Question: Subscription Case Study Problem 1 : Break - Even Analysis Imagine you are running a new business that sells monthly subscription boxes filled with [

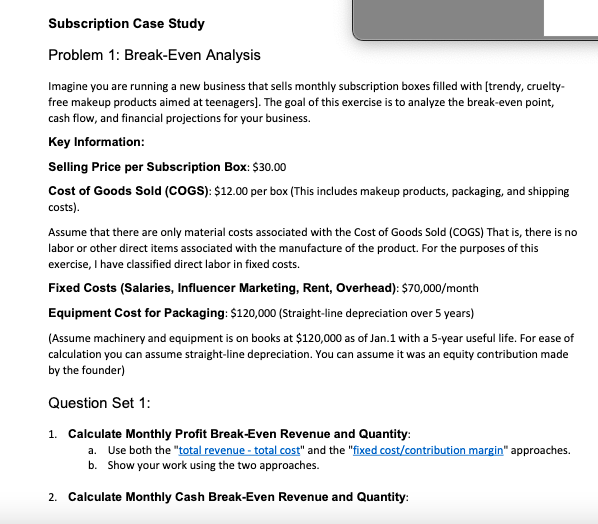

Subscription Case Study

Problem : BreakEven Analysis

Imagine you are running a new business that sells monthly subscription boxes filled with trendy cruelty

free makeup products aimed at teenagers The goal of this exercise is to analyze the breakeven point,

cash flow, and financial projections for your business.

Key Information:

Selling Price per Subscription Box: $

Cost of Goods Sold COGS: $ per box This includes makeup products, packaging, and shipping

costs

Assume that there are only material costs associated with the Cost of Goods Sold COGS That is there is no

labor or other direct items associated with the manufacture of the product. For the purposes of this

exercise, I have classified direct labor in fixed costs.

Fixed Costs Salaries Influencer Marketing, Rent, Overhead: $month

Equipment Cost for Packaging: $Straightline depreciation over years

Assume machinery and equipment is on books at $ as of Jan. with a year useful life. For ease of

calculation you can assume straightline depreciation. You can assume it was an equity contribution made

by the founder

Question Set :

Calculate Monthly Profit BreakEven Revenue and Quantity:

a Use both the "total revenue total cost" and the "fixed costcontribution margin" approaches.

b Show your work using the two approaches.

Calculate Monthly Cash BreakEven Revenue and Quantity:

Problem : Cash Flow & Income

Assume that the selling price, COGS, fixed costs, equipment, and depreciation are the same as in Problem

but with the following additional information:

To launch, you must maintain a buffer of one months worth of subscription boxes on hand at all

times. Since you begin on Jan you need to order months' worth of inventory on Jan which

you pay for on delivery.

You estimate that the number of subscriptions you sell will be the same for January and February,

achieving the breakeven quantity calculated in Problem

You ship boxes throughout the month, and customers are billed immediately upon shipment.

Question Set :

Calculate Your Cash Position at the End of January:

a Consider initial inventory purchases and subscription payments.

b Factor in depreciation, fixed costs, and upfront marketing expenses.

Develop an Income Statement for January.

Calculate the Difference Between January Cash GenerationUse vs Profits.

Note: For Question Sets and negative balances in any asset accounts are acceptable.

Problem : Cash Flow with Day Payment Delay

Assume all of the cost and expense assumptions remain as in Problem but youve been granted day

terms with your suppliers, and customers are billed days after receiving their first box.

Specific Scenario:

Payment for materials is made days after receipt.

Customers pay for their subscription days after receiving the box.

Business Sequence:

Events in January

Jan : Order months' worth of inventory.

Jan : Goods are received; payment is due on Feb nd

Throughout January: Ship the subscription boxes to reach breakeven. Customers will pay in February at

the end of their day trial.

Events in February

Feb : Order months worth of inventory to replenish January shipments.

Feb : Receive goods; payment due on March nd

Feb : Receive payment for January shipments.

Throughout February: Ship boxes to maintain the breakeven number of subscribers.

Events in March

Mar : Order months worth of inventory to replenish February shipments.

Mar : Receive goods; payment due on April nd

Mar : Receive payment for February shipments.

Throughout March: Ship boxes to maintain the breakeven number of subscribers.

Events in April

Apr : Order months worth of inventory to replenish March shipments.

Apr : Receive goods; payment due on May nd

Apr : Receive payment for March shipments.

Throughout April: Ship boxes to maintain the breakeven number of subscribers.

Question Set :

Develop a monthly Income Statement as of the end of each month January through April

Calculate your cash generationusage for each month

Develop an ending balance sheet for each month Assets: Cash, AR Inventory, Machinery. Liabilities:

AP Net Worth: Assets Liabilities

Report on your cumulative cash generationusage at the end of each month

Report on your total profit for the entiremonth period

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock