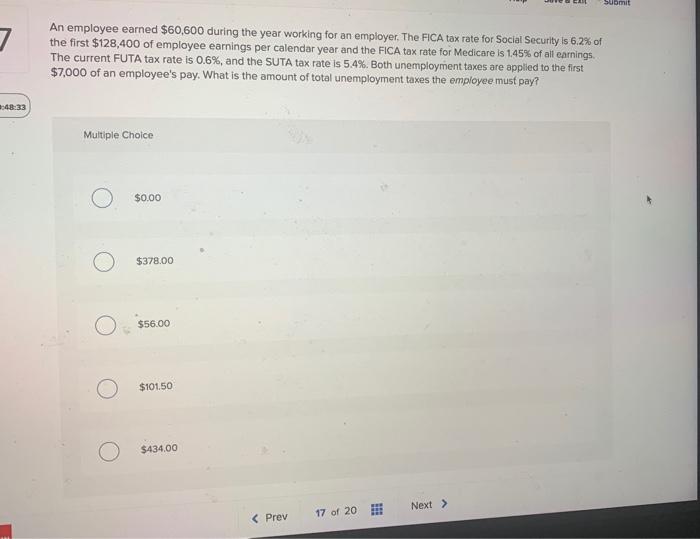

Question: Submit 7 An employee earned $60,600 during the year working for an employer, The FICA tax rate for Social Security is 6.2% of the first

Submit 7 An employee earned $60,600 during the year working for an employer, The FICA tax rate for Social Security is 6.2% of the first $128,400 of employee earnings per calendar year and the FICA tax rate for Medicare is 1.45% of all earnings The current FUTA tax rate is 0.6%, and the SUTA tax rate is 5.4%. Both unemployment taxes are applied to the first $7,000 of an employee's pay. What is the amount of total unemployment taxes the employee must pay? 48:33 Multiple Choice $0.00 $378.00 $56.00 $101.50 $434.00 Next > 20

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock