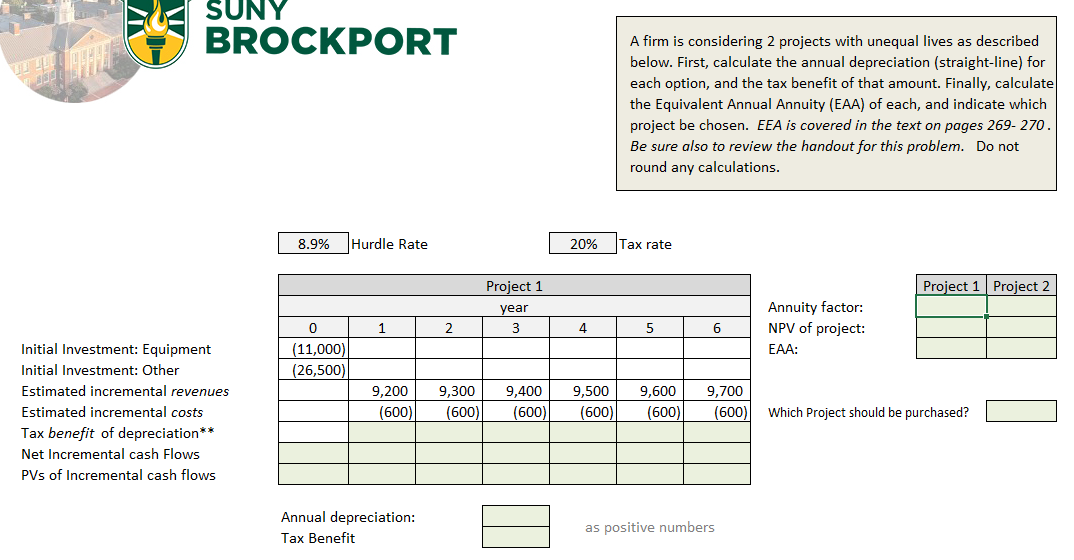

Question: SUNY BROCKPORT A firm is considering 2 projects with unequal lives as described below. First, calculate the annual depreciation (straight-line) for each option, and the

SUNY BROCKPORT A firm is considering 2 projects with unequal lives as described below. First, calculate the annual depreciation (straight-line) for each option, and the tax benefit of that amount. Finally, calculate the Equivalent Annual Annuity (EAA) of each, and indicate which project be chosen. EEA is covered in the text on pages 269-270. Be sure also to review the handout for this problem. Do not round any calculations. 8.9% Hurdle Rate 20% Tax rate Project 1 Project 2 Project 1 year 3 1 2 4 5 6 0 (11,000) (26,500) Annuity factor: NPV of project: EAA: Initial Investment: Equipment Initial Investment: Other Estimated incremental revenues Estimated incremental costs Tax benefit of depreciation** Net Incremental cash Flows PVs of Incremental cash flows 9,200 (600) 9,300 (600) 9,400 (600) 9,500 (600) 9,600 (600) 9,700 (600) Which Project should be purchased? Annual depreciation: Tax Benefit M as positive numbers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts