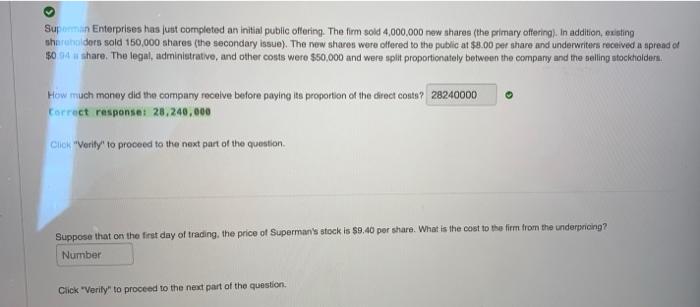

Question: Superman Enterprises has just completed an initial public offering. The firm sold 4,000,000 new shares (the primary offering). In addition, existing shareholders sold 160,000 shares

Superman Enterprises has just completed an initial public offering. The firm sold 4,000,000 new shares (the primary offering). In addition, existing shareholders sold 160,000 shares the secondary issue). The now shares were offered to tho public at $8.00 per share and underwriters received a spread of 1504 share. The legal, administrative, and other costs were $50,000 and were split proportionately between the company and the selling stockholders How much money did the company recalve before paying its proportion of the direct costs? 28240000 Correct response: 28.240,000 CLICK "Verity to proceed to the next part of the question Suppose that on the first day of trading, the price of Superman's stock is $9.40 por share. What is the cost to the firm from the underpricing? Number Click "Verily to proceed to the next part of the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts