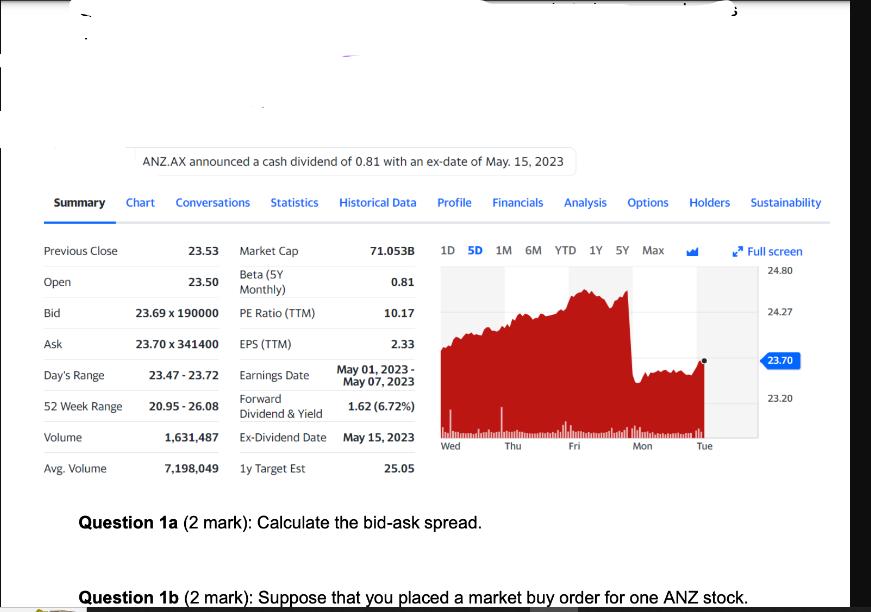

Question: Summary Chart Conversations Statistics Historical Data Previous Close Open Bid Ask Day's Range 52 Week Range Volume ANZ.AX announced a cash dividend of 0.81

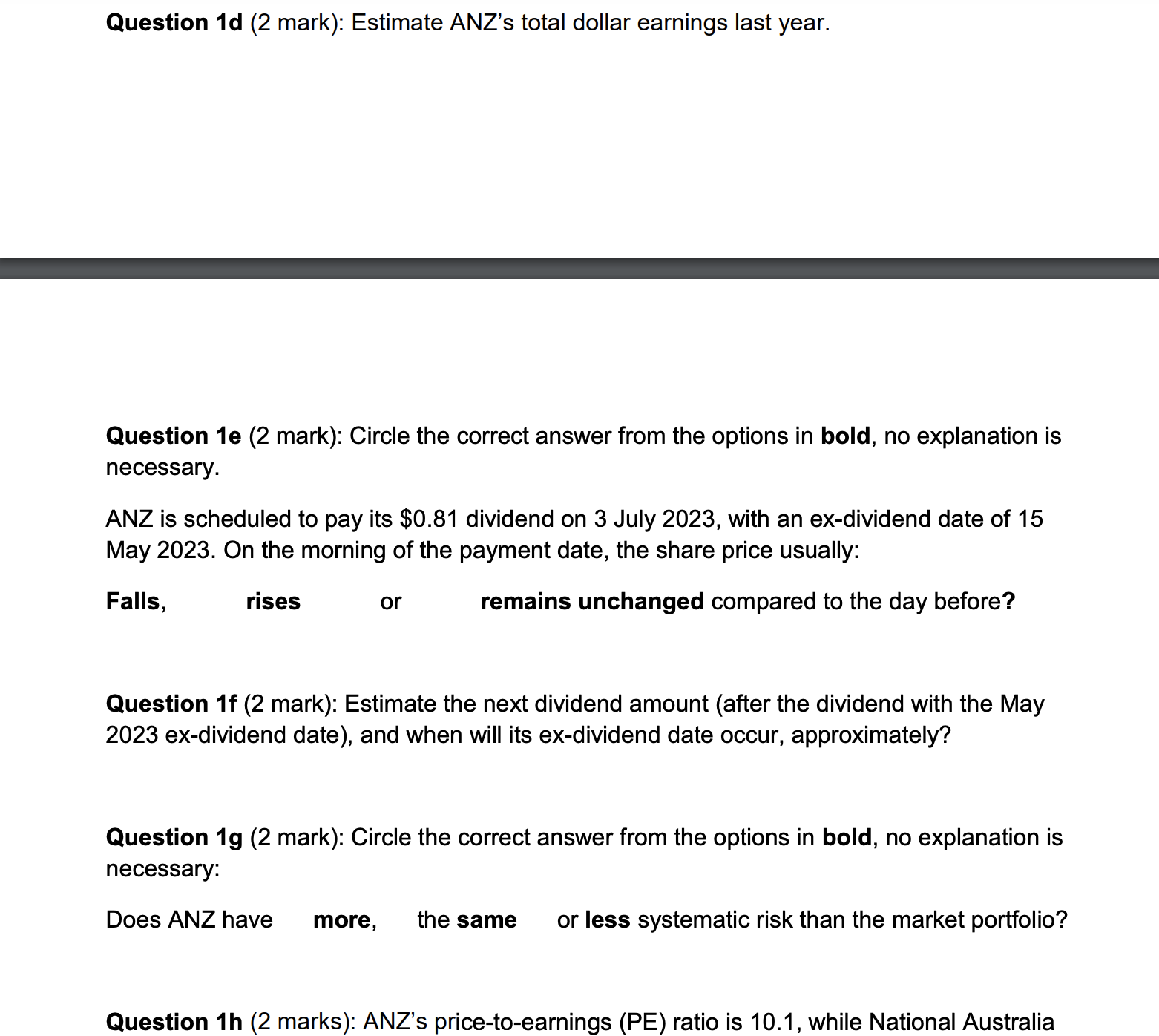

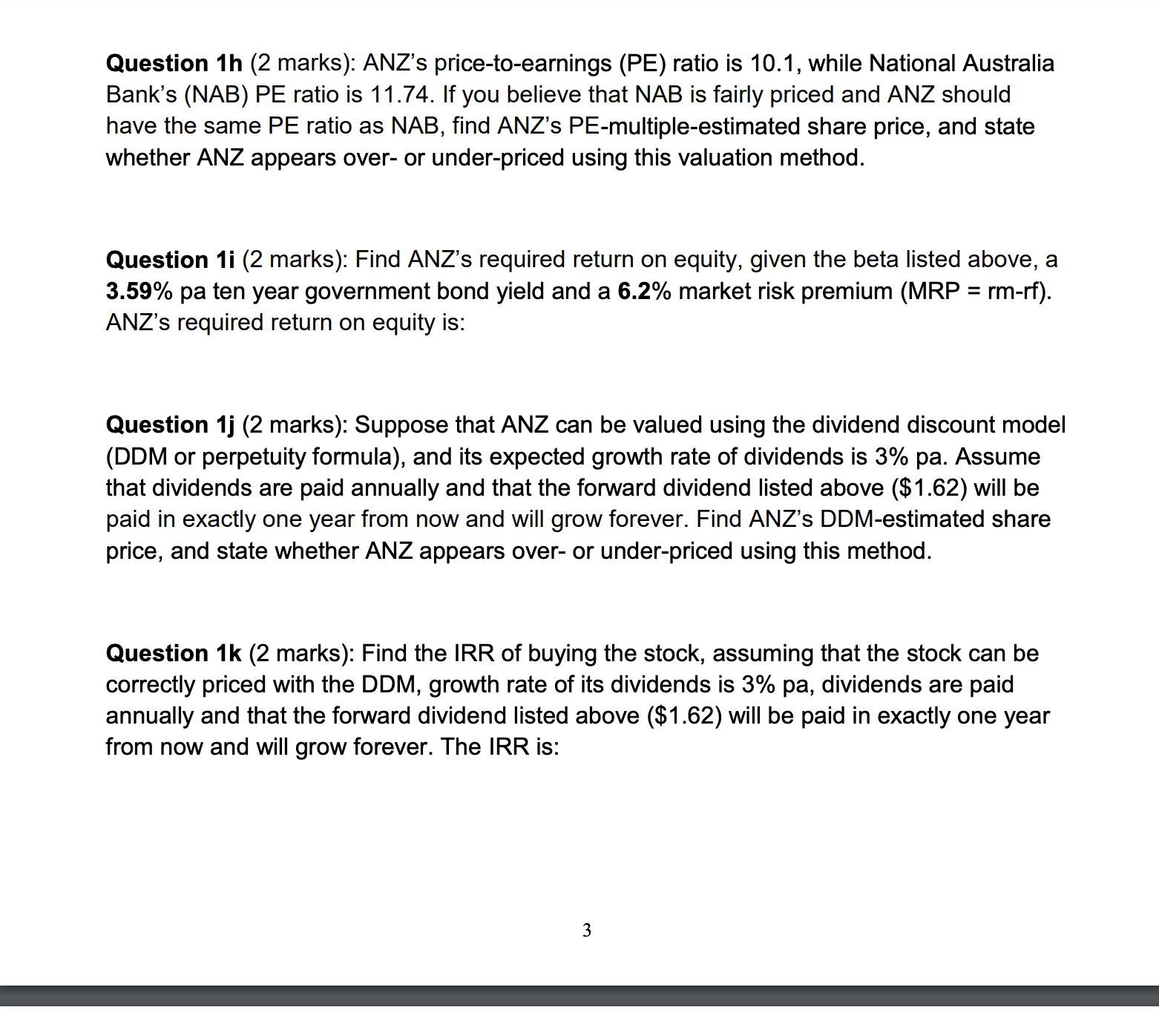

Summary Chart Conversations Statistics Historical Data Previous Close Open Bid Ask Day's Range 52 Week Range Volume ANZ.AX announced a cash dividend of 0.81 with an ex-date of May. 15, 2023 Avg. Volume 23.53 Market Cap Beta (5Y Monthly) PE Ratio (TTM) 23.50 23.69 x 190000 23.70 x 341400 23.47-23.72 20.95-26.08 1,631,487 7,198,049 EPS (TTM) Earnings Date Forward Dividend & Yield Ex-Dividend Date 1y Target Est 71.053B 0.81 10.17 2.33 May 01, 2023- May 07, 2023 1.62 (6.72%) May 15, 2023 25.05 Profile Financials Analysis Options 1D 5D 1M 6M YTD 1Y 5Y Max Wed Question 1a (2 mark): Calculate the bid-ask spread. Thu Fri Mon Holders Tue 6. Sustainability Full screen 24.80 Question 1b (2 mark): Suppose that you placed a market buy order for one ANZ stock. 24.27 23.70 23.20 Question 1d (2 mark): Estimate ANZ's total dollar earnings last year. Question 1e (2 mark): Circle the correct answer from the options in bold, no explanation is necessary. ANZ is scheduled to pay its $0.81 dividend on 3 July 2023, with an ex-dividend date of 15 May 2023. On the morning of the payment date, the share price usually: Falls, rises remains unchanged compared to the day before? or Question 1f (2 mark): Estimate the next dividend amount (after the dividend with the May 2023 ex-dividend date), and when will its ex-dividend date occur, approximately? Question 1g (2 mark): Circle the correct answer from the options in bold, no explanation is necessary: Does ANZ have more, the same or less systematic risk than the market portfolio? Question 1h (2 marks): ANZ's price-to-earnings (PE) ratio is 10.1, while National Australia Question 1h (2 marks): ANZ's price-to-earnings (PE) ratio is 10.1, while National Australia Bank's (NAB) PE ratio is 11.74. If you believe that NAB is fairly priced and ANZ should have the same PE ratio as NAB, find ANZ's PE-multiple-estimated share price, and state whether ANZ appears over- or under-priced using this valuation method. Question 1i (2 marks): Find ANZ's required return on equity, given the beta listed above, a 3.59% pa ten year government bond yield and a 6.2% market risk premium (MRP = rm-rf). ANZ's required return on equity is: Question 1j (2 marks): Suppose that ANZ can be valued using the dividend discount model (DDM or perpetuity formula), and its expected growth rate of dividends is 3% pa. Assume that dividends are paid annually and that the forward dividend listed above ($1.62) will be paid in exactly one year from now and will grow forever. Find ANZ's DDM-estimated share price, and state whether ANZ appears over- or under-priced using this method. Question 1k (2 marks): Find the IRR of buying the stock, assuming that the stock can be correctly priced with the DDM, growth rate of its dividends is 3% pa, dividends are paid annually and that the forward dividend listed above ($1.62) will be paid in exactly one year from now and will grow forever. The IRR is: 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts