Question: Sunland Inc. operates a retail computer store. To improve its delivery services to customers, the company purchased four new trucks on April 1, 2020. The

Sunland Inc. operates a retail computer store. To improve its delivery services to customers, the company purchased four new trucks on April 1, 2020. The terms of acquisition for each truck were as follows:

| 1. | Truck #1 had a list price of $28,700 and was acquired for a cash payment of $22,700. | |

| 2. | Truck #2 had a list price of $27,400 and was acquired for a down payment of $1,800 cash and a noninterest-bearing note with a face amount of $25,600. The note is due April 1, 2021. Sunland would normally have to pay interest at a rate of 9% for such a borrowing, and the dealership has an incremental borrowing rate of 8%. | |

| 3. | Truck #3 had a list price of $24,700. It was acquired in exchange for a computer system that Sunland carries in inventory. The computer system cost $16,200 and is normally sold by Sunland for $20,500. Sunland uses a perpetual inventory system. | |

| 4. | Truck #4 had a list price of $24,100. It was acquired in exchange for 1,000 common shares of Sunland Inc. The common shares trade in an active market valued at $22 per share in the most recent trade. |

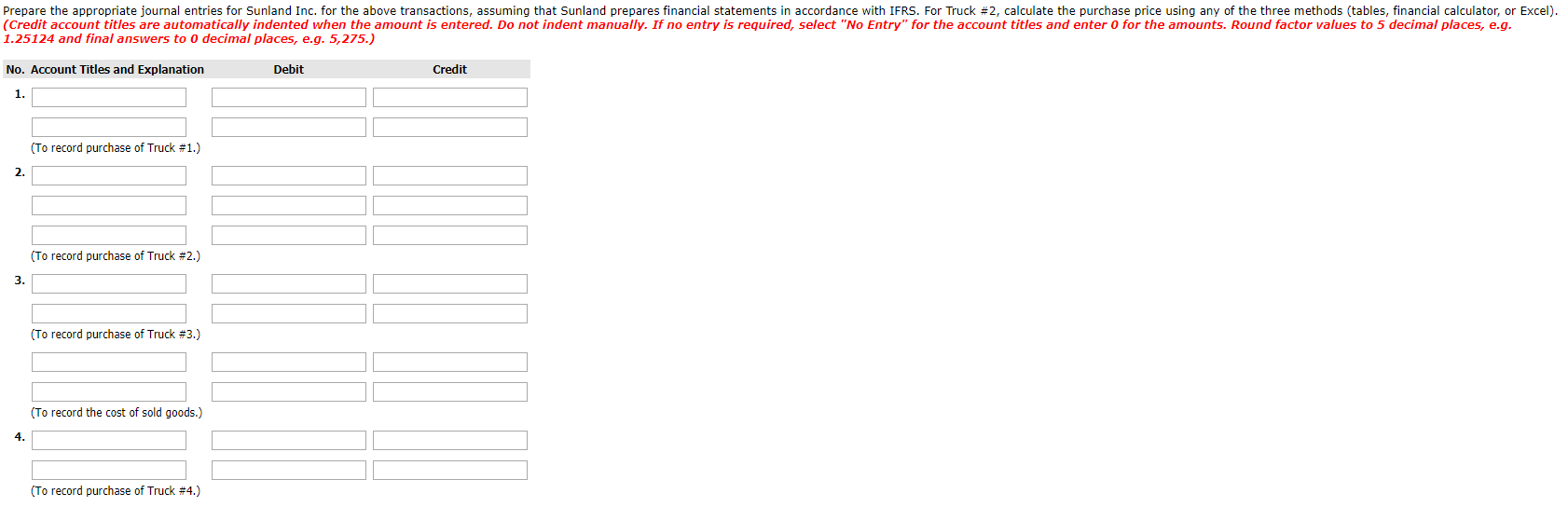

Prepare the appropriate journal entries for Sunland Inc. for the above transactions, assuming that Sunland prepares financial statements in accordance with IFRS. For Truck #2, calculate the purchase price using any of the three methods (tables, financial calculator, or Excel). (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Round factor values to 5 decimal places, e.g. 1.25124 and final answers to 0 decimal places, e.g. 5,275.) No. Account Titles and Explanation Debit Credit 1. (To record purchase of Truck #1.) (To record purchase of Truck #2.) 3. (To record purchase of Truck #3.) (To record the cost of sold goods.) (To record purchase of Truck #4.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts