Question: Summarize your answers from Requirement 3 using the FIFO method I need the calculation, please Smith Electronic Company's chip-mounting production department had 300 units of

Summarize your answers from Requirement 3 using the FIFO method

I need the calculation, please

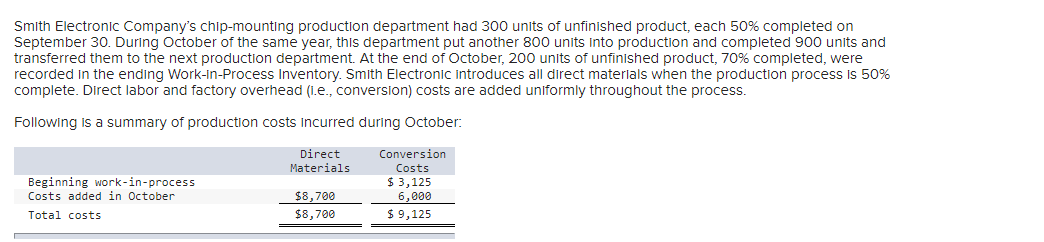

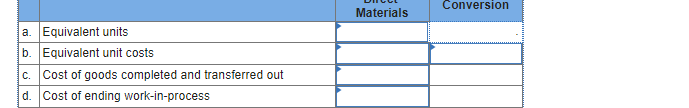

Smith Electronic Company's chip-mounting production department had 300 units of unfinished product, each 50% completed on September 30. During October of the same year, this department put another 800 units Into production and completed 900 units and transferred them to the next production department. At the end of October, 200 units of unfinished product, 70% completed, were recorded in the ending Work-in-Process Inventory. Smith Electronic introduces all direct materials when the production process is 50% complete. Direct labor and factory overhead (i.e., conversion) costs are added uniformly throughout the process. Following is a summary of production costs incurred during October: Direct Materials Beginning work-in-process Costs added in October Total costs Conversion Costs $ 3,125 6,000 $ 9,125 $8,700 $8,700 Conversion Materials a. Equivalent units b. Equivalent unit costs C. Cost of goods completed and transferred out d. Cost of ending work-in-process

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts