Question: Summit Inc. is developing a plan to finance its asset base, the details of which are listed below. $ $ Current assets Proportion of current

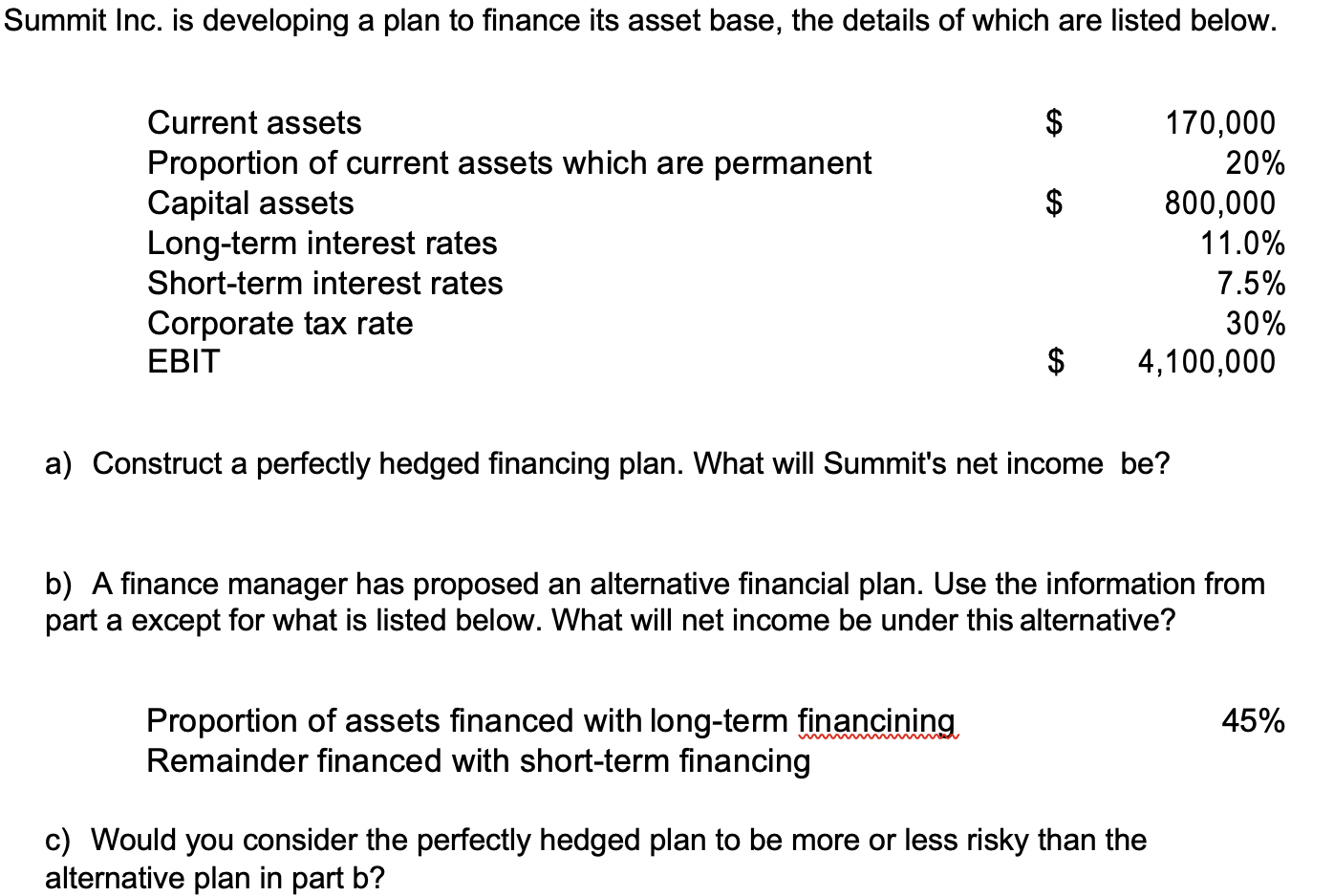

Summit Inc. is developing a plan to finance its asset base, the details of which are listed below. $ $ Current assets Proportion of current assets which are permanent Capital assets Long-term interest rates Short-term interest rates Corporate tax rate EBIT 170,000 20% 800,000 11.0% 7.5% 30% 4,100,000 $ a) Construct a perfectly hedged financing plan. What will Summit's net income be? b) A finance manager has proposed an alternative financial plan. Use the information from part a except for what is listed below. What will net income be under this alternative? 45% Proportion of assets financed with long-term financining Remainder financed with short-term financing c) Would you consider the perfectly hedged plan to be more or less risky than the alternative plan in part b? Summit Inc. is developing a plan to finance its asset base, the details of which are listed below. $ $ Current assets Proportion of current assets which are permanent Capital assets Long-term interest rates Short-term interest rates Corporate tax rate EBIT 170,000 20% 800,000 11.0% 7.5% 30% 4,100,000 $ a) Construct a perfectly hedged financing plan. What will Summit's net income be? b) A finance manager has proposed an alternative financial plan. Use the information from part a except for what is listed below. What will net income be under this alternative? 45% Proportion of assets financed with long-term financining Remainder financed with short-term financing c) Would you consider the perfectly hedged plan to be more or less risky than the alternative plan in part b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts