Question: Sue is an engineer who needs your help preparing her tax return. She provides you with a copy of her pay stub for the current

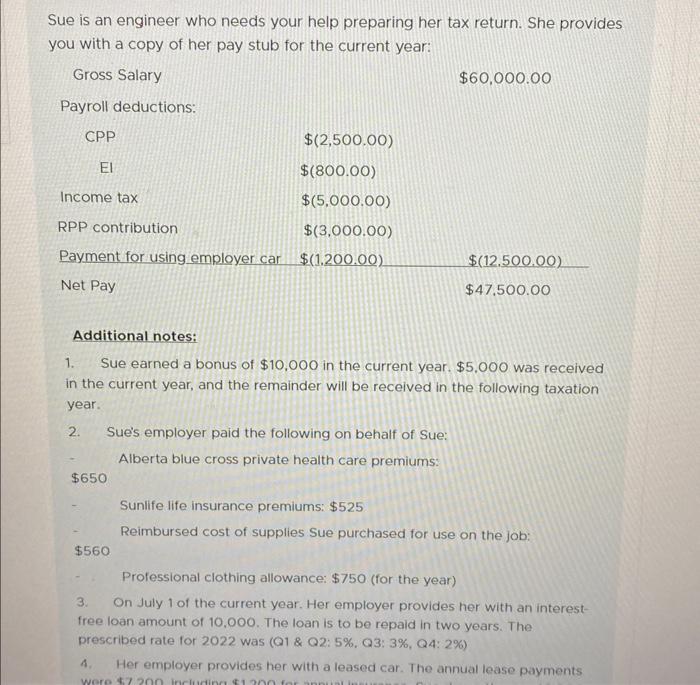

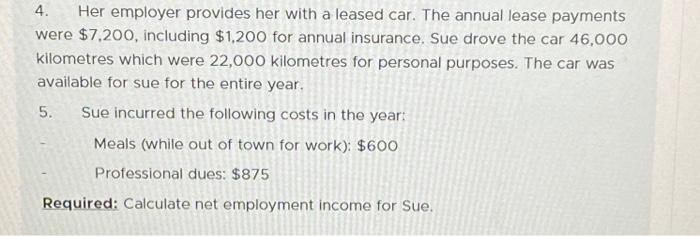

Sue is an engineer who needs your help preparing her tax return. She provides you with a copy of her pay stub for the current year: Additional notes: 1. Sue earned a bonus of $10,000 in the current year. $5.000 was received in the current year, and the remainder will be received in the following taxation year. 2. Sue's employer paid the following on behalf of Sue: - Alberta blue cross private health care premiums: $650 Sunlife life insurance premiums: $525 - Reimbursed cost of supplies Sue purchased for use on the job: $560 Professional clothing allowance: $750 (for the year) 3. On July 1 of the current year. Her employer provides her with an interestfree loan amount of 10,000 . The loan is to be repald in two years. The prescribed rate for 2022 was (Q1 \& Q2: 5%,Q3:3%,Q4:2% ) 4. Her employer provides her with a leased car. The annual lease payments 4. Her employer provides her with a leased car. The annual lease payments were $7,200, including $1,200 for annual insurance. Sue drove the car 46,000 kilometres which were 22,000 kilometres for personal purposes. The car was available for sue for the entire year. 5. Sue incurred the following costs in the year: Meals (while out of town for work): $600 Professional dues: $875 Required: Calculate net employment income for Sue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts