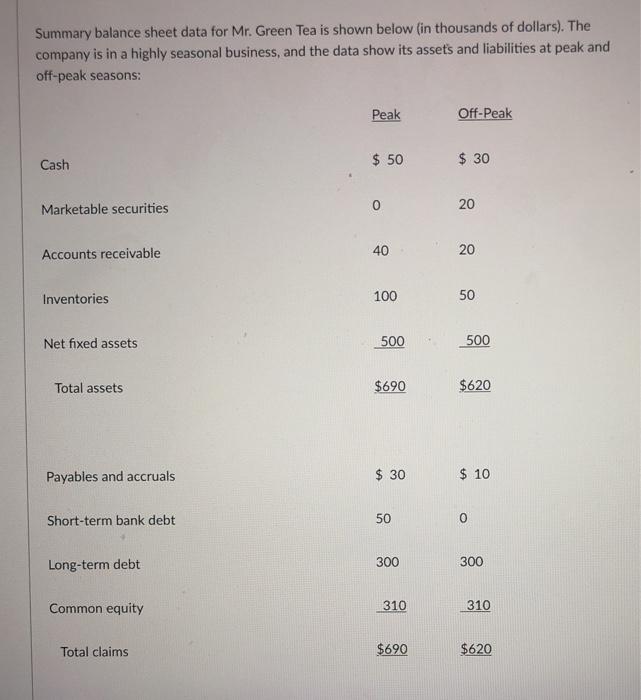

Question: Summary balance sheet data for Mr. Green Tea is shown below (in thousands of dollars). The company is in a highly seasonal business, and the

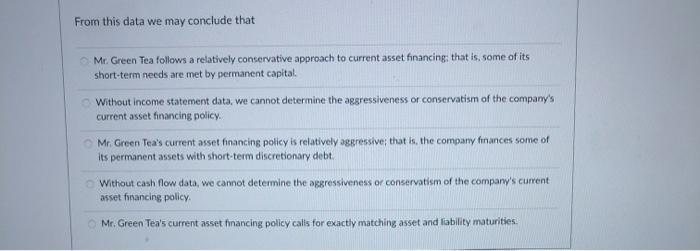

Summary balance sheet data for Mr. Green Tea is shown below (in thousands of dollars). The company is in a highly seasonal business, and the data show its assets and liabilities at peak and off-peak seasons: Peak Off-Peak Cash $ 50 $ 30 Marketable securities 0 20 Accounts receivable 40 20 Inventories 100 50 Net fixed assets 500 500 Total assets $690 $620 Payables and accruals $ 30 $ 10 Short-term bank debt 50 0 Long-term debt 300 300 Common equity 310 310 Total claims $690 $620 From this data we may conclude that Mr. Green Tea follows a relatively conservative approach to current asset financing that is some of its short-term needs are met by permanent capital Without income statement data, we cannot determine the aggressiveness or conservatism of the company's current asset financing policy Mr Green Tea's current asset financing policy is relatively aggressive that the company finances some of its permanent assets with short-term discretionary debt. Without cash flow data, we cannot determine the aggressiveness or conservatism of the company's current asset financing policy Mr. Green Tea's current asset financing policy calls for exactly matching asset and liability maturities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts