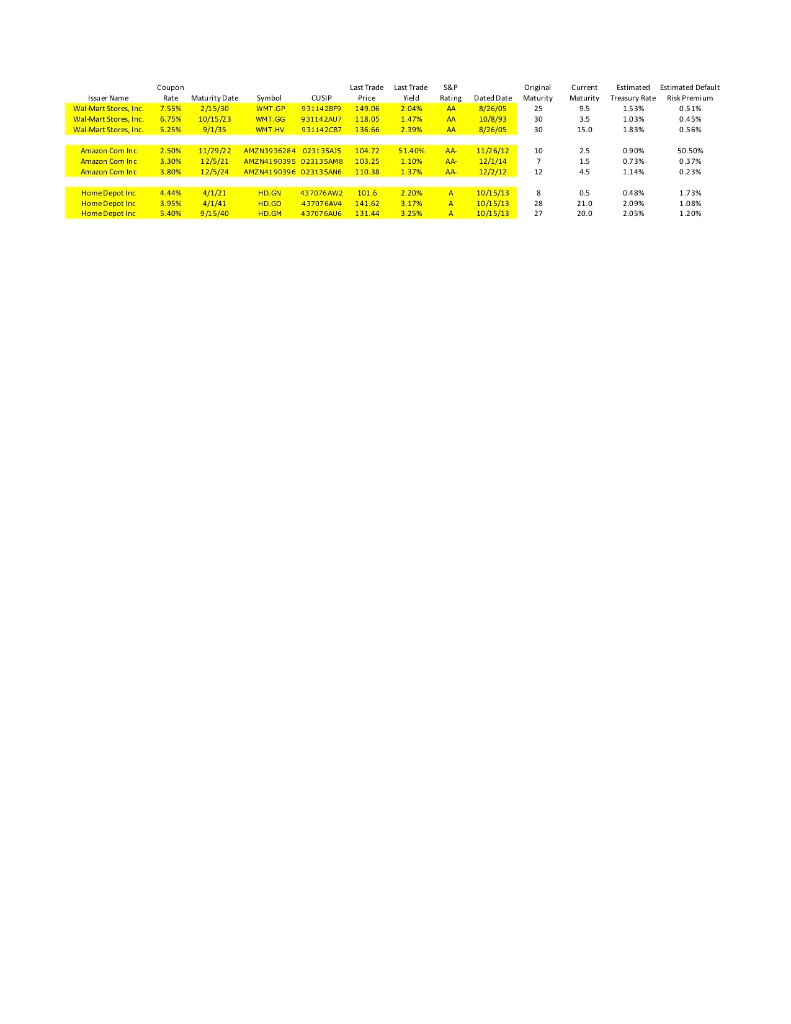

Question: Summarize the differences in the default risk premiums for the three companies. Original Maturity Coupon Rate 7.55% 6.75% 5.25% Wal Mart Stores, Inc. Wal-Mart Stores,

Summarize the differences in the default risk premiums for the three companies.

Original Maturity Coupon Rate 7.55% 6.75% 5.25% Wal Mart Stores, Inc. Wal-Mart Stores, Inc. Wal-Mart Stores Inc. Maturity Date 2/15/30 10/15/23 9/1/35 Symbol WMT.GP WMT.GG WMT.HY OUSIP 931142879 9 3114202 9311142087 Last Trade Last Trade Yield 149.06 2.04% 128.05 1.47% 135.662 .39%, Current Maturity 9.5 3.5 Sep RMine Dated Date A4 8 /26/05 A 10/8/93 A43 /26/05 Estimated Treasury Rate 1.53% 103% 1839 Estimated Default Risk Premium 0.51% 0.45% 0.56% yo 15.0 Amazon Cominc Amazon Com Inc Amazon Com Inc 25 7.50% 3.30% 3,80% 11/29/27 12/5/21 12/5/24 AMZN3936284 0231 35A15 AMZN4190395 023135AM8 AMZN41 90396 023135ANA a jaza 3** *** 104.72 103.25 110.38 1.10% 1.37% AA AA 11/25/12 12/1/14 12/2/12 0.90% 0.73% 1.14% 50.50% 0.37% 0.23% 048% 1.73% Home Depot inc Home Depot ing Home Depot inc 4,44% 3.95% .40% 4/1/21 4/1/41 9/15/40 HD GN HD.GO HD.GM 437026 AW2 437076AV4 437076AUE 1016 141.62 131.44 2.20% 3.17% 3.25% A A A 10/15/13 10/15/13 10/15/13 # 21.0 103% 209% 2.05% 5 20.0 1205 Original Maturity Coupon Rate 7.55% 6.75% 5.25% Wal Mart Stores, Inc. Wal-Mart Stores, Inc. Wal-Mart Stores Inc. Maturity Date 2/15/30 10/15/23 9/1/35 Symbol WMT.GP WMT.GG WMT.HY OUSIP 931142879 9 3114202 9311142087 Last Trade Last Trade Yield 149.06 2.04% 128.05 1.47% 135.662 .39%, Current Maturity 9.5 3.5 Sep RMine Dated Date A4 8 /26/05 A 10/8/93 A43 /26/05 Estimated Treasury Rate 1.53% 103% 1839 Estimated Default Risk Premium 0.51% 0.45% 0.56% yo 15.0 Amazon Cominc Amazon Com Inc Amazon Com Inc 25 7.50% 3.30% 3,80% 11/29/27 12/5/21 12/5/24 AMZN3936284 0231 35A15 AMZN4190395 023135AM8 AMZN41 90396 023135ANA a jaza 3** *** 104.72 103.25 110.38 1.10% 1.37% AA AA 11/25/12 12/1/14 12/2/12 0.90% 0.73% 1.14% 50.50% 0.37% 0.23% 048% 1.73% Home Depot inc Home Depot ing Home Depot inc 4,44% 3.95% .40% 4/1/21 4/1/41 9/15/40 HD GN HD.GO HD.GM 437026 AW2 437076AV4 437076AUE 1016 141.62 131.44 2.20% 3.17% 3.25% A A A 10/15/13 10/15/13 10/15/13 # 21.0 103% 209% 2.05% 5 20.0 1205

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts