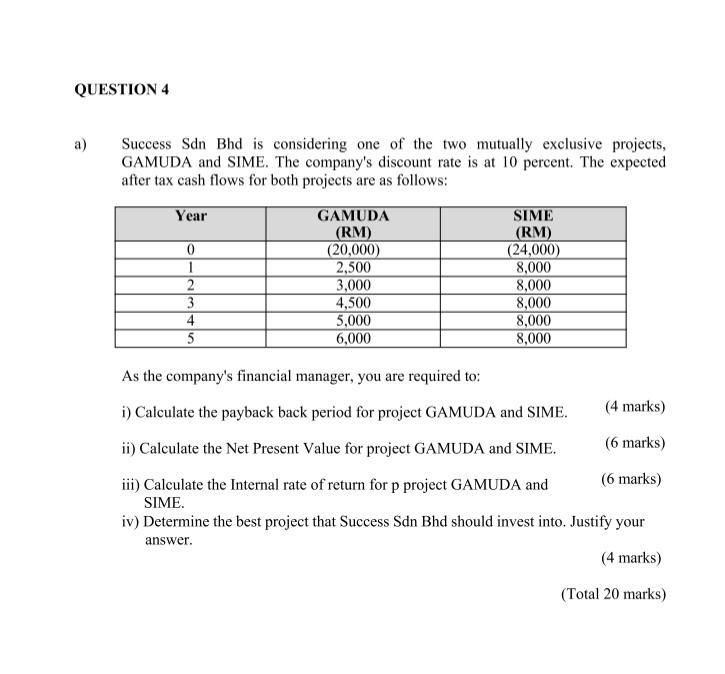

Question: Success Sdn Bhd is considering one of the two mutually exclusive projects, GAMUDA and SIME. The company's discount rate is at 10 percent. The expected

Success Sdn Bhd is considering one of the two mutually exclusive projects, GAMUDA and SIME. The company's discount rate is at 10 percent. The expected after tax cash flows for both projects are as follows: As the company's financial manager, you are required to: i) Calculate the payback back period for project GAMUDA and SIME. (4 marks) ii) Calculate the Net Present Value for project GAMUDA and SIME. (6 marks) iii) Calculate the Internal rate of return for p project GAMUDA and (6 marks) SIME. iv) Determine the best project that Success Sdn Bhd should invest into. Justify your answer. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock