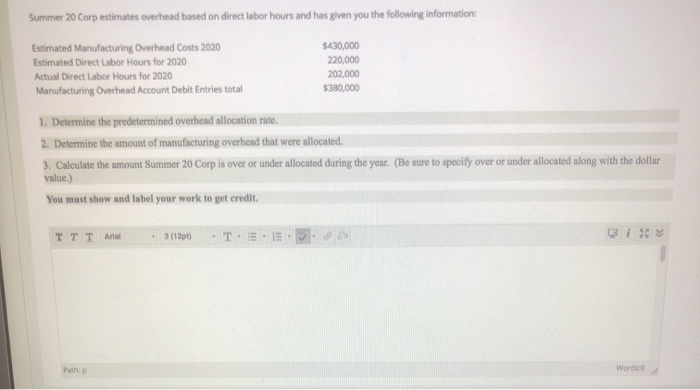

Question: Summer 20 Corp estimates overhead based on direct labor hours and has given you the following information: Estimated Manufacturing Overhead Costs 2020 $430,000 Estimated Direct

Summer 20 Corp estimates overhead based on direct labor hours and has given you the following information: Estimated Manufacturing Overhead Costs 2020 $430,000 Estimated Direct Labor Hours for 2020 220,000 Actual Direct Labor Hours for 2020 202,000 Manufacturing Overhead Account Debit Entries total $380,000 1. Determine the predetermined overhead allocation rate, 2. Determine the amount of manufacturing overhead that were allocated. 3. Calculate the amount Summer 20 Corp is over or under allocated during the year. (Be sure to specify over or under allocated along with the dollar value.) You must show and label your work to get credit TTT Ariel - 3 (121) T.EE Path Words

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts