Question: Sue has $74,029.20 in her defined contribution plan at work. Of that balance, $54,041.32 comes from her own contributions, and $19,987.88 comes from her employer's.

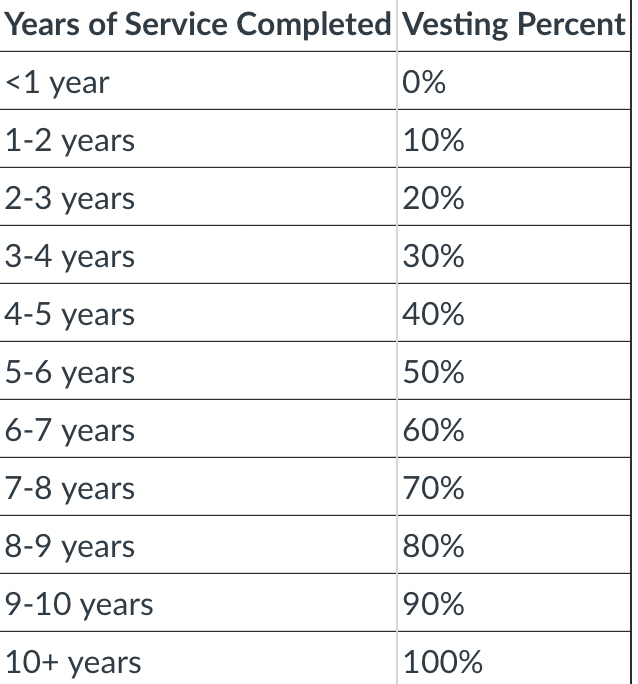

Sue has $74,029.20 in her defined contribution plan at work. Of that balance, $54,041.32 comes from her own contributions, and $19,987.88 comes from her employer's. The plan uses the 10-year step vesting schedule given below. If Sue leaves her job now, after 15 years and 8 months of service, how much of her plan balance would she keep?

group of answer choices:

$84,023.14

$78,964.48

$69,093.92

$74,029.20

Years of Service Completed Vesting Percent \begin{tabular}{|l|l|} \hline

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock