Question: Superior Developers sells lots for residential development. When lots are sold, Superior recognizes income for financial reporting purposes in the year of the sale. For

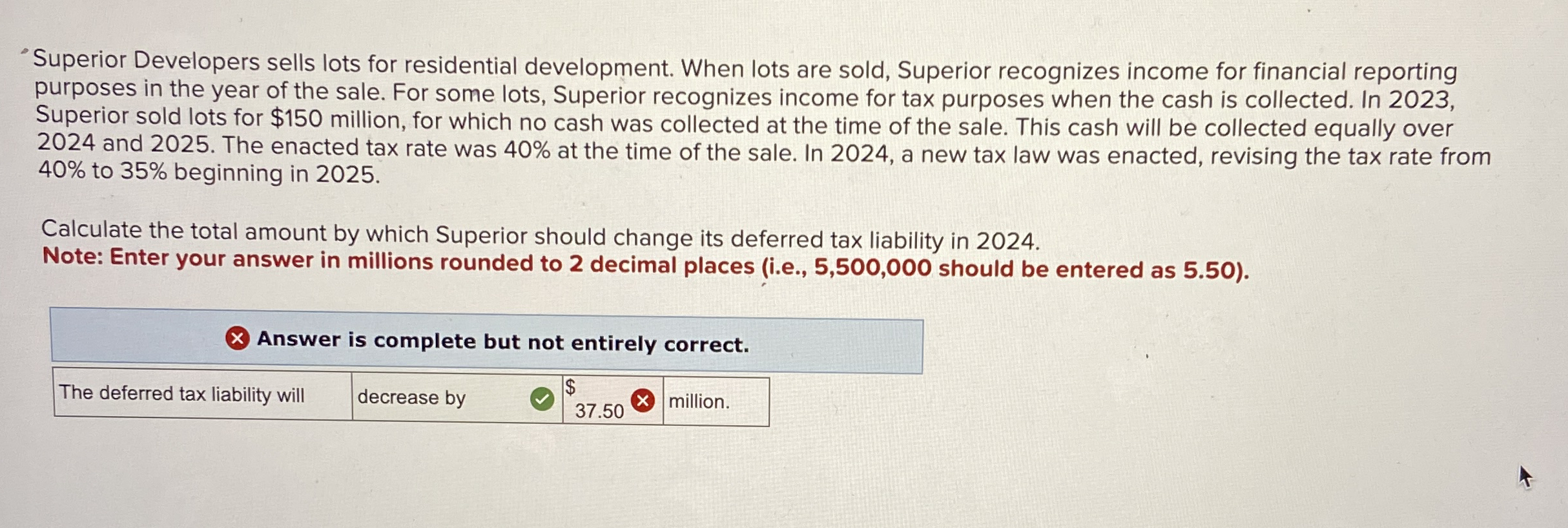

Superior Developers sells lots for residential development. When lots are sold, Superior recognizes income for financial reporting

purposes in the year of the sale. For some lots, Superior recognizes income for tax purposes when the cash is collected. In

Superior sold lots for $ million, for which no cash was collected at the time of the sale. This cash will be collected equally over

and The enacted tax rate was at the time of the sale. In a new tax law was enacted, revising the tax rate from

to beginning in

Calculate the total amount by which Superior should change its deferred tax liability in

Note: Enter your answer in millions rounded to decimal places ie should be entered as

Answer is complete but not entirely correct.

The deferred tax liability will

decrease by

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock