Question: Submit your answers in an Excel spreadsheet: 1.) Explain which of the investments would be preferred by a risk-averse investor and which would be preferred

Submit your answers in an Excel spreadsheet:

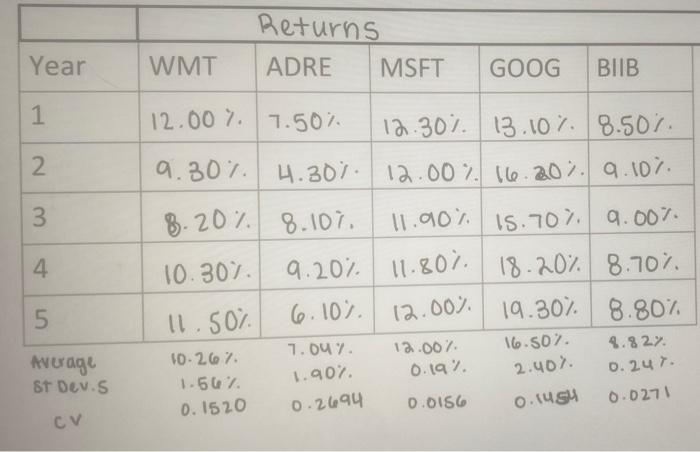

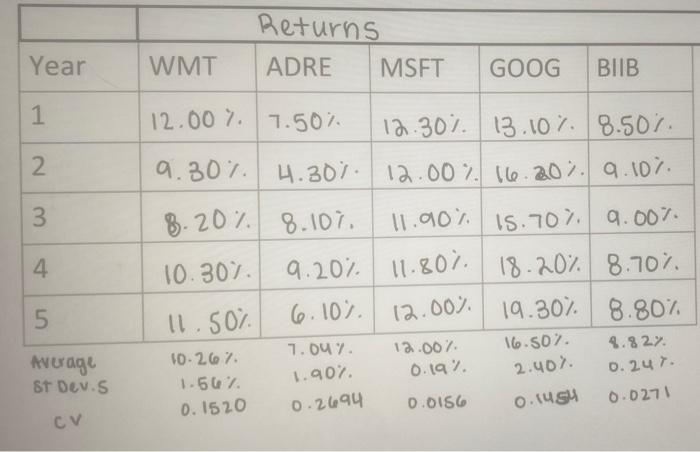

1.) Explain which of the investments would be preferred by a risk-averse investor and which would be preferred by a risk-seeking investor.

2.) a. Using the data provided in the picture, determine the return and risk for a portfolio made up of the following three stocks if you wish to distribute your investment as follows: 20% in ADRE, 65% in MSFT and 15% in GOOG.

b. How would the portfolio be affected if you distributed your investment in the following way: 30% in ADRE, 25% in MSFT and 45% in GOOG.

Year 1 2 3 Returns WMT ADRE MSFT GOOG BIIB 12.00 7. 7.50% 12.30% 13.10% 18.50%. 9.30% 4.301. 12.00% 16.20% 9 10% 8.20%. 8.107 11.90% 15.70% 9.00%. 10.307 9.20% 11.80% 18.20% 8.70% 11.50% 6.10%. 19.30% 8.80% 10-267. 7.04%. 12.007 16.502 9.82.. 1.56% 1.90%. 0.1520 0.0166 0.0271 4 . 5 12.00% Average St Dev.s 0.19% 2.40%. 0.247. 0.2694 0.1484 CV

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock