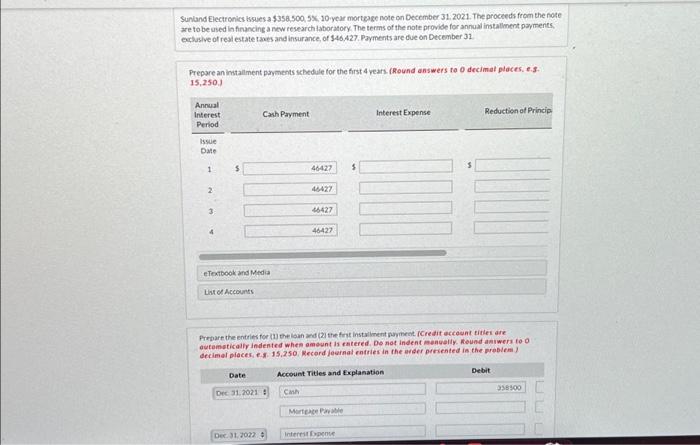

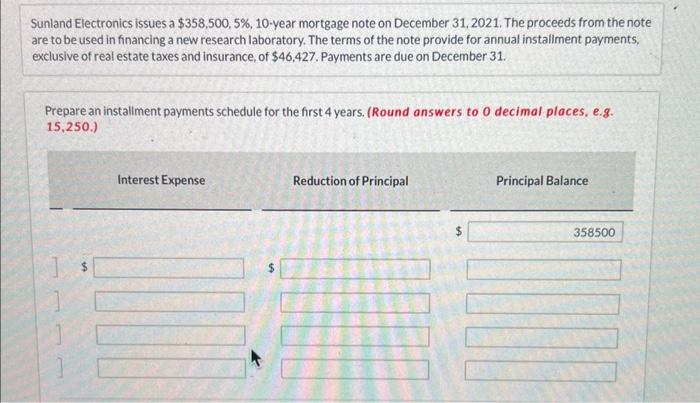

Question: Sunland Electronics issues a $358,500, 5%, 10-year mortgage note on December 31, 2021. The proceeds from the note are to be used in financing a

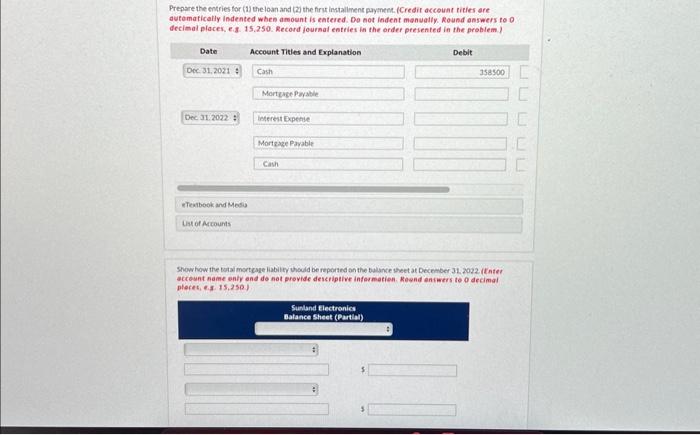

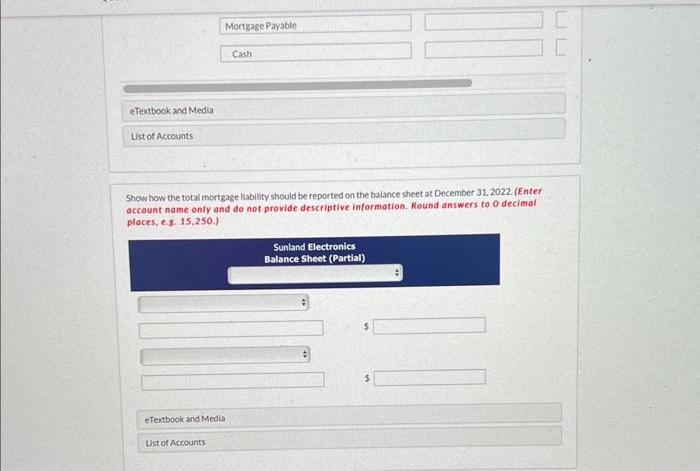

Prepare the entries for (1) the loan and (2) the firy installment paymen. (Credir account tides are avtomatically indented when amount is eatered. Do not indent manually. Round answers to 0 decimal places, e.s. 15.250. Record journal entries in the order presented in the problem.) account name anly and de not provide desciptive infermation. Reand encwers to o decimal pleret, e.s. 15,250) Sunland Electronics issues a $358,500,5%,10-year mortgage note on December 31,2021 . The proceeds from the note are to be used in financing a new research laboratory. The terms of the note provide for annual installment payments, exclusive of real estate taxes and insurance, of $46,427. Payments are due on December 31. Prepare an installment payments schedule for the first 4 years. (Round answers to 0 decimal places, e.g. 15,250.) are to be used in frincing a new rese arch laboratory. The terms of the note provide for annual installenent parments echasve of real estate taxes and insurance, of 346,427 . Payments are due on December 31 Prepare an imstallment parments schedule for the first 4 vears. (Round answers ta 0 decimal places, e.s. 15,250.) decimal places, ex. 15,250, Recerd jearnal enfries in the arder presented is the prabiem) Show how the total mortgage liability should be reported on the balance sheet at December 31, 2022 (Enter account name only and do not provide descriptive information. Round answers to 0 decimal places, e.8. 15,250.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts