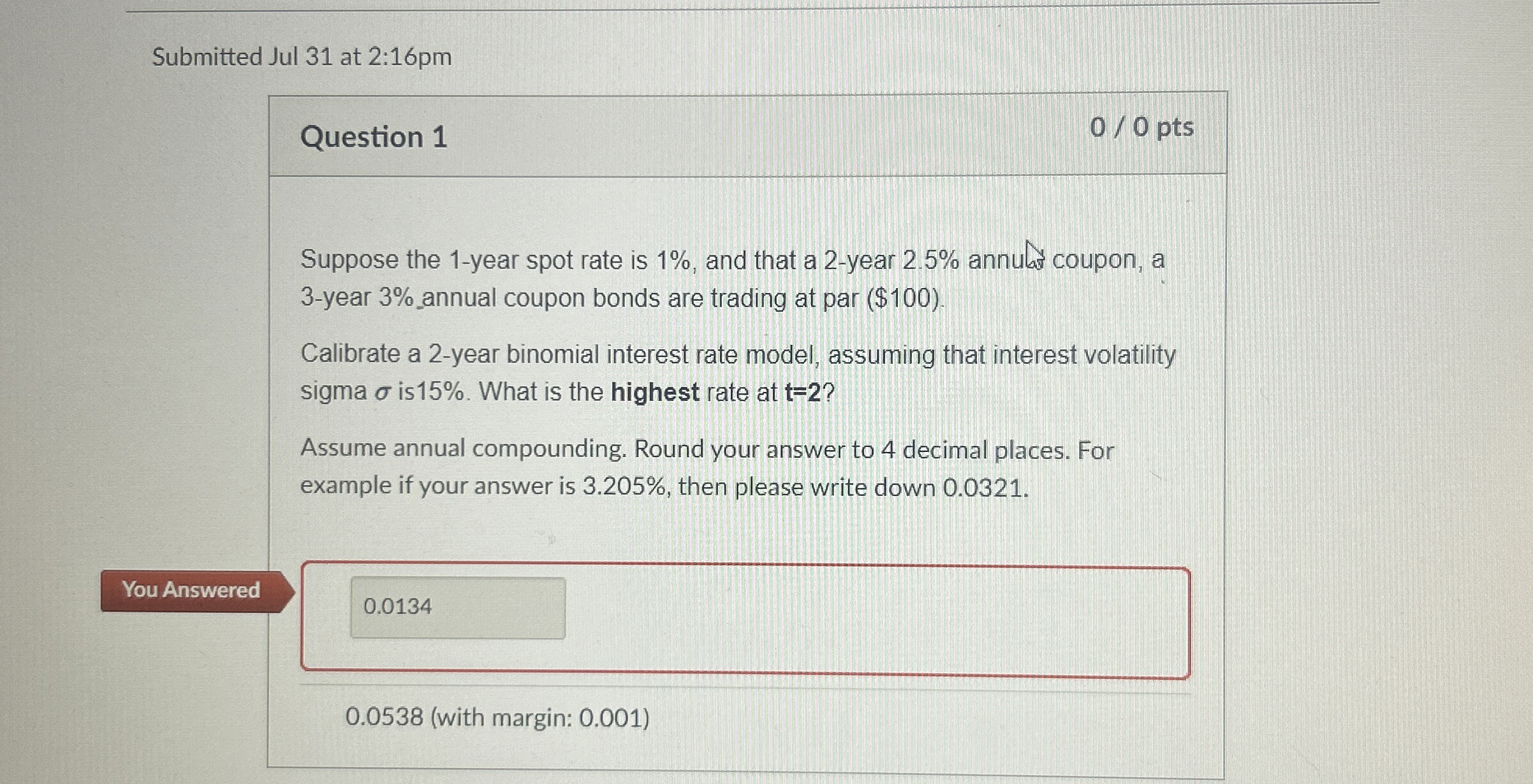

Question: Submitted Jul 3 1 at 2 : 1 6 pm Question 1 0 0 pts Suppose the 1 - year spot rate is 1 %

Submitted Jul at :pm

Question

pts

Suppose the year spot rate is and that a year annulas coupon, a year annual coupon bonds are trading at par $

Calibrate a year binomial interest rate model, assuming that interest volatility sigma is What is the highest rate at

Assume annual compounding. Round your answer to decimal places. For example if your answer is then please write down

with margin:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock