Question: Submit Test Silver Chef Company processes tomatoes into ketchup, tomato juice, and canned tomatoes. During July 2020, the joint costs of processing the tomatoes were

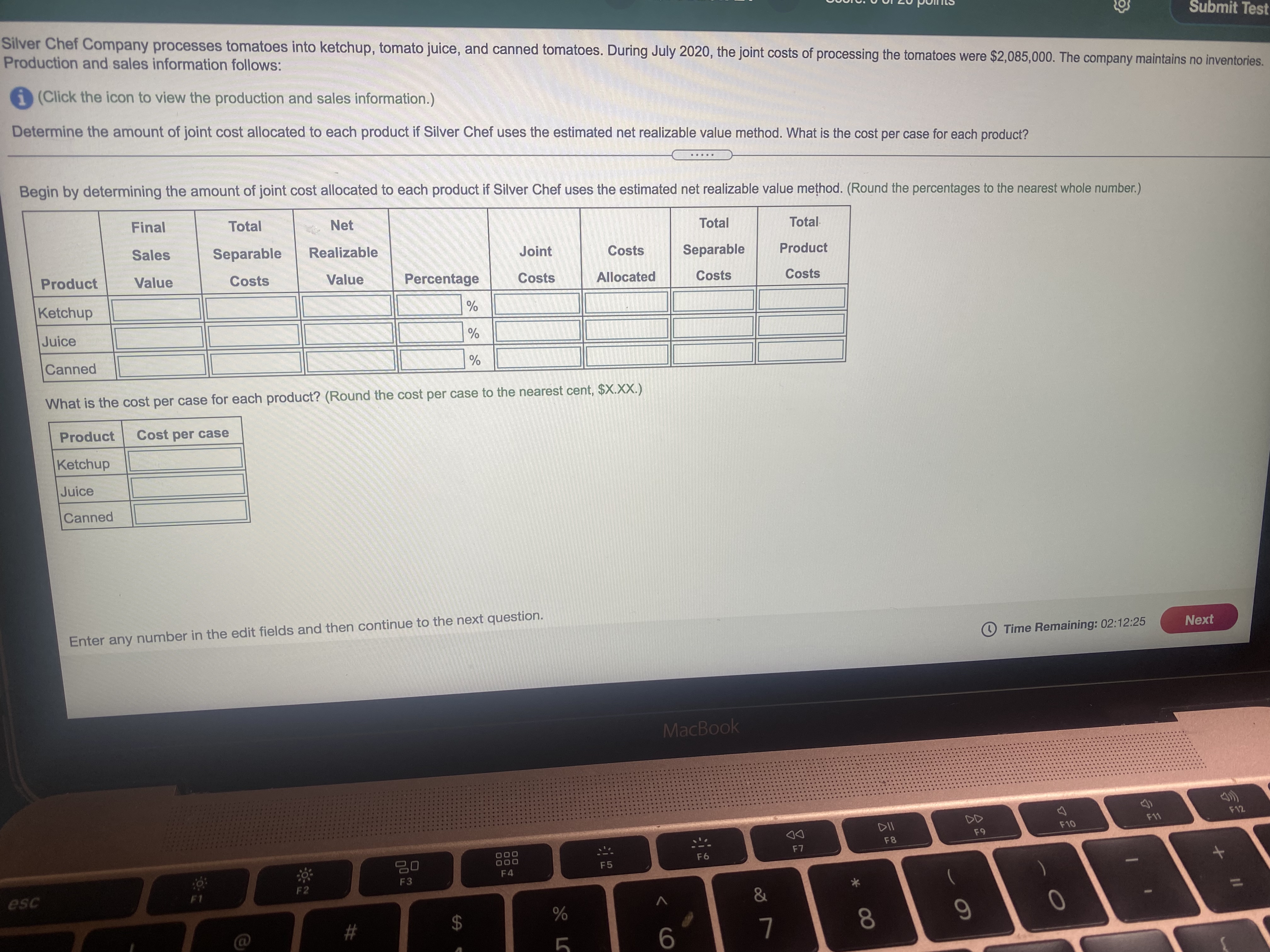

Submit Test Silver Chef Company processes tomatoes into ketchup, tomato juice, and canned tomatoes. During July 2020, the joint costs of processing the tomatoes were $2,085,000. The company maintains no inventories. Production and sales information follows: i (Click the icon to view the production and sales information.) Determine the amount of joint cost allocated to each product if Silver Chef uses the estimated net realizable value method. What is the cost per case for each product? Begin by determining the amount of joint cost allocated to each product if Silver Chef uses the estimated net realizable value method. (Round the percentages to the nearest whole number.) Final Total Net Total Total Sales Separable Realizable Joint Costs Separable Product Product Value Costs Value Percentage Costs Allocated Costs Costs Ketchup % Juice % Canned |% What is the cost per case for each product? (Round the cost per case to the nearest cent, $X.XX.) Product Cost per case Ketchup Juice Canned Enter any number in the edit fields and then continue to the next question. Time Remaining: 02:12:25 Next MacBook F12 F9 F10 F6 F7 20 F4 F5 esc F1 A & % CO @ 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts