Question: Submit Answer format: Currency: Round to: 2 decimal places. A developer has 20 acres of real estate for a project. She has two projects to

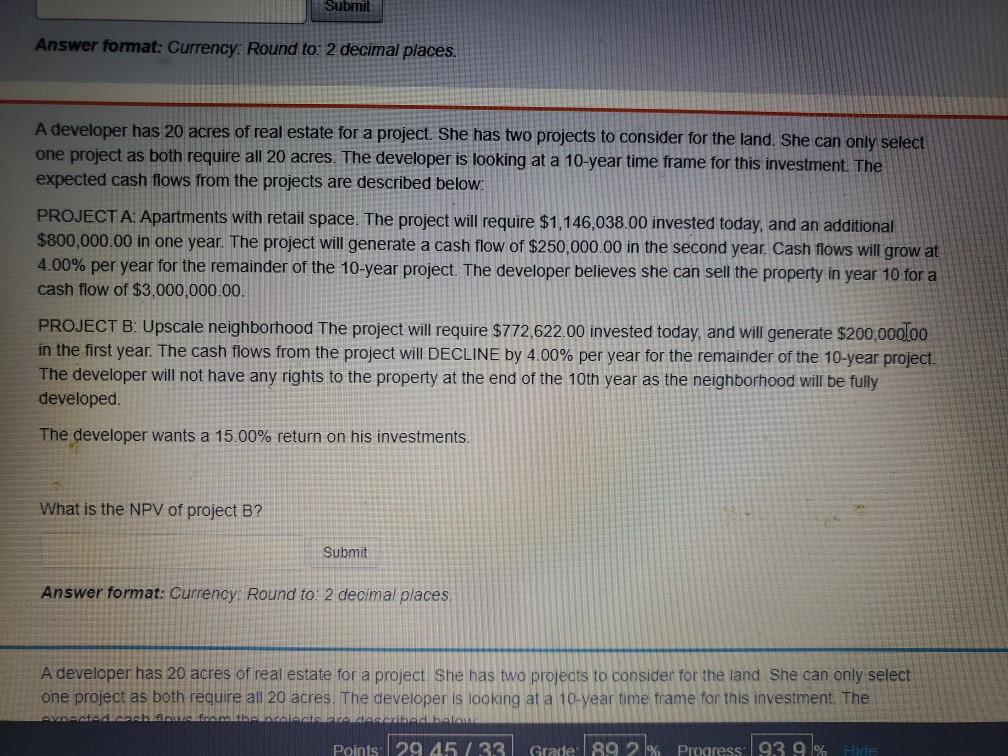

Submit Answer format: Currency: Round to: 2 decimal places. A developer has 20 acres of real estate for a project. She has two projects to consider for the land. She can only select one project as both require all 20 acres. The developer is looking at a 10-year time frame for this investment. The expected cash flows from the projects are described below: PROJECT A: Apartments with retail space. The project will require $1,146,038.00 invested today, and an additional $800,000.00 in one year. The project will generate a cash flow of $250,000.00 in the second year. Cash flows will grow at 4.00% per year for the remainder of the 10-year project. The developer believes she can sell the property in year 10 for a cash flow of $3,000,000.00 PROJECT B: Upscale neighborhood The project will require $772,622.00 invested today, and will generate $200,000loo in the first year. The cash flows from the project will DECLINE by 4.00% per year for the remainder of the 10-year project. The developer will not have any rights to the property at the end of the 10th year as the neighborhood will be fully developed The developer wants a 15.00% return on his investments. What is the NPV of project B? Submit Answer format: Currency: Round to 2 decimal places A developer has 20 acres of real estate for a project. She has two projects to consider for the land she can only select one project as both require all 20 acres. The developer is looking at a 10-year time frame for this investment. The thaalaats Points: 29.45 / 33 Grade 89 % Progress 93 9% Mitte

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts