Question: Super Carpeting Inc. ( SCI) just paid a dividend (D4) of $2.40 per share, and its annual dividend is expected to grow at a constant

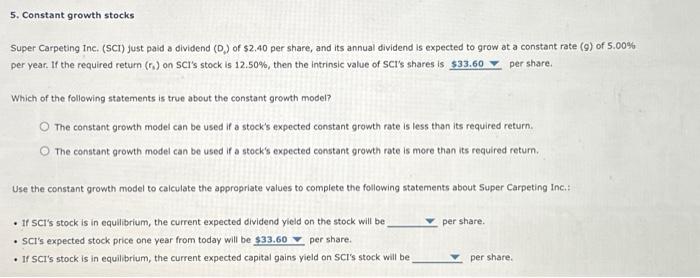

Super Carpeting Inc. ( SCI) just paid a dividend (D4) of $2.40 per share, and its annual dividend is expected to grow at a constant rate (9) of 5.00% per year. If the required return (r3) on 5CI 's stock is 12.50%, then the intrinsic value of SCI's shares is per share. Which of the following statements is true about the constant growth model? The constant growth model can be used if a stock's expected constant growth rate is less than its required return. The constant growth model can be used if a stock's expected constant growth rate is more than its required return. Use the constant growth model to calculate the appropriate values to complete the following statements about Super Carpeting Inc: - If SCl's stock is in equilibrium, the current expected dividend yield on the stock will be per share. - SCI's expected stock price one year from today will be per share. - If SCI's stock is in equilibrium, the current expected capital gains yield on SCI's stock will be per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts