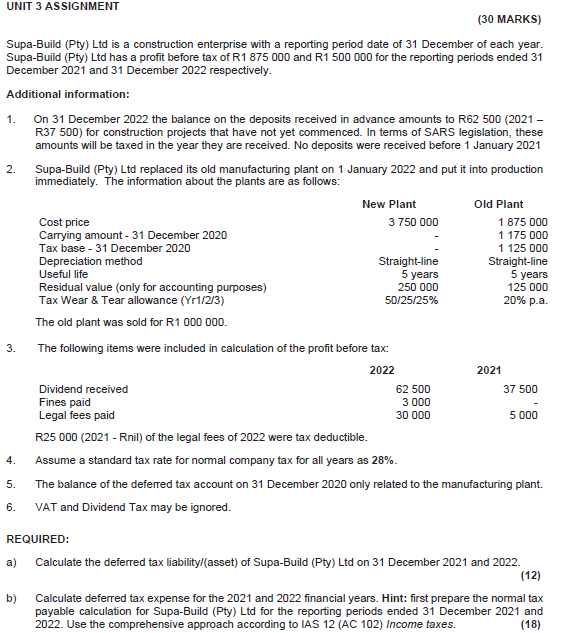

Question: Supa - Build ( Pty ) Ltd is a construction enterprise with a reporting period date of 3 1 December of each year. Supa -

SupaBuild Pty Ltd is a construction enterprise with a reporting period date of December of each year. SupaBuild Pty Ltd has a profit before tax of R and R for the reporting periods ended December and December respectively.

Additional information:

On December the balance on the deposits received in advance amounts to R R for construction projects that have not yet commenced. In terms of SARS legislation, these amounts will be taxed in the year they are received. No deposits were received before January

SupaBuild Pty Ltd replaced its old manufacturing plant on January and put it into production immediately. The information about the plants are as follows:

New Plant:

Cost price R

Carrying amount December R

Tax base December R

Depreciation method Straightline

Useful life years

Residual value only for accounting purposes R

Tax Wear & Tear allowance Yr

Old Plant:

Cost price R

Carrying amount December R

Tax base December R

Depreciation method Straightline

Useful life years

Residual value only for accounting purposes R

Tax Wear & Tear allowance pa

The old plant was sold for R

The following items were included in calculation of the profit before tax:

:

Dividend received R

Fines paid R

Legal fees paid R

:

Dividend received R

Fines paid R

Legal fees paid R

R Rnil of the legal fees of were tax deductible.

Assume a standard tax rate for normal company tax for all years as

The balance of the deferred tax account on December only related to the manufacturing plant.

VAT and Dividend Tax may be ignored.

REQUIRED:

a Calculate the deferred tax liabilityasset of SupaBuild Pty Ltd on December and

b Calculate deferred tax expense for the and financial years.

Hint: first prepare the normal tax payable calculation for SupaBuild Pty Ltd for the reporting periods ended December and Use the comprehensive approach according to IAS AC Income taxes.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock