Question: Super Eats started their business on 2 January 2021 and purchased two delivery motorbikes at R30 000 each. The financial year end of the

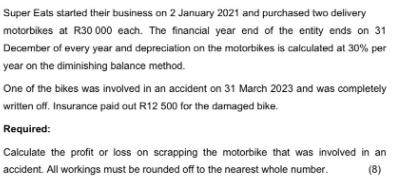

Super Eats started their business on 2 January 2021 and purchased two delivery motorbikes at R30 000 each. The financial year end of the entity ends on 31 December of every year and depreciation on the motorbikes is calculated at 30% per year on the diminishing balance method. One of the bikes was involved in an accident on 31 March 2023 and was completely written off. Insurance paid out R12 500 for the damaged bike. Required: Calculate the profit or loss on scrapping the motorbike that was involved in an accident. All workings must be rounded off to the nearest whole number. (8)

Step by Step Solution

3.46 Rating (146 Votes )

There are 3 Steps involved in it

To calculate the profit or loss on scrapping the motorbike that was involved in an accident we need ... View full answer

Get step-by-step solutions from verified subject matter experts