Question: Sunnlementary Chapter 4 Supplementary Self Study Problems SSS Problem 4-1 (Personal Tax Credits - 5 Cases) In each of the following independent Cases, determine the

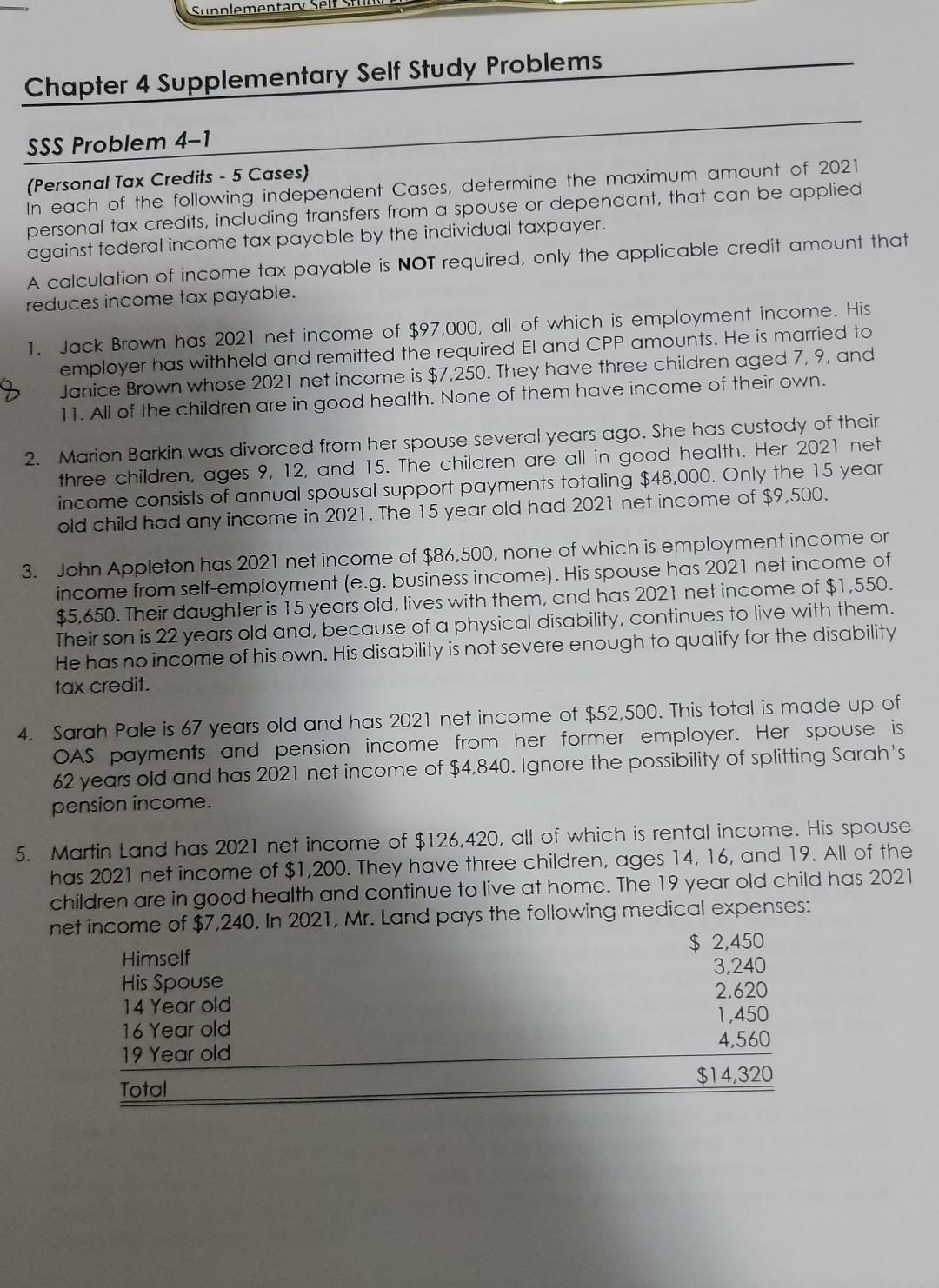

Sunnlementary Chapter 4 Supplementary Self Study Problems SSS Problem 4-1 (Personal Tax Credits - 5 Cases) In each of the following independent Cases, determine the maximum amount of 2021 personal tax credits, including transfers from a spouse or dependant, that can be applied against federal income tax payable by the individual taxpayer. A calculation of income tax payable is NOT required, only the applicable credit amount that reduces income tax payable. 1. Jack Brown has 2021 net income of $97,000, all of which is employment income. His employer has withheld and remitted the required El and CPP amounts. He is married to Janice Brown whose 2021 net income is $7.250. They have three children aged 7.9, and 11. All of the children are in good health. None of them have income of their own. 2. Marion Barkin was divorced from her spouse several years ago. She has custody of their three children, ages 9, 12, and 15. The children are all in good health. Her 2021 net income consists of annual spousal support payments totaling $48,000. Only the 15 year old child had any income in 2021. The 15 year old had 2021 net income of $9.500. 3. John Appleton has 2021 net income of $86,500, none of which is employment income or income from self-employment (e.g. business income). His spouse has 2021 net income of $5,650. Their daughter is 15 years old, lives with them, and has 2021 net income of $1,550. Their son is 22 years old and, because of a physical disability, continues to live with them. He has no income of his own. His disability is not severe enough to qualify for the disability tax credit. 4. Sarah Pale is 67 years old and has 2021 net income of $52,500. This total is made up of OAS payments and pension income from her former employer. Her spouse is 62 years old and has 2021 net income of $4,840. Ignore the possibility of splitting Sarah's pension income. 5. Martin Land has 2021 net income of $126,420, all of which is rental income. His spouse has 2021 net income of $1,200. They have three children, ages 14, 16, and 19. All of the children are in good health and continue to live at home. The 19 year old child has 2021 net income of $7.240. In 2021, Mr. Land pays the following medical expenses: Himself $ 2,450 His Spouse 3,240 14 Year old 2,620 16 Year old 1,450 19 Year old 4,560 Total $14,320

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts