Question: Superb Digital Services, Inc., has provided the following data from the company's records for the year just ended December 31: 2 (Click the icon to

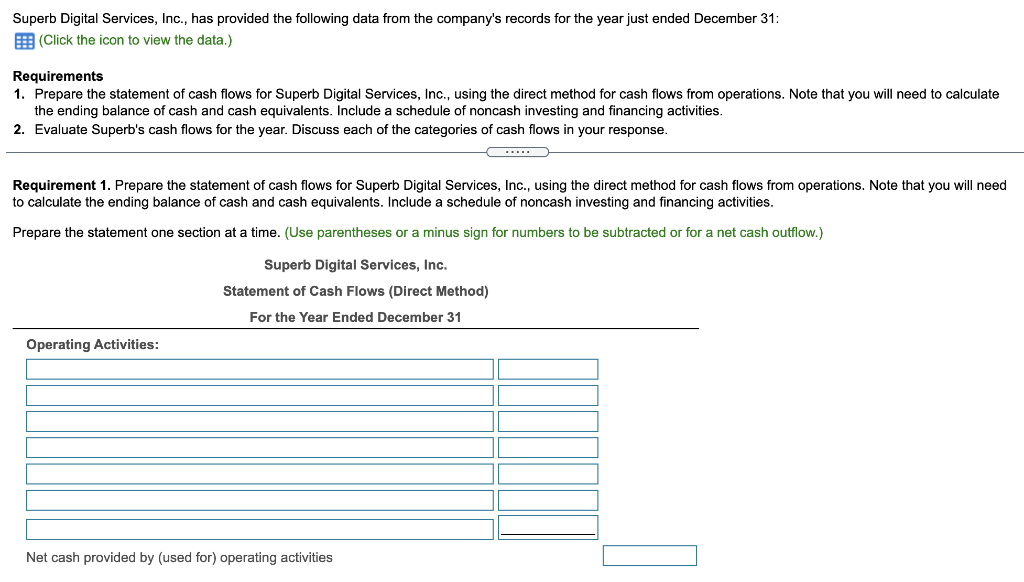

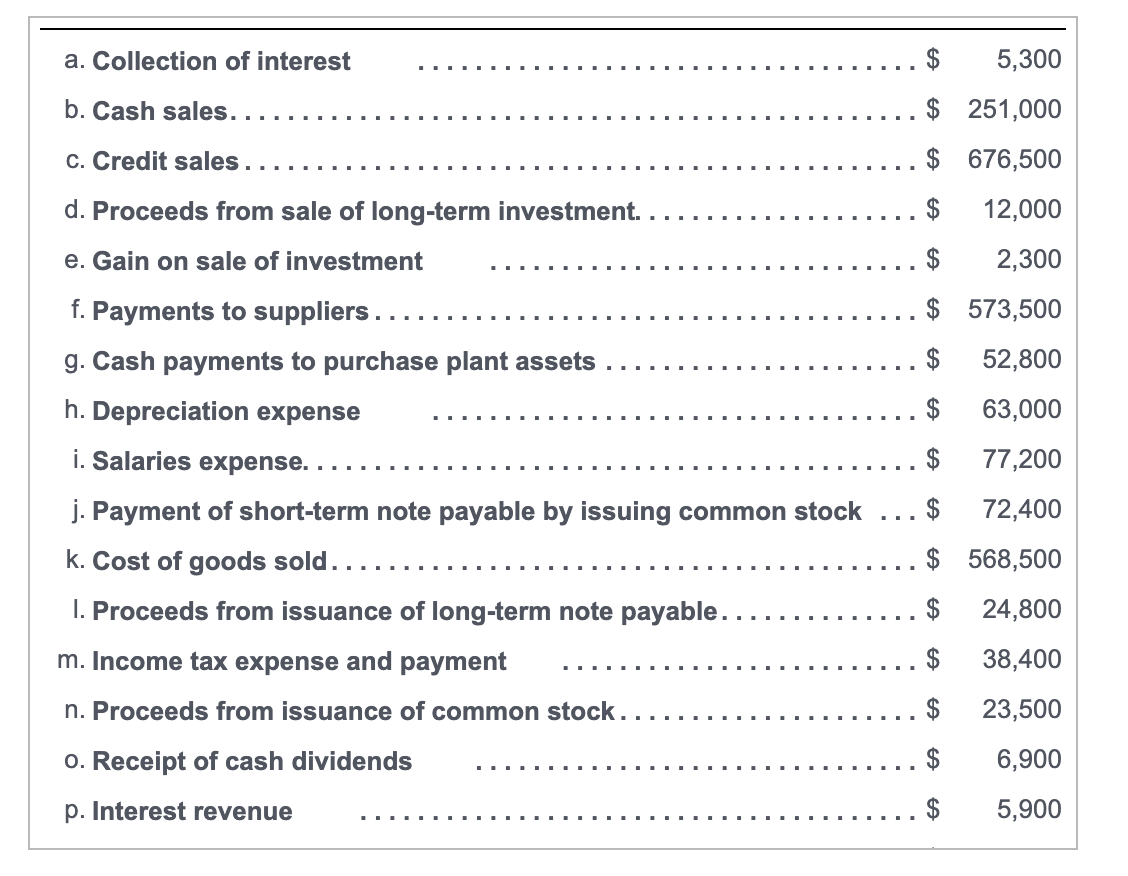

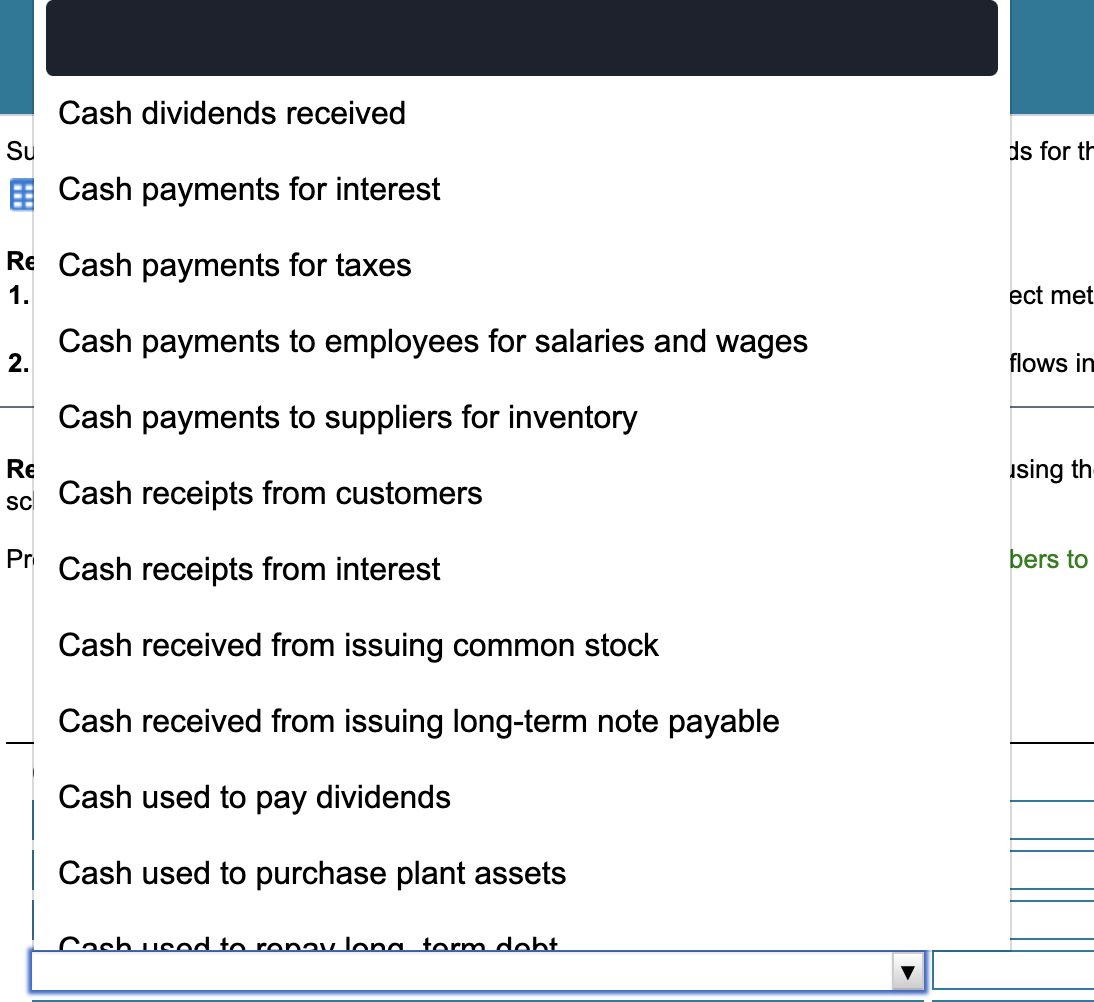

Superb Digital Services, Inc., has provided the following data from the company's records for the year just ended December 31: 2 (Click the icon to view the data.) Requirements 1. Prepare the statement of cash flows for Superb Digital Services, Inc., using the direct method for cash flows from operations. Note that you will need to calculate the ending balance of cash and cash equivalents. Include a schedule of noncash investing and financing activities. 2. Evaluate Superb's cash flows for the year. Discuss each of the categories of cash flows in your response. ..!!! Requirement 1. Prepare the statement of cash flows for Superb Digital Services, Inc., using the direct method for cash flows from operations. Note that you will need to calculate the ending balance of cash and cash equivalents. Include a schedule of noncash investing and financing activities. Prepare the statement one section at a time. (Use parentheses or a minus sign for numbers to be subtracted or for a net cash outflow.) Superb Digital Services, Inc. Statement of Cash Flows (Direct Method) For the Year Ended December 31 Operating Activities: Net cash provided by (used for) operating activities a. Collection of interest $ 5,300 b. Cash sales.. $ 251,000 c. Credit sales $ 676,500 12,000 $ 2,300 d. Proceeds from sale of long-term investment. e. Gain on sale of investment f. Payments to suppliers.. g. Cash payments to purchase plant assets $ 573,500 $ 52,800 h. Depreciation expense $ 63,000 i. Salaries expense. $ 77,200 $ 72,400 $ 568,500 j. Payment of short-term note payable by issuing common stock k. Cost of goods sold...... 1. Proceeds from issuance of long-term note payable. m. Income tax expense and payment $ 24,800 $ 38,400 n. Proceeds from issuance of common stock. 23,500 0. Receipt of cash dividends $ 6,900 p. Interest revenue $ 5,900 Cash dividends received Su ds for th & Cash payments for interest ect met Re Cash payments for taxes 1. Cash payments to employees for salaries and wages 2. flows in Cash payments to suppliers for inventory RE using th SC Cash receipts from customers Pr Cash receipts from interest bers to Cash received from issuing common stock Cash received from issuing long-term note payable Cash used to pay dividends Cash used to purchase plant assets Cach licad to ranaw lana torm dont

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts