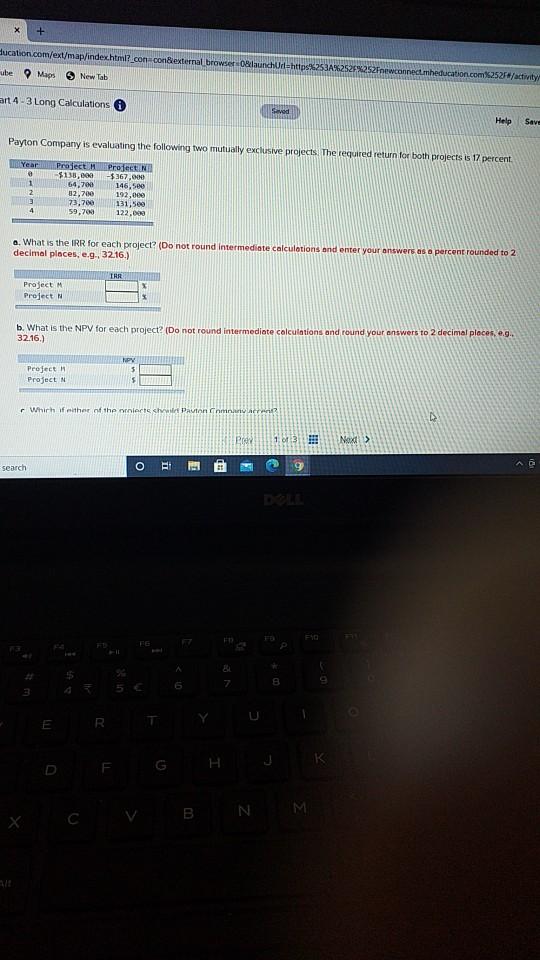

Question: Sucation.com/ext/map/indexhtml?_con=conexternal browser launchUrl=http%253A ube Maps > New Tab inect.mheducation.com 252/activity art 4 -3 Long Calculations w Help Save Payton Company is evaluating the following two

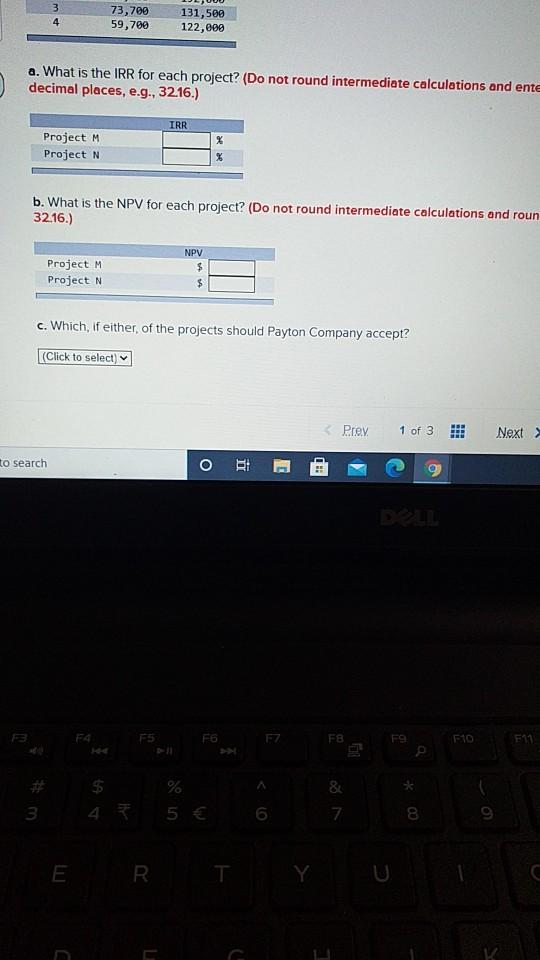

Sucation.com/ext/map/indexhtml?_con=conexternal browser launchUrl=http%253A ube Maps > New Tab inect.mheducation.com 252/activity art 4 -3 Long Calculations w Help Save Payton Company is evaluating the following two mutually exclusive projects. The required return for both projects is 17 percent Year 1 2 3 4 Project M -5138,000 64,700 32,700 73,700 59,700 Project -$367,000 146,500 192,000 131,500 122.000 a. What is the IRR for each project? (Do not round Intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 3216.) TRR Project M Project b. What is the NPV for each project? (Do not round intermediate calculations and round your answers to 2 decimal places. e... 32.16.) Project Project N MPY 5 SI Which feather of the merken Pavionnm CT? Brey 1.013! Next > Search O El CE E 6 7 B E R. D B NM 3 73,700 59,700 4 131,500 122,000 a. What is the IRR for each project? (Do not round intermediate calculations and ente decimal places, e.g., 3216.) IRR Project M Project N % % b. What is the NPV for each project? (Do not round intermediate calculations and roun 32.16.) NPV $ Project M Project N c. Which, if either of the projects should Payton Company accept? (Click to select) Prey FI 1 of 3 Next to search O E F5 F6 F8 F9 710 F11 $ 4 F 5 & 7 3 6 8 9 Y

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock