Question: Success Tips Success Tips eedback 9. The NPV and payback period Suppose you are evaluating a project with the cash inflows shown in the following

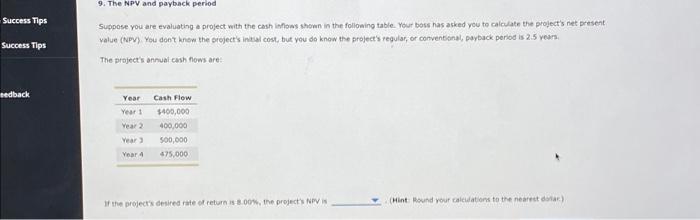

Success Tips Success Tips eedback 9. The NPV and payback period Suppose you are evaluating a project with the cash inflows shown in the following table. Your boss has asked you to calculate the project's net present value (NPV). You don't know the project's initial cost, but you do know the project's regular, or conventional, payback period is 2.5 years. The project's annual cash flows are: Year Year 1 Year 2 Year 3 Year 4 Cash Flow $400,000 400,000 500,000 475,000 If the project's desired rate of return is 8.00%, the project's NPV is (Hint: Round your calculations to the nearest dollar.)

Suppose you are evaluating e project with the cosh ioflows shown in the following table. Your boss has asked you to calculate the project's net present value (NPM), You dont know the project's intal cost, but you do know the project's regular, or conventinal; payback period is 2.5 years. The project's annual cash fows are: If the project's desired rate of reture is 8.00%, the project Now is (Hint Mosuld rour calcidations to the neartet dolar.)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock